The RIA subsidiary of small business 401(k) plans provider Human Interest, Inc. has appointed two retirement and investment industry veterans to its board.

Human Interest Advisors, whose services are offered alongside its parent firm’s plan administration and recordkeeping services, has added the former executives from JPMorgan Asset Management and BlackRock to augment the experience of the leadership team of the growing unit.

Anne Lester has 30 years of experience in the retirement industry and joins from JPAM where she was a managing director and portfolio manager and led the launch of the firm’s SmartRetirement Target Date franchise. She has also recently become a published author with her first book ‘Your Best Financial Life.’

“I believe that everyone deserves to have access to a secure financial future. That’s why I’m so excited to join HIA’s Board of Directors and use the breadth of my experience to help ensure that employees of small and mid-sized businesses across the U.S. have access to affordable retirement plans,” she said.

Lester is joined on the board by Richard Arney, currently a director at Accial Capital, an investor in asset-backed fintech lending portfolios in emerging markets. He was previously with BlackRock where he served on the Corporate Governance and Responsible Investment Committee and has also held roles at McKinsey & Company, Accenture, and the California State Senate.

“I’m very excited to be in this role at HIA where I’m hopeful to put my years of investment and governance experience to support companies and employees in their retirement investment journey,” says Richard.

In 2023, HIA added Ronnie Cox from Pensionmark Financial Group as its investment director and Kristin Burnett from Protego Trust Bank and Russell Investments as chief compliance officer.

“With the addition of Anne Lester and Richard Arney to our board, we’re doubling down on helping everyday Americans achieve their financial goals,” said Klinton Miyao, head of HIA. "Anne and Richard's commitment to HIA’s mission and culture of compliance combined with their expertise will be a tremendous asset as we continue to build out our investment services platform to help participants make informed investment decisions.”

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

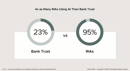

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.