With the S&P 500 stock index jumping 24% last year, the financial results that broker-dealers and registered investment advisors will report in coming weeks promise to be stellar.

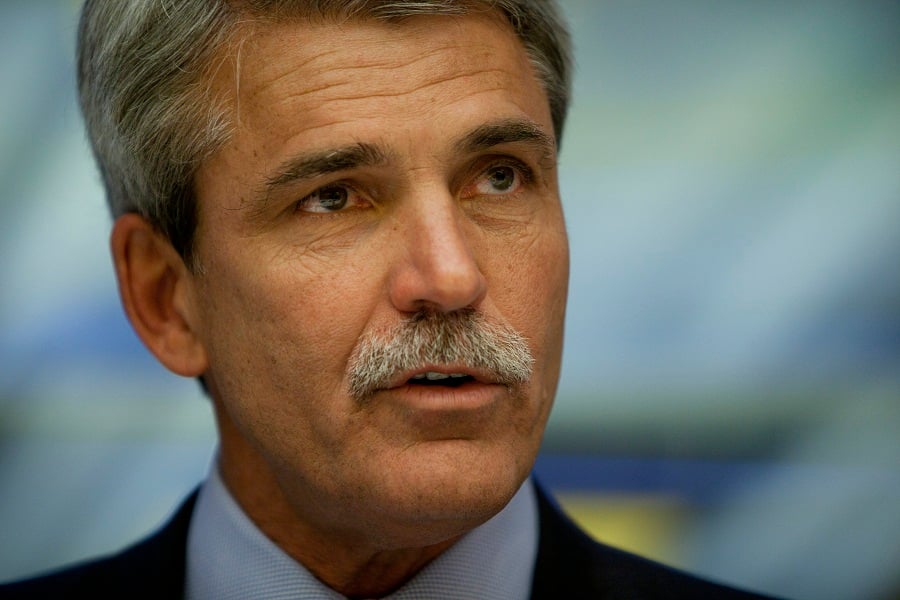

Another early indicator, the compensation of a key industry executive, Paul Reilly, CEO and chair of Raymond James Financial Inc., reveals that executive pay could also soar.

Raymond James reported in a proxy filing with the Securities and Exchange Commission Monday morning that Reilly's total compensation hit $34.9 million in the company's fiscal year ending Sept. 30, almost double the $17.6 million in total compensation Reilly took home a year earlier.

Raymond James is an anomaly in that its fiscal year closes at the end of September rather than the calendar year, when most financial firms close their books.

The overwhelming bulk of Reilly's pay bump came from stock awards, which totaled $24.8 million in fiscal 2023 compared to $8.4 million the preceding year. His bonus was $9.23 million in 2023 compared to $8.5 million one year earlier, and his salary was $750,000 last year compared to $687,500 a year earlier.

The median of the annual total compensation of all employees at Raymond James other than the CEO was $126,100, according to the company, and the ratio of the annual total compensation of the CEO to the median of the annual total compensation of all employees was 277 to 1.

Shares of Raymond James (RJF) were trading at $111.41 at 12:42 p.m. Monday, down a little more than half a percentage point.

"It’s a positive to see executive compensation rise in lockstep with firm performance," said Louis Diamond, an industry recruiter. "And compensation should be looked at when the firm has a good year. Raymond James had a good 2023 in recruiting and retaining financial advisors."

Raymond James' private client group, with close to 8,700 financial advisors across a variety of channels, reported record net revenue of $8.65 billion in fiscal 2023, an increase of 12%, and record pretax income of $1.76 billion, an increase of 71%, compared to fiscal 2022.

The record net revenue was driven by the benefit of higher short-term interest rates on Raymond James' fees and net interest income from its bank deposit program.

The private client group's assets under administration ended fiscal 2023 at $1.2 trillion, increasing 16% compared to Sept. 30, 2022. In addition to higher equity markets, client assets were boosted by strong net inflows, which included domestic private client net new assets of $73 billion, or 7.7% of the assets at the beginning of the period, which was driven by financial advisor retention and recruiting results, according to the company.

By listening for what truly matters and where clients want to make a difference, advisors can avoid politics and help build more personal strategies.

JPMorgan and RBC have also welcomed ex-UBS advisors in Texas, while Steward Partners and SpirePoint make new additions in the Sun Belt.

Counsel representing Lisa Cook argued the president's pattern of publicly blasting the Fed calls the foundation for her firing into question.

The two firms violated the Advisers Act and Reg BI by making misleading statements and failing to disclose conflicts to retail and retirement plan investors, according to the regulator.

Elsewhere, two breakaway teams from Morgan Stanley and Merrill unite to form a $2 billion RIA, while a Texas-based independent merges with a Bay Area advisory practice.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.