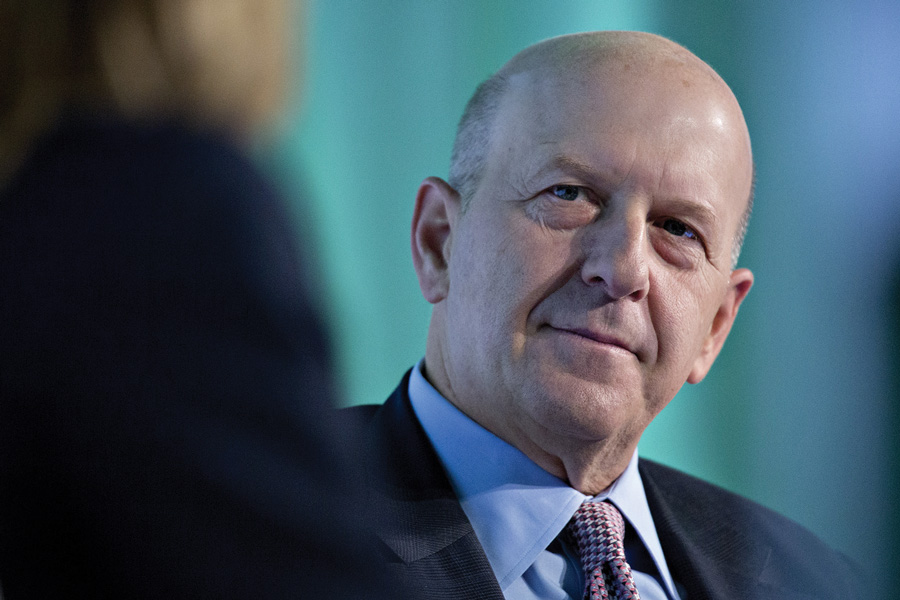

Goldman Sachs Group Inc. expects to put a tighter leash on hiring this year after embarking on one of the firm’s biggest rounds of job cuts ever, Chief Executive David Solomon said.

“We have a much tighter hiring plan in 2023,” Solomon said at a Credit Suisse Group conference Tuesday. “We’re very focused on expenses.”

Goldman last month began implementing a plan to eliminate about 3,200 positions, or 6.5% of the bank’s headcount. The move was meant to address rising expenses and falling revenue and profit. Slowdowns in various business lines, an expensive consumer banking foray and an uncertain outlook for markets and the economy are prompting the bank to rein in costs.

Merger activity and fees from raising money for companies have taken a hit across Wall Street, and a slump in asset prices has crimped another source of gains for the New York-based company. But Solomon said sentiment among CEOs has improved in recent months after predictions last year that the U.S. economy was headed toward a possible recession.

“The consensus has shifted to be a little bit more dovish in the CEO community that we can navigate through this with a softer economic landing,” Solomon said at the conference. “The chance of a softer landing feels better than it did six to nine months ago.”

Goldman plans to host an investor day on Feb. 28, only the second in the bank’s history.

At the same conference, Morgan Stanley chief financial officer Sharon Yeshaya said the “fog of uncertainty” is beginning to lift on business activity, which could give a boost to investment banking fees.

Solomon’s counterpart at Bank of America Corp., Brian Moynihan, said at a BofA Securities Financial Services Conference Tuesday that consumers are still in a position of strength, even as inflation and other economic headwinds persist. Americans continue to spend, though the rate of growth in spending is slowing, and they still have capacity to borrow, the CEO said.

On the hiring front, Moynihan said Bank of America is focused on bringing expenses down and head count back in line with historic norms, a reversal from the hiring “engine” that was “cranking” during the war for talent last year. Investments in digital platforms have helped keep head count at branches flat even as interactions with customers rise, he said.

After a two-year period of inversion, the muni yield curve is back in a more natural position – and poised to create opportunities for long-term investors.

Meanwhile, an experienced Connecticut advisor has cut ties with Edelman Financial Engines, and Raymond James' independent division welcomes a Washington-based duo.

Osaic has now paid $17.2 million to settle claims involving former clients of Jim Walesa.

Oregon-based Eagle Wealth Management and Idaho-based West Oak Capital give Mercer 11 acquisitions in 2025, matching last year's total. “We think there's a great opportunity in the Pacific Northwest,” Mercer's Martine Lellis told InvestmentNews.

Osaic-owned CW Advisors has added more than $500 million to reach $14.5 billion in AUM, while Apella's latest deal brings more than $1 billion in new client assets.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.