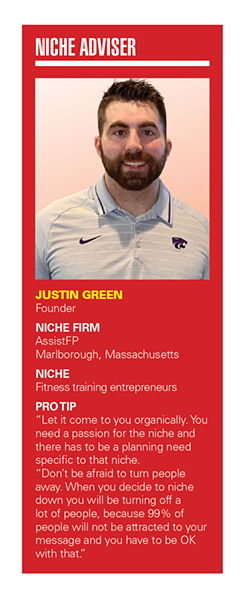

In the truest spirit of a financial planning niche, Justin Green is going with what he loves.

Green, 29, is the founder of AssistFP, a Marlborough, Massachusetts-based financial advisory practice serving fitness-training entrepreneurs, many of whom have evolved into online coaches.

Like so many folks working in wealth management, Green’s path has not been a direct one.

While he started his financial planning career in 2017 with a registered investment advisory firm on Cape Cod, his undergraduate degree is in sports management.

“I’m very passionate about working out and fitness, and I considered becoming a fitness coach,” said Green, who has been working out “five or six days a week for the past 13 or 14 years.”

Instead, he went back to school to get a master’s degree in financial planning and quickly realized being a generalist adviser wasn’t going to cut it.

The launch of AssistFP in March of last year was originally marketed to fitness entrepreneurs and millennials, but even that was too general, he quickly discovered.

“I think it’s extremely important to have a niche and when I launched, I thought millennials were a niche, but that’s very broad,” Green said. “I felt like I was producing good (marketing) content, but it was falling on deaf ears. When you’re speaking to everyone, you’re speaking to no one.”

Turns out, the focus on fitness coaching was a natural move and right in front of him all along.

“Once I started my own firm, I started networking and connecting with online fitness coaches,” he said. “They’re self-employed, they have all the needs of self-employed people, and I can relate on a personal level as well. They’re all primarily driven by taxes and tax management.”

While fitness coaching has been around for decades, the pandemic forced a creative migration to online services, which is where Green sees lots of potential business opportunities.

“When the pandemic hit, most fitness coaches went online, and it seems like a lot of trends that hit because of the pandemic won’t go away, and that’s why I’m spending a lot of time networking and communicating with fitness coaches on Instagram,” he said. “Most of these people got into fitness coaching because they loved teaching and helping people, but they didn’t get into it to control taxes and learn about the tax code.”

In addition to his marketing efforts on social media, Green has launched a podcast, Dollars & Dumbbells, where he interviews fitness coaches and other business professionals about running businesses and managing finances.

“When I’m connecting with fitness coaches, I’m also connecting with business coaches for fitness coaches, and I’ve found opportunities to speak to their clients,” he said. “I can get about 30 fitness coaches on the call and do an introduction to financial planning.”

Green is also hoping to develop an online course that he'll offer in tandem with a business coach.

Like a lot of niche advisers, Green is learning that fee structures are often more art than science.

He will do one-time financial plans and manage client portfolios, but his mainstay is a $200 monthly fee with an initial $500 upfront payment. And the fees are likely to go up this year, he said.

“I have the runway to build this out for quite a while,” he said. “If you need an immediate income from a new business or new niche, it won’t happen immediately. Even early on, it was very clear to me that it was going to take more time to gain traction if I got really focused with my method. When you decide to niche down you will be turning off a lot of people, because 99% of people will not be attracted to your message and you have to be OK with that.”

Surveys show continued misconceptions and pessimism about the program, as well as bipartisan support for reforms to sustain it into the future.

With doors being opened through new legislation and executive orders, guiding clients with their best interests in mind has never been more critical.

Meanwhile, Stephens lures a JPMorgan advisor in Louisiana, while Wells Fargo adds two wirehouse veterans from RBC.

Large institutions are airing concerns that everyday investors will cut into their fee-bargaining power and stakeholder status, among other worries.

Fights over compensation are a common area of hostility between wealth management firms and their employees, including financial advisors.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.