Pimco parent Allianz back in the black

With the sale of Dresdner Bank now well behind it, Allianz appears to be back on track. Proof? The Pimco and Oppenheimer parent recorded close to a $6B profit in 2009.

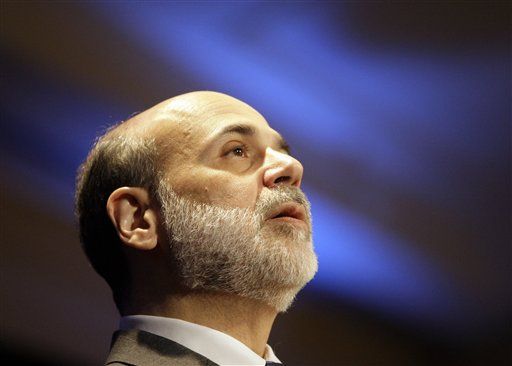

Fed head Bernanke says record low rates still needed

Federal Reserve Chairman Ben Bernanke told Congress on Wednesday that record-low interest rates are still needed to ensure that the economic recovery will last.

AIG agrees to sell Alico to MetLife for $15.5B

Last week, AIG announced it was unloading its Asia-based operations. On Monday, the embattled insurer agreed to sell its Alico unit to MetLife for $15.5B. Is Nan Shan next?

Deconstructing AIG: Insurer to sell its Asian ops to Prudential PLC for $35.5B

The quest for cash continues, as the besieged company agrees to sell off its Asian unit to Prudential PLC for $35.5B. The next to go? Ask MetLife.

SEC needs to remember that investors come first

Like the public's trust and confidence in Wall Street, faith in the Securities and Exchange Commission was shattered as a result of the 2008 financial meltdown.

So which way is the stock market headed? Experts offer little help

Up? Down? Flat? Rarely have economists and analysts so disagreed over the future of the stock market.

Fleming nabs two big names for Morgan Stanley’s invesment management biz

Gregory J. Fleming, who took the helm of Morgan Stanley Investment Management earlier this month, has nabbed two big names to boost the firm's invesment management biz

What advisers really think of income annuities

Hint: they think the retirement products attract customers who are frightened by the market

ObamaCare means slow going for retirement reform

Legislators are still tied up with health care issues, leaving retirement initiatives to flounder. Tax proposals may be the exception

CFP Board hikes requirement for certification exam

The increase in class work on how to prepare and present financial plans is intended to bridge theory and practice

Rashomon? SEC, Cuomo offer vastly different takes on BofA firing

Bank of America fired its top lawyer in December 2008 before its fateful takeover of Merrill Lynch simply to make way for another executive, and not because he had given the company legal advice it didn't want to hear, the Securities and Exchange Commission has said in a court filing.

‘All-out panic’ on Wall Street as Dow plunges most since 1987

The Dow dropped the most in intraday trading since the market crash of 1987. Was it worries over Greece, or a simple trading mistake that triggered the chaos?

Hensler to replace Carey as Oppenheimer distribution chief: sources

Onetime DWS exec Philipp Hensler is said to have been on the short list for the job last summer before OppenheimerFunds settled on Carey.

A wee spot of bother

Despite getting smaller, Royal Bank of Scotland still has some very big problems. Bad loans and a shaky economy top the list. Turning a profit? That's still a ways off.

Advisers on the advisory biz: Full speed ahead this year

Following the tumult of 2009, advisers see better days ahead for their practices this year--with the majority of advisers now focused on growing their businesses again.

SEC votes to short-circuit short sales

The SEC voted today to zap short-sales. How? By reviving a Depression-era -- yes, Depression-era -- 'circuit-breaker' rule.

Didn’t see this one coming: Investment ‘psychic’ charged with fraud

'America's Prophet' and investment adviser Sean David Morton said he used psychic powers to predict the movement of the stock market. One move Morton probably didn't see coming: the government charged him with fraud.

Volatility got you down? Turn to option collars

To manage the latest bout of market volatility, consider an option collar strategy. Option-phobic advisers take heart: There is no need to embark on a wild ride or trade all day long.

ING’s insurance unit flops in the fourth quarter

ING Groep NV, one of Europe's largest banking and insurance groups, reduced its losses to €712 million ($980 million) for the fourth quarter on Wednesday, reflecting a mixed operating performance and a big charge related to an earlier bailout.