During the furious sell-off in stocks last quarter, ETF investors piled into equity funds. That’s troubling to bulls looking for an end to the rout.

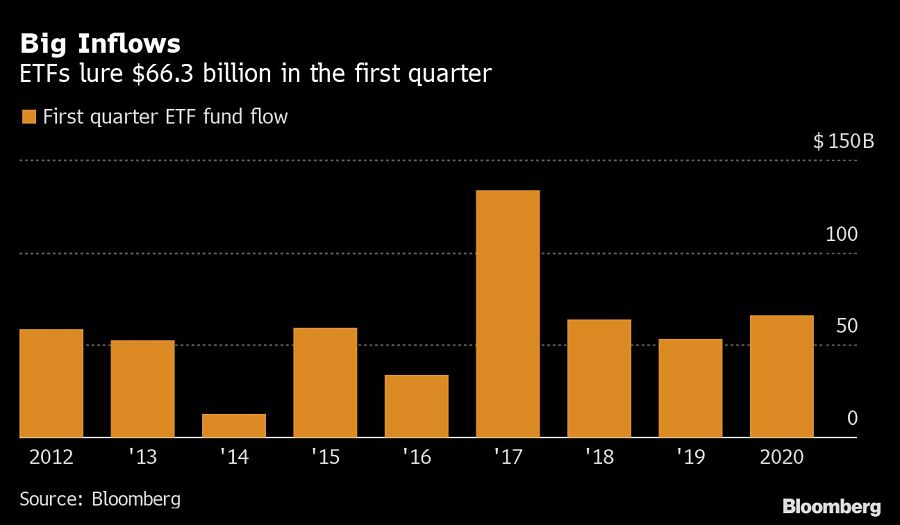

Exchange-traded funds lured $66.3 billion during the first three months of the year even as the S&P 500 plunged as much as 34% from its record on the way to the worst quarter since 2008. The haul was about $8 billion more than ETFs attracted in the same period a year ago, according to data compiled by Bloomberg. Equity funds led the inflows, with a $41.8 billion intake. Fixed-income products added $11.8 billion.

After $5 trillion in value was wiped from U.S. stocks this year, Wall Street has become obsessed with finding an end to the rout. For bulls, a key prerequisite for a bottom is retail investors finding the losses are too big to bear. While the biggest ETF that tracks the S&P 500 did see outflows, a mom-and-pop darling, the Vanguard S&P 500 ETF, lured $18.7 billion.

“It tells me that investors are still trying to pick a bottom,” said Matt Maley, equity strategist at Miller Tabak & Co. “Bear markets usually don’t bottom out until most investors throw in the towel, so this news concerns me.”

While VOO was clearly a big winner as retail investors are often the last ones to bail, a peer fund -- SPDR S&P 500 ETF Trust, or SPY -- lost $19.6 billion in that period. The $235 billion ETF is normally targeted by traders due to its high liquidity.

Another possible reason for the ETF industry's big intake in the first quarter was the rush to fixed-income products. Those funds are normally seen as safer alternatives during challenging economic times.

The bank's new training initiative aims to add hundreds of advisors as it expands its mass-affluent advice unit, according to Barron's.

The lawyers' group warns that adjudicating certain claims externally and limiting punitive damages, among other suggestions, could hurt investors.

With Parkworth Wealth Management and its Silicon Valley tech industry client base now onboard, Savant accelerates its vision of housing 10 to 12 specialty practices under its national RIA.

The wealth tech giant is unveiling its new offerings, designed for advisor productivity and client engagement, as investors and experts continue to grapple with the implications of AI.

Meanwhile, Merchant is continuing to expand its support for RIAs by partnering with a South Dakota-chartered trust company.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.