Financial advisers and registered reps jumped to new firms at a much slower rate during the first half of the year, but some broker-dealers still made notable hires of established, veteran advisers.

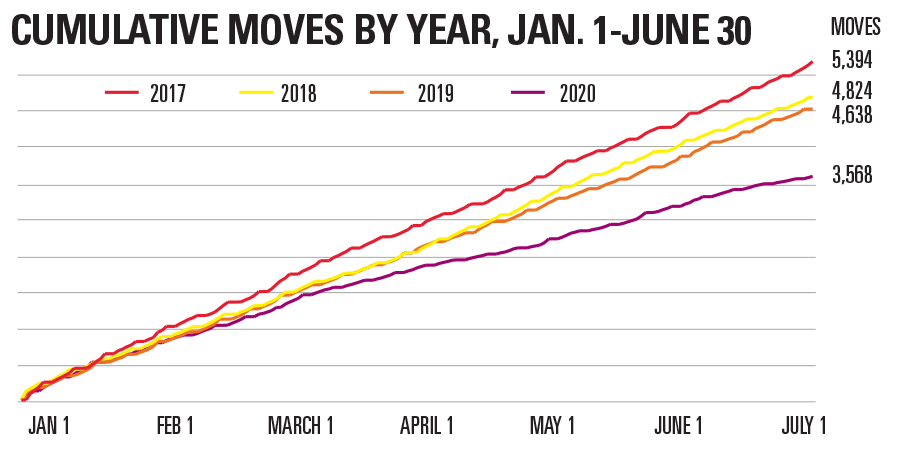

According to data from InvestmentNews Research, 3,568 reps and advisers moved to a new firm in the first half of 2020, a decline of 23.1% when compared to the first half of last year.

And the drop is even sharper when compared to 2017, a recent high-water mark for adviser recruiting across the financial advice industry. Over the first six months of that year, 5,394 reps and advisers jumped to a new firm, a first-half slump of 33.9% in 2020 when compared to three years ago.

The InvestmentNews data includes advisers who move directly between firms, joining the new firm within 60 days of leaving the old firm, excluding moves between affiliated firms and moves that result from a merger or acquisition. It is collected from a variety of sources, including press releases, regulatory filings and direct submissions.

There is no doubt that the COVID-19 pandemic has slowed down brokers and advisers moving from one firm to another, even as broker-dealers ramp up efforts to replace face-to-face meetings and meals with recruits with virtual and online conferences.

Meanwhile, as the pandemic rolls on, Wells Fargo Advisors Financial Network, the independent contractor adviser arm of Wells Fargo Advisors, recently has added high producing advisers from wirehouse competitors such as UBS and Merrill Lynch.

That's something of a turnaround for Wells Fargo, which has seen a number of advisers walk out the door in the wake of 2016 banking scandals.

The advisers that recently moved to Wells Fargo's FiNet group include Thomas Freeman, who left UBS in June and leads a team with $1.6 billion in client assets, and three advisers, Troy Elser and Ryan Gutowski from UBS and Andrew Hahn from Merrill Lynch, who joined Seventy2 Capital Wealth Management, with $277 million in assets. Elser and Gutowski moved in June while Gutowski moved to FiNet last month.

Firms like Seventy2 Capital Management use FiNet as a back office for brokerage services. Wells Fargo Advisors is the only major wirehouse that has a variety of platforms, from bank broker to wealth management to independent contractor, for advisers.

"We asked ourselves, can we do a better job in the independent model, and came to the conclusion that we could," said Freeman, managing director of FCS Private Wealth Management. "At our size, we can have a little more control of our destiny and have the vision of what the practice should be."

"There is nothing wrong with UBS and we enjoyed it there," Freeman said. "But for our service model and sophistication of clients this made more sense. I've been thinking about this for a long time."

FiNet is also well known on the Street for its attractive recruiting bonus to advisers, and is currently offering in the neighborhood of 100% of an adviser's annual fees and commissions, known as "trailing 12" in the industry, to select recruits. That is clearly on the high end of industry deals for independent contractor advisers.

"FiNet has always been in the position, for the right profile of advisers, to have a competitive offering and we think it’s the most competitive out there," said Kent Christian, FiNet's president.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Research reveals a 4% year-on-year increase in expenses that one in five Americans, including one-quarter of Gen Xers, say they have not planned for.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.