Once again, InvestmentNews is proud to share its list of 40 of the best and brightest of our industry’s next generation.

As has been the case since the inception of the 40 Under 40 program, as we judged this year’s nominees, we found ourselves overwhelmed by the quality of candidates. The total 2021 crop of candidates was a hefty multiple of the 40 who were ultimately selected, covering the full spectrum of eligible ages and hitting every corner of the industry. Like so much of the market, there is a preponderance of RIAs, but the honorees represent the full range of the industry — from wirehouses to tech firms and even a regulator.

These 40 embody the increasing diversity of the financial advice community and reflect the industry’s expansion to work with underserved communities and groups that can reap the benefits of their expertise.

Keep an eye on these young stars. Add them on LinkedIn and follow their next moves. History shows that this group has only just begun to make its mark. And if you have any question, look at last year’s winners. They’ve done great work during a wild year, taking leadership positions in crypto, marketing and diversity — and they aren’t done yet.

We salute this year’s class for renewing the sense of inspiration we can all derive just by observing people doing good and doing well.

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

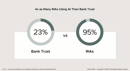

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.