I begin each day by perusing a variety of email newsletters, a list I’ve cultivated with the goal of keeping me out of an information echo chamber.

One consensus I’ve seen emerging is that reducing pandemic unemployment benefits will ease hiring challenges. It’s been hard to find nonpolitical counterpoints to this. But I did find one source that challenged this notion.

Last week, Bloomberg’s Joe Weisenthal looked at the BLS report on job openings and labor turnover in his excellent morning newsletter. Among the highlights:

“One indicator that economists like to look at is the so-called Beveridge Curve, which plots the unemployment rate against the rate of job openings. Historically there’s been a somewhat stable relationship between the two. Job openings go up and the unemployment rate goes down, as you would expect. But as with everything else weird about this recovery, that’s breaking down ... Tim Duy of SGH Macro Advisors notes that this new weird shape of the curve holds true even if you look at alternative measures of non-employment besides the standard U-3 measure: ‘It appears that labor market frictions not related to unemployment insurance appear to have been increasing.’ That’s not exactly great news if you are expecting the end of enhanced UI benefits will dramatically ease labor market frictions.”

This bears watching, if only to make sure you’re thinking critically, but surely to monitor where the reopening of the economy will bring us.

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

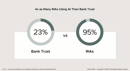

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.