The Financial Industry Regulatory Authority Inc. started an inquiry in November into whether broker and financial advisor James Iannazzo broke industry rules when he allegedly "structured cash transactions in his personal bank and brokerage accounts to avoid federal reporting requirements," according to his BrokerCheck report. Iannazzo was fired by Merrill Lynch a year ago after an uproar at a Connecticut smoothie shop that went viral online.

Iannazzo, who is now registered with Aegis Capital Corp., did not return a call Monday morning to comment. His BrokerCheck report states that an investigation is pending in the matter and that Finra has made a "preliminary decision" to recommend some type of disciplinary action against him.

Merrill Lynch fired Iannazzo last January after the incident. Iannazzo had ordered a drink at a Robeks location in Fairfield, Connecticut, that appeared to trigger an allergic reaction in his son, who had to be taken in an ambulance to the hospital.

Iannazzo’s attorneys later said that emergency medical responders recommended that he return to the shop to ascertain what was put in the smoothie, but that Iannazzo lost his temper when an employee told him they “didn’t know.”

Attorneys representing Gianna Marie Miranda, an 18-year-old employee at the smoothie shop, sued for $300,000 in damages after Iannazzo threw the drink at Miranda and called her a “f—ing immigrant loser.” In August, Iannazzo agreed to pay $7,500.

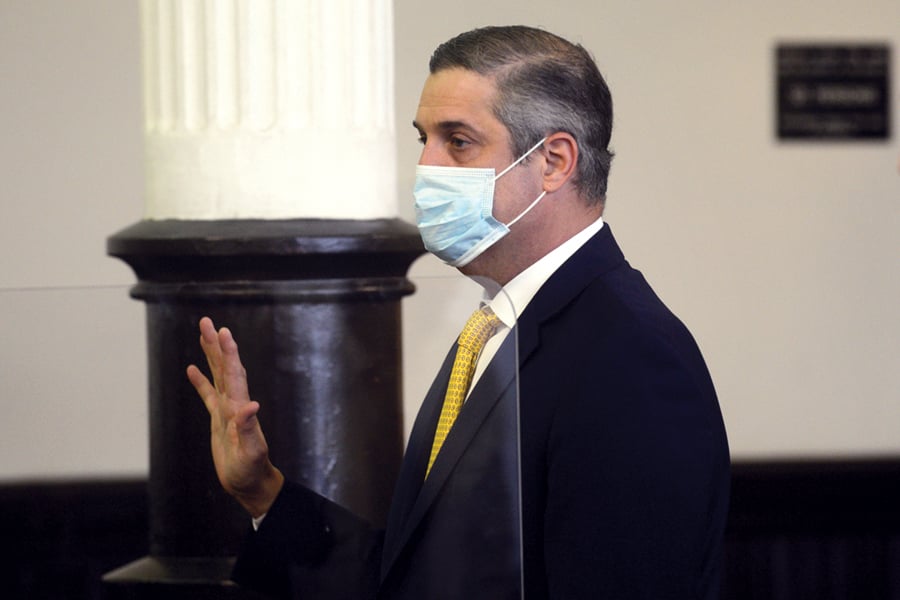

The interaction was caught on video and shared widely on social media. Iannazzo at the time turned himself in to police, was arrested and charged with a felony for intimidation based on bigotry or bias in the second degree, as well as two misdemeanors.

In April, Iannazzo was assigned to an accelerated rehabilitation program to sidestep a criminal conviction. After one year of supervision, charges against him will be dismissed.

Rajesh Markan earlier this year pleaded guilty to one count of criminal fraud related to his sale of fake investments to 10 clients totaling $2.9 million.

From building trust to steering through emotions and responding to client challenges, new advisors need human skills to shape the future of the advice industry.

"The outcome is correct, but it's disappointing that FINRA had ample opportunity to investigate the merits of clients' allegations in these claims, including the testimony in the three investor arbitrations with hearings," Jeff Erez, a plaintiff's attorney representing a large portion of the Stifel clients, said.

Chair also praised the passage of stablecoin legislation this week.

Maridea Wealth Management's deal in Chicago, Illinois is its first after securing a strategic investment in April.

Orion's Tom Wilson on delivering coordinated, high-touch service in a world where returns alone no longer set you apart.

Barely a decade old, registered index-linked annuities have quickly surged in popularity, thanks to their unique blend of protection and growth potential—an appealing option for investors looking to chart a steadier course through today's choppy market waters, says Myles Lambert, Brighthouse Financial.