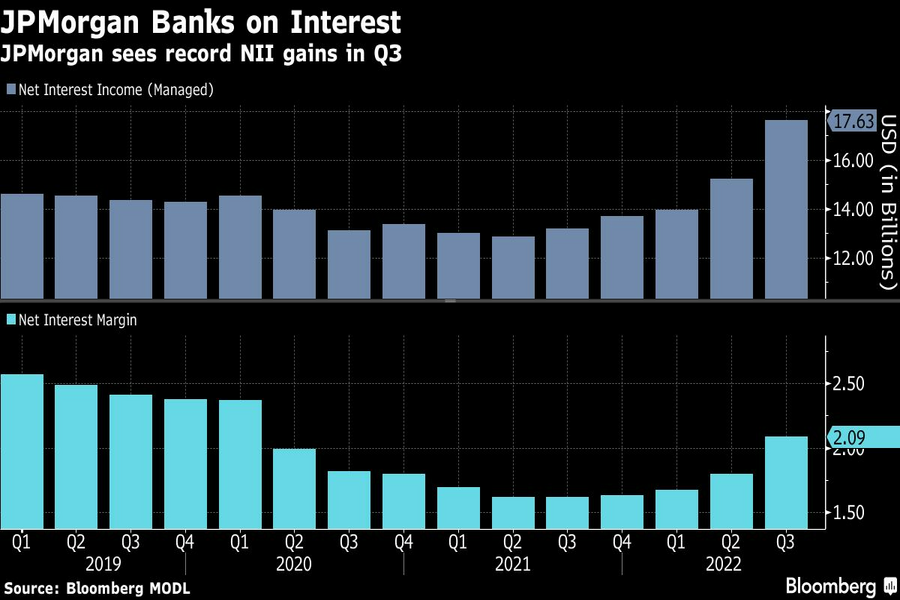

JPMorgan Chase & Co. reported its highest quarterly net interest income ever and raised its guidance for the year as the biggest U.S. bank reaps rewards from the Federal Reserve’s interest rate hikes.

The firm generated $17.6 billion in third quarter net interest income, the money it earns on loans minus what it pays out for deposits. Expenses also came in lower than analysts expected, driving a profit beat.

“In the U.S., consumers continue to spend with solid balance sheets, job openings are plentiful and businesses remain healthy,” Chief Executive Officer Jamie Dimon said in a statement Friday. “However, there are significant headwinds immediately in front of us,” the CEO said, citing high inflation leading to higher global interest rates, quantitative tightening, the war in Ukraine, and “the fragile state of oil supply and prices.”

Investors are scouring Friday’s results for four of the biggest U.S. banks for clues on how consumers and companies are faring as interest rates rise and recession threats mount. Wells Fargo & Co., Citigroup Inc. and Morgan Stanley also report third-quarter results Friday, with Bank of America Corp. and Goldman Sachs Group Inc. up next week.

At a conference Thursday, Dimon said he doesn’t think the U.S. can avoid a recession as the Federal Reserve raises interest rates to choke off inflation. The CEO said his “gut” tells him that the central bank’s benchmark rate will probably have to rise higher than the 4% to 4.5% level many economists are predicting, as price pressures persist. Core inflation, excluding food and energy, jumped to a 40-year high of 6.6% in September from a year earlier, data released Thursday showed.

Shares of JPMorgan, which are down 28% this year, rose 4.4% at 9:39 a.m. in New York. The gain of 12% since Wednesday represents the strongest three-day streak since November 2020.

Results were marred by a $959 million net investment securities loss, which “reflected higher net losses on sales of U.S. Treasuries and mortgage-backed securities,” the New York-based company said in the statement.

JPMorgan raised its guidance for this year’s net interest income excluding its markets business, saying it now expects about $61.5 billion. The firm said in July it would pull in at least $58 billion from that source.

JPMorgan temporarily suspended share buybacks in July in order to quickly meet higher capital requirements while maintaining flexibility to navigate a changing economic environment. The move came at a cost to investors: In the year preceding the pause, the firm had averaged about $2.2 billion of buybacks a quarter. Dimon said in the statement Friday that the firm hopes to resume buybacks early next year.

JPMorgan’s noninterest expenses rose 12% to $19.2 billion, slightly lower than what analysts were expecting. The firm’s spending has been a key focus for investors this year after executives predicted an 8.6% increase from 2021. Costs are up 7% for the first nine months of the year.

Investment-banking fees fell 47%, less than analysts expected. JPMorgan President Daniel Pinto said last month that revenue from the business could fall by half as clients spooked by economic uncertainty stay on the sidelines. Trading revenue rose slightly, with a 22% jump in fixed income offset by an 11% drop in equities. Pinto said last month that markets revenue could increase 5% in the third quarter from a year earlier.

The firm set aside $1.5 billion for potentially soured loans, more than the $1.2 billion analysts expected. That’s a stark contrast from a year ago, when the firm’s earnings were boosted by reserve releases after predicted losses tied to the Covid-19 pandemic never materialized.

Chasing productivity is one thing, but when you're cutting corners, missing details, and making mistakes, it's time to take a step back.

It is not clear how many employees will be affected, but none of the private partnership’s 20,000 financial advisors will see their jobs at risk.

The historic summer sitting saw a roughly two-thirds pass rate, with most CFP hopefuls falling in the under-40 age group.

"The greed and deception of this Ponzi scheme has resulted in the same way they have throughout history," said Daniel Brubaker, U.S. Postal Inspection Service inspector in charge.

Elsewhere, an advisor formerly with a Commonwealth affiliate firm is launching her own independent practice with an Osaic OSJ.

Stan Gregor, Chairman & CEO of Summit Financial Holdings, explores how RIAs can meet growing demand for family office-style services among mass affluent clients through tax-first planning, technology, and collaboration—positioning firms for long-term success

Chris Vizzi, Co-Founder & Partner of South Coast Investment Advisors, LLC, shares how 2025 estate tax changes—$13.99M per person—offer more than tax savings. Learn how to pass on purpose, values, and vision to unite generations and give wealth lasting meaning