James Iannazzo, the former Merrill Lynch broker who was fired in January after an incident at a Connecticut smoothie shop, is now a registered broker with Aegis Capital Corp., which is based in New York and has 300 retail registered reps.

Iannazzo, who had worked for Merrill Lynch in Stamford, Connecticut, became registered with Aegis on Tuesday, according to his BrokerCheck profile. Aegis has both independent contractor brokers and employee financial advisers under its roof, and it's not clear which type of business Iannazzo will be conducting at the firm's Westport, Connecticut, office.

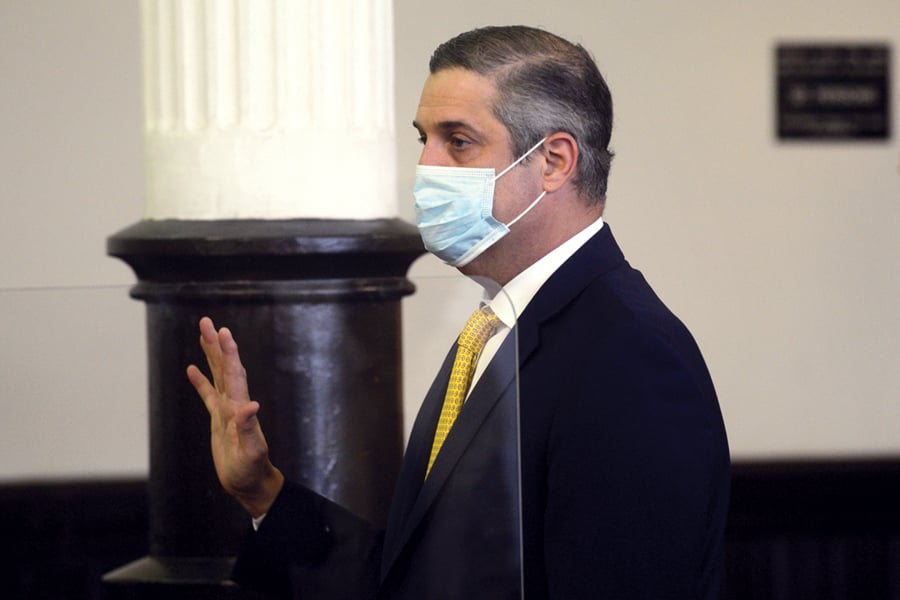

Iannazzo, 48, was arrested after the incident in January and faces three charges, including intimidation based on bigotry or bias in the second degree, a felony. The other charges are second-degree breach of peace and first-degree criminal trespass. Earlier this month, he applied for a pretrial probation program, and a Superior Court Judge in Bridgeport, Nbidi Moses, continued the case until April 8.

In November, Aegis Capital Corp. was sanctioned $2.75 million by the Financial Industry Regulatory Authority Inc. for churning, or excessive trading in client accounts, from 2014 to 2018.

Eugene Riccio, the attorney for Iannazzo, declined to comment about his hiring by Aegis. An attorney for Aegis, Michael Ference, also declined to comment.

Iannazzo was arrested Jan. 22 by the Fairfield, Connecticut, police after erupting at a Robeks smoothie store, throwing a drink at an employee, hitting employees and demanding to know who made a smoothie that contained peanuts and caused his child to have a severe allergic reaction, according to the Fairfield police.

A video of the incident, in which Iannazzo repeatedly uses profanity and calls one employee an “immigrant loser,” caused a firestorm at the time on social media platforms including Twitter. Iannazzo told officers that he was upset about his son's severe allergic reaction and went back to the store as a result, according to the police.

President meets with ‘highly overrated globalist’ at the White House.

A new proposal could end the ban on promoting client reviews in states like California and Connecticut, giving state-registered advisors a level playing field with their SEC-registered peers.

Morningstar research data show improved retirement trajectories for self-directors and allocators placed in managed accounts.

Some in the industry say that more UBS financial advisors this year will be heading for the exits.

The Wall Street giant has blasted data middlemen as digital freeloaders, but tech firms and consumer advocates are pushing back.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.