Displaying 64 results

As cash flows to companies after tax reform, here’s how to invest

Take advantage of a likely pickup in mergers and acquisitions through financial services funds and bank stocks.

Bitcoin price breaks $10,000. Here’s what history tells us comes next.

Loosely defined, a bubble is a rapid increase in an asset price that's not substantiated by its fundamentals.

Beware of so-called ‘liquid’ alts for retail investors

Some are useful to a subset of investors with a long-term horizon; not to everyone.

These fund categories are lagging in the bull run

Energy, real estate and small-cap value funds have struggled this year compared to other categories.

What ‘Moneyball’ can teach advisers about better portfolio construction

By focusing on market diversification, you can more easily build winning portfolios based on objective data.

Help clients boost returns without increasing risk

If your clients are considering private placement life insurance or private placement variable annuities, here's what you should consider as part of the planning process.

Stocks versus bonds: Which best help meet retirement goals?

The asset-side case for stocks is unambiguous, though most people think that bonds hedge human capital better than stocks.

Few financial advisers pitch ESG funds to clients. Missed opportunity?

Yet women and millennials want to buy funds with strong environmental, social responsibility and corporate governance components.

The case for more U.S. infrastructure investment by the private sector

Many new U.S. infrastructure funds are designed to offer investors the possibility of higher income in exchange for taking some additional risk.

BlackRock’s Larry Fink: Money managers must help companies focus on long-term thinking

Geopolitical uncertainty, created in part by Brexit and the U.S. presidential race, is leading to “intense short-termism,” he says.

Liquid alternative funds failed to prove their worth post-Brexit?

Plus: The downside of lower oil prices, how to get your money back from Wells Fargo, and why central banks are buying gold.

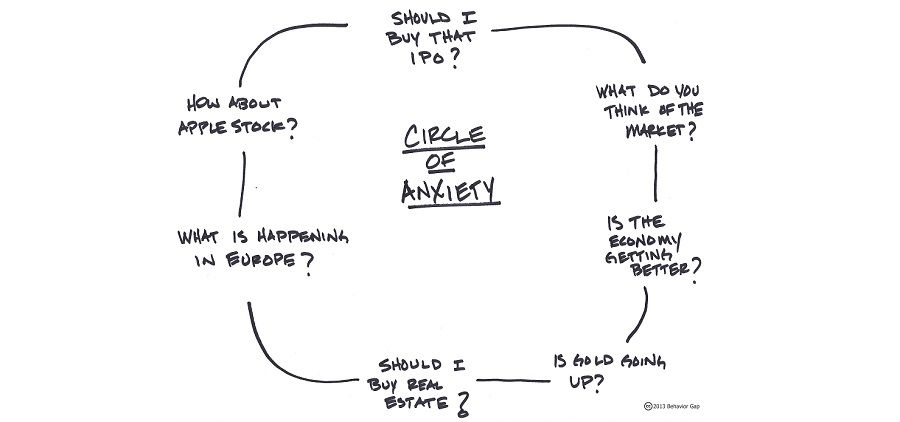

Do this before you apply the science of investing

Financial advisers have both the blessing and obligation to help people cope with their money anxiety.

Stop lying to yourself about value investing

Value stocks never have and never will dance to the rhythm of business or market cycles.

Why gold makes sense for investors

The price of gold rose more in the first quarter of 2016 than during any quarter since the…

Taking a cue from insiders on strategic-beta ETFs

It's no secret that strategic-beta exchange-traded products have become a pervasive part of the marketplace, rewarding investors with innovative tools to diversify and fine-tune portfolios in ways traditional market-capitalization-weighted indexes don't allow.

Investors still looking for ways to bridge the gap between stocks and bonds

Legg Mason investor survey shows tremendous pressure on stock performance, a need for safer income-generating investments.

Warren Buffett’s investing dos and don’ts

Whether you're a home buyer considering a mortgage, or an executive weighing a takeover, the 85-year-old billionaire has advice for anyone looking to live a more rational, financially successful life.

The power of infrastructure investing in uncertain markets

Good infrastructure products are unlikely to wildly outperform equities, but they're also unlikely to create serious losses

Ask the Adviser: How can I best protect my investments as the markets are sinking?

Before the stock market begins to decline, investors need to have a set of plans designed to remove emotion from the decision-making process.

Use charitable giving to offset bull market gains

Year-end donations can help mitigate next year's tax bite.