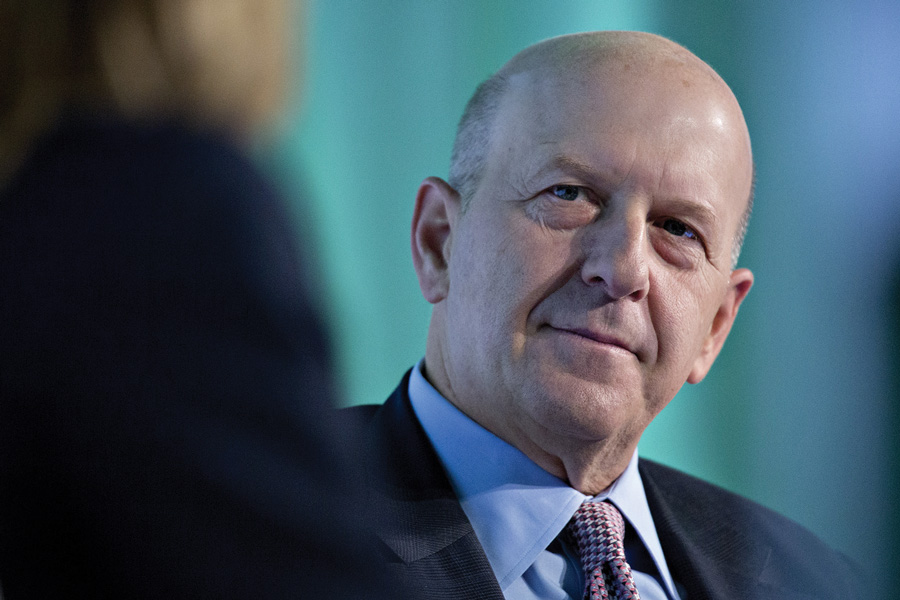

Goldman Sachs Group Inc. boosted David Solomon’s compensation 24 percent to $31 million for a year in which earnings slumped at the Wall Street giant.

The board lifted the CEO’s pay after profit tumbled 24 percent and the firm spent much of the year dousing internal rifts and pitching investors on a simplified strategy. After giving up on its retail-banking ambitions, New York-based Goldman has returned its focus to business lines embraced by Solomon’s predecessors.

The package for the 62-year-old banker includes a $2 million base salary and $29 million in variable compensation, with $20.3 million of that in the form of restricted stock units, according to a regulatory filing. His pay jump was greater than every other major US bank CEO whose compensation has been disclosed.

Unlike last year, the pay announcement was made after the conclusion of an annual gathering of the firm’s top-ranked executives in Florida.

Goldman’s shares advanced 12 percent in 2023, ranking it fourth among the six biggest US banks. The firm began the year by embarking on one of its biggest rounds of job cuts ever, eliminating about 3,200 jobs.

The bank was hurt last year by clogged-up capital markets that kept a lid on fees and magnified losses on real estate investments, as well as its failing consumer strategy. That resulted in Goldman posting just $8.52 billion in net income for the year, sharply off the pace of recent years.

While the bank still touts three divisions in its results, it has avoided spotlighting what it calls the “platform solutions” business and has been directing investors to focus on its investment bank and the money-management business. Those two groups accounted for about 95% of Goldman’s revenue last year.

Last month, JPMorgan Chase & Co. said it awarded longtime CEO Jamie Dimon $36 million for last year, up 4.3 percent from a year earlier. Morgan Stanley increased James Gorman’s pay 17 percent to $37 million for his final year as CEO.

Elsewhere in Utah, Raymond James also welcomed another experienced advisor from D.A. Davidson.

A federal appeals court says UBS can’t force arbitration in a trustee lawsuit over alleged fiduciary breaches involving millions in charitable assets.

NorthRock Partners' second deal of 2025 expands its Bay Area presence with a planning practice for tech professionals, entrepreneurs, and business owners.

Rather than big projects and ambitious revamps, a few small but consequential tweaks could make all the difference while still leaving time for well-deserved days off.

Hadley, whose time at Goldman included working with newly appointed CEO Larry Restieri, will lead the firm's efforts at advisor engagement, growth initiatives, and practice management support.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.