Mar 19, 2024 —

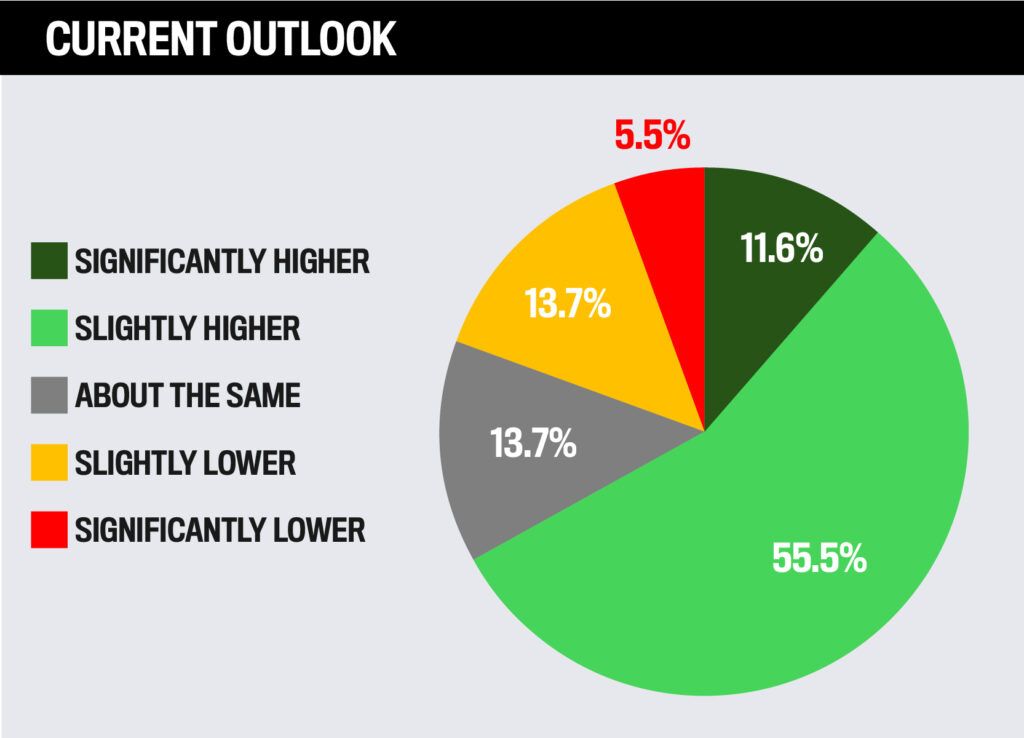

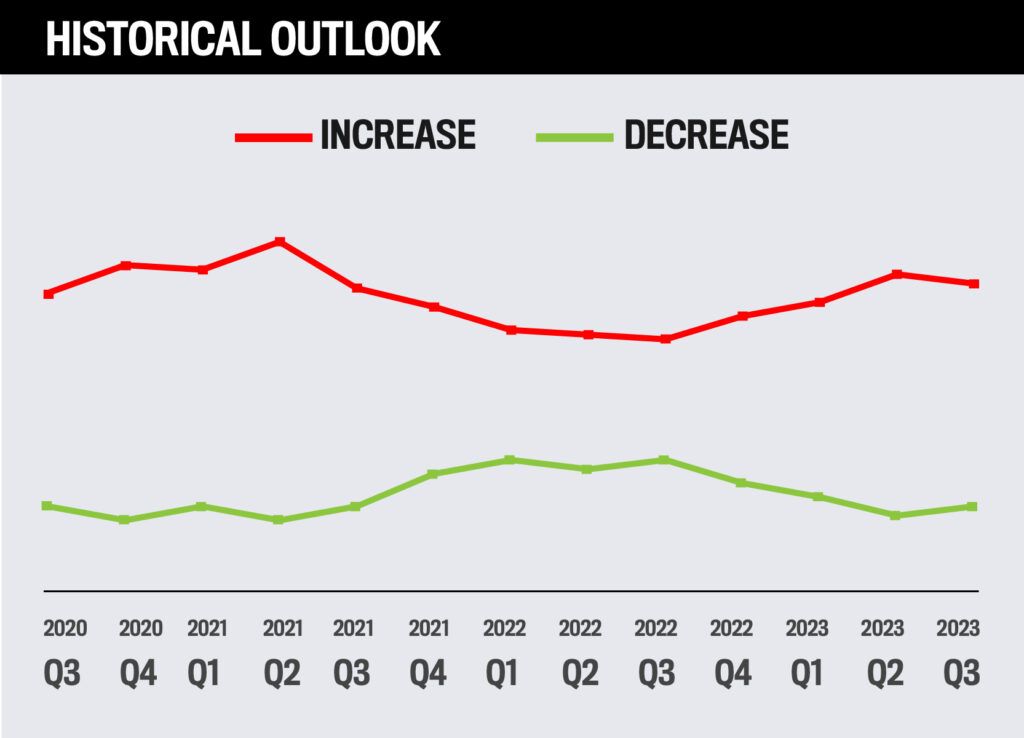

Where do you expect the S&P to be in 12 months, compared with today?

Between October and December 2023, 67% of advisors expected markets to rise over the coming year while 19% expected them to fall. This represents a slight decline in sentiment over the previous quarter but an improvement over the previous year. This overall outlook is similar to where it was in the fourth quarter of 2021.

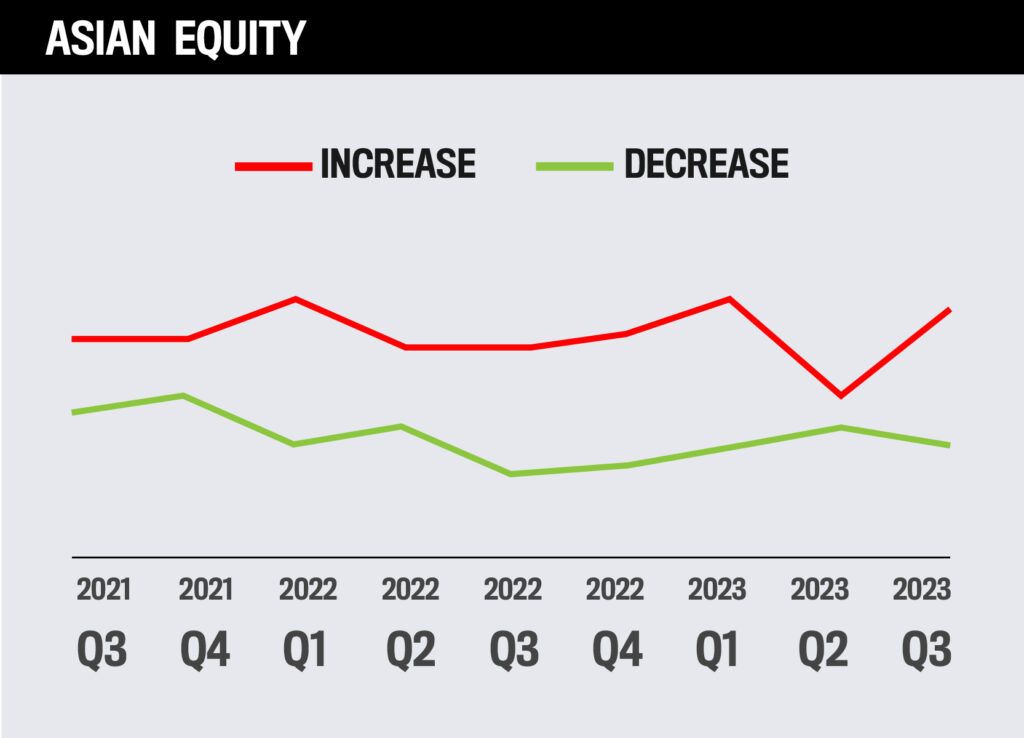

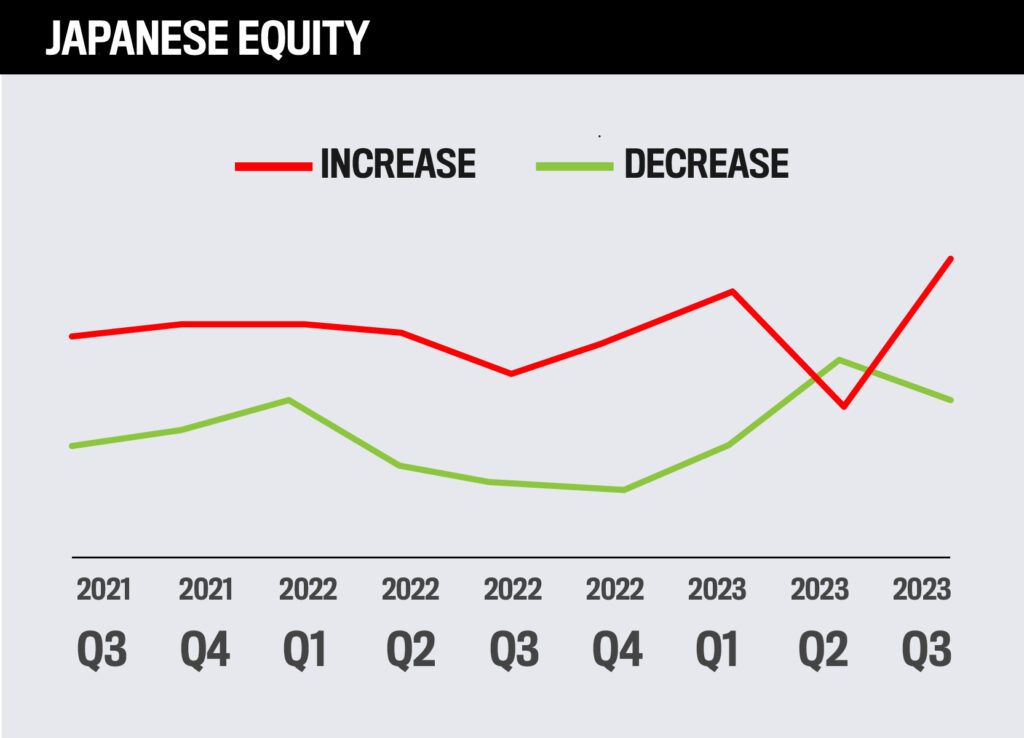

Equities

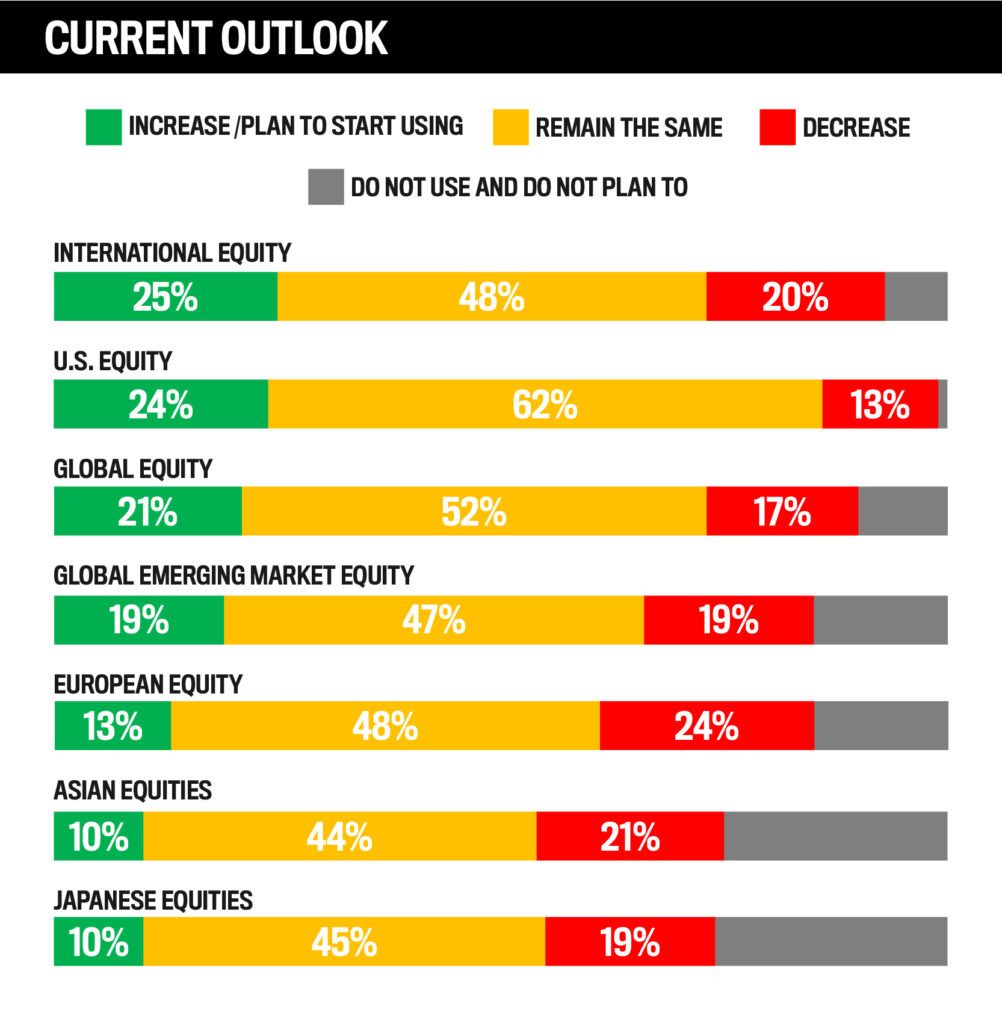

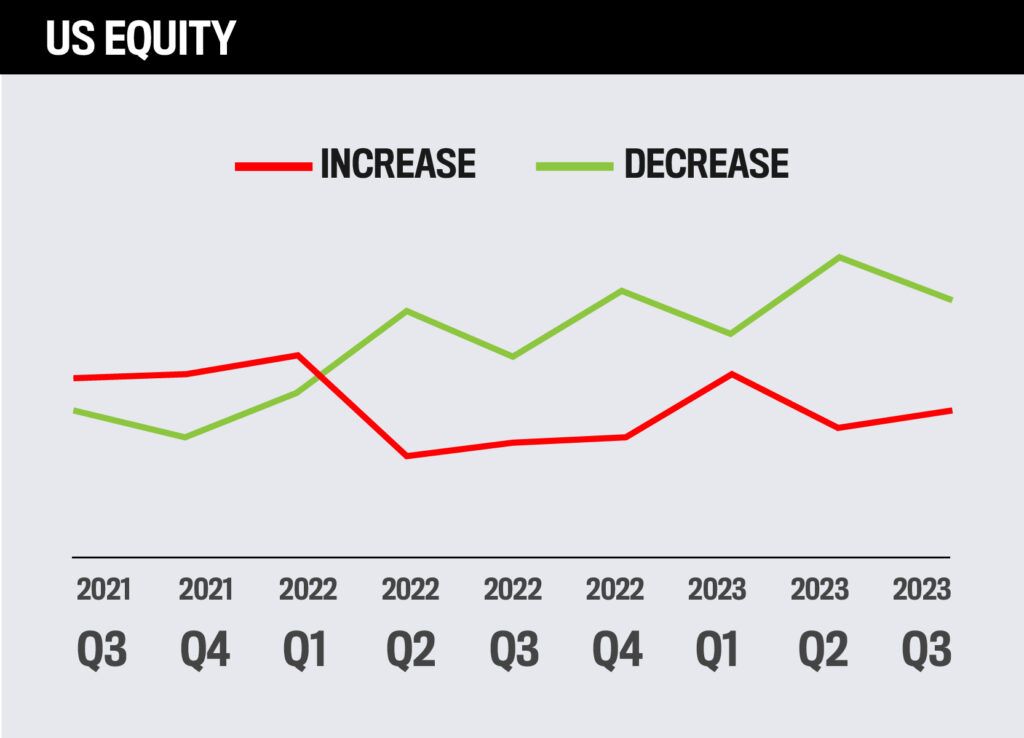

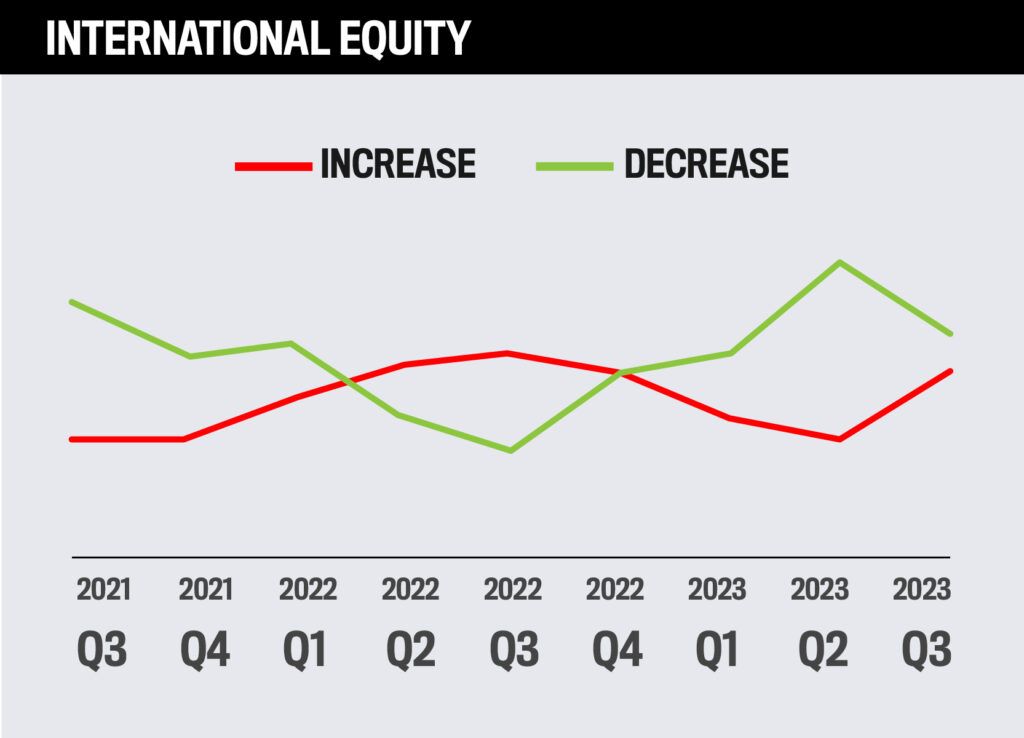

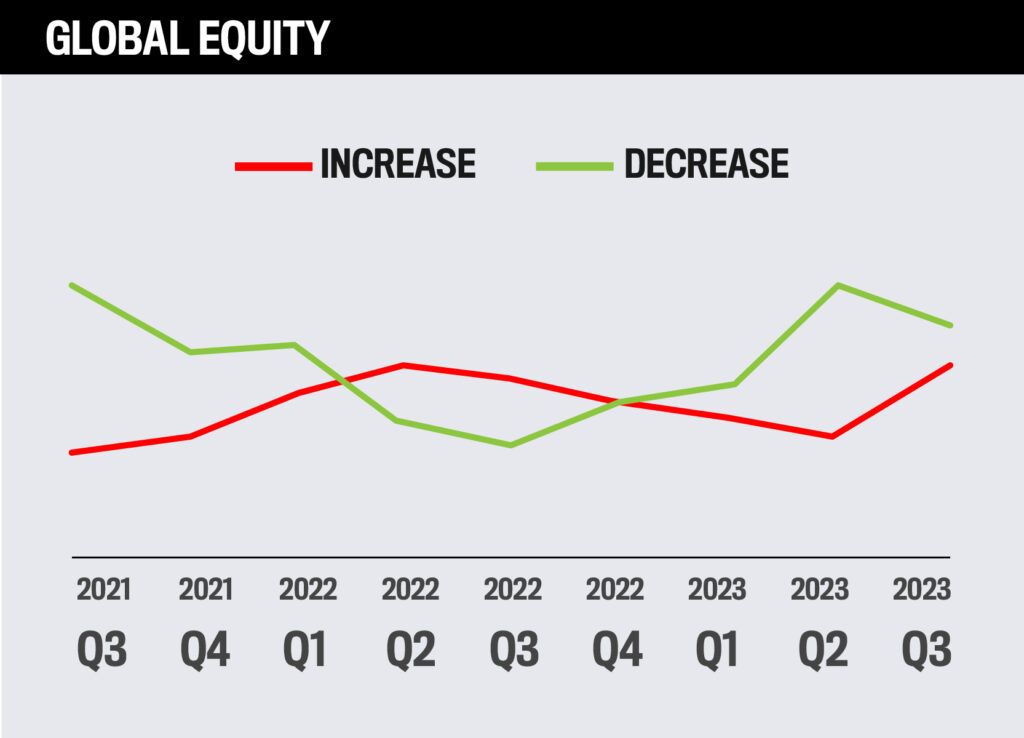

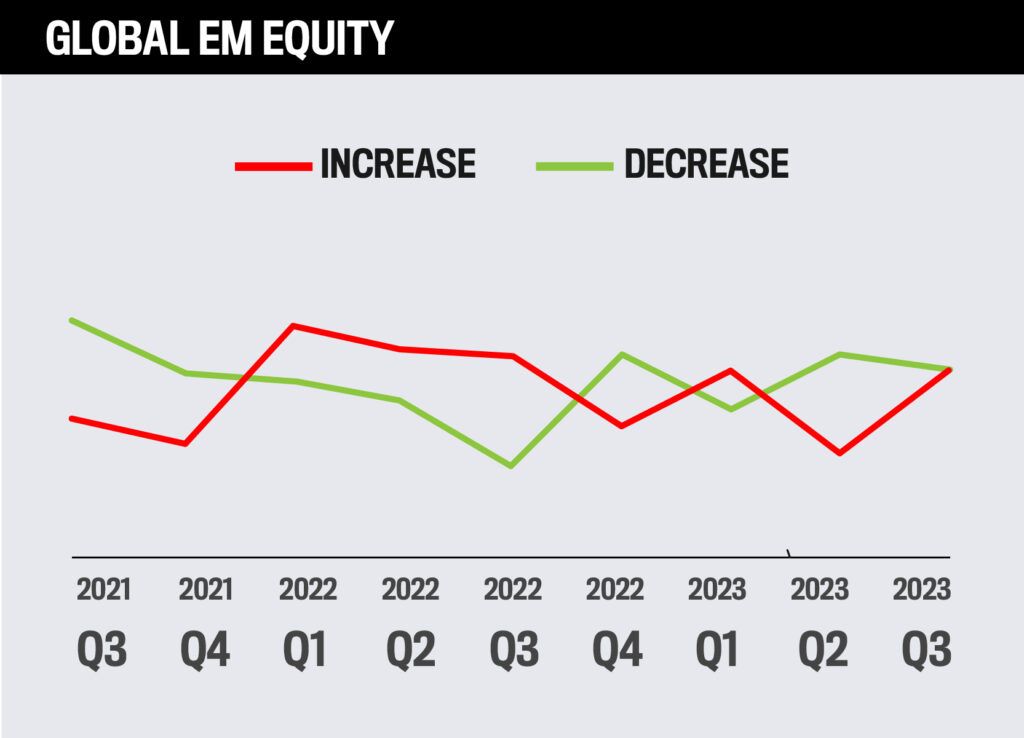

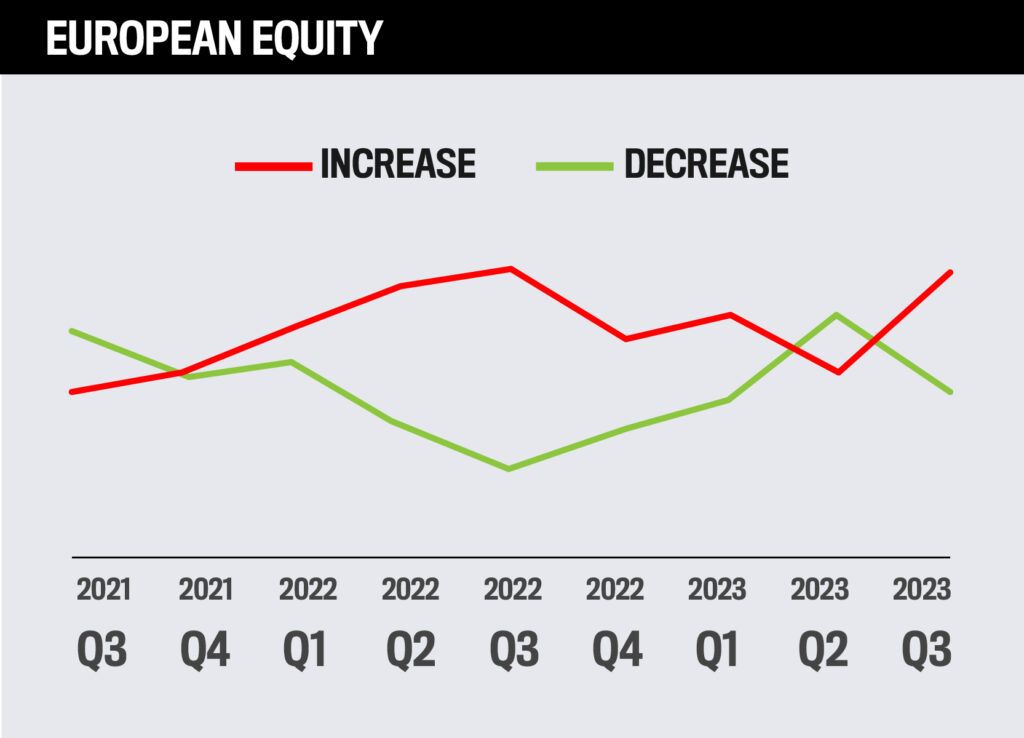

How advisors plan to allocate assets to equities over the next year

Within equity markets, international equity is expected to see the most investment among financial professionals over the next year, while Japanese equity is expected to see the least.

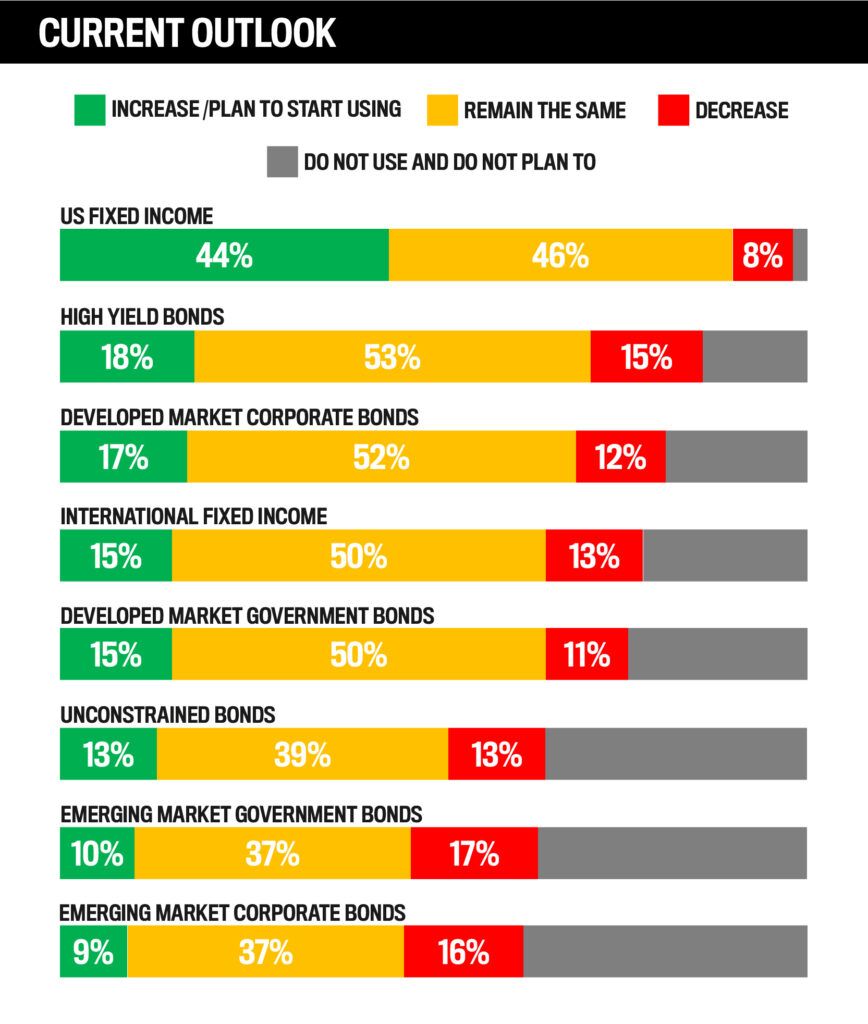

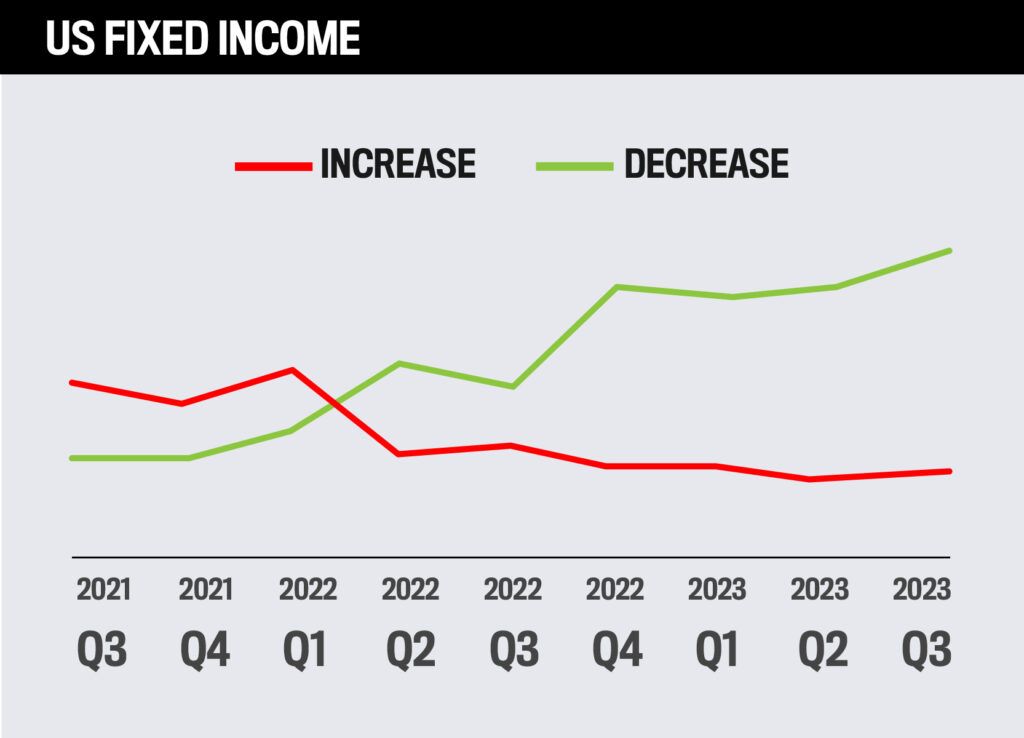

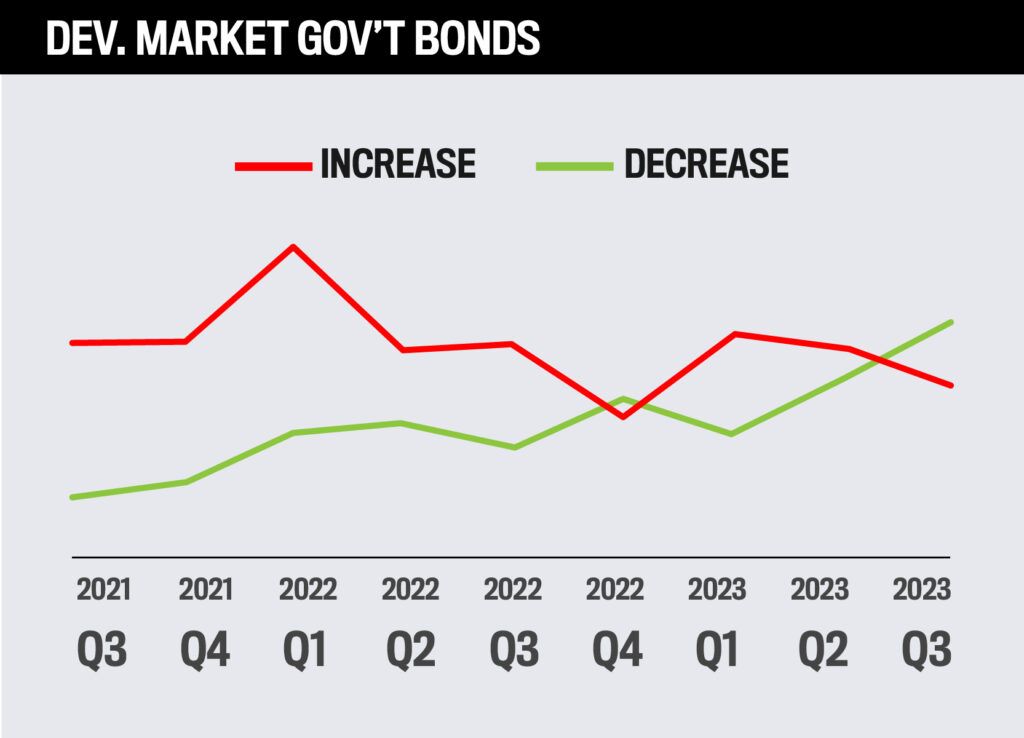

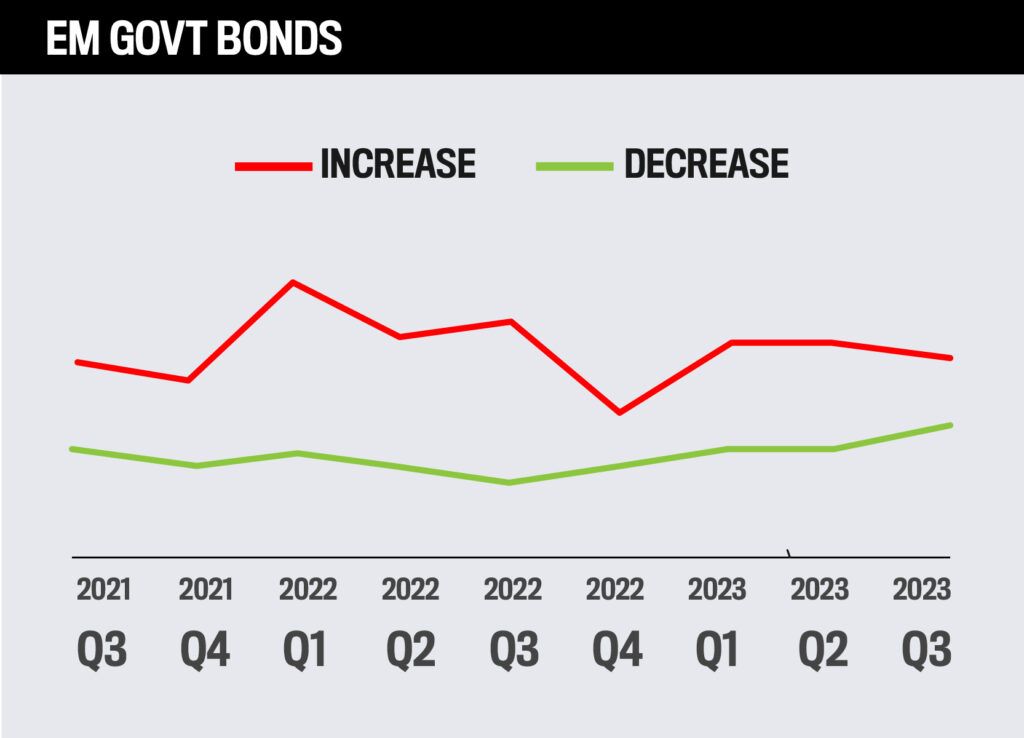

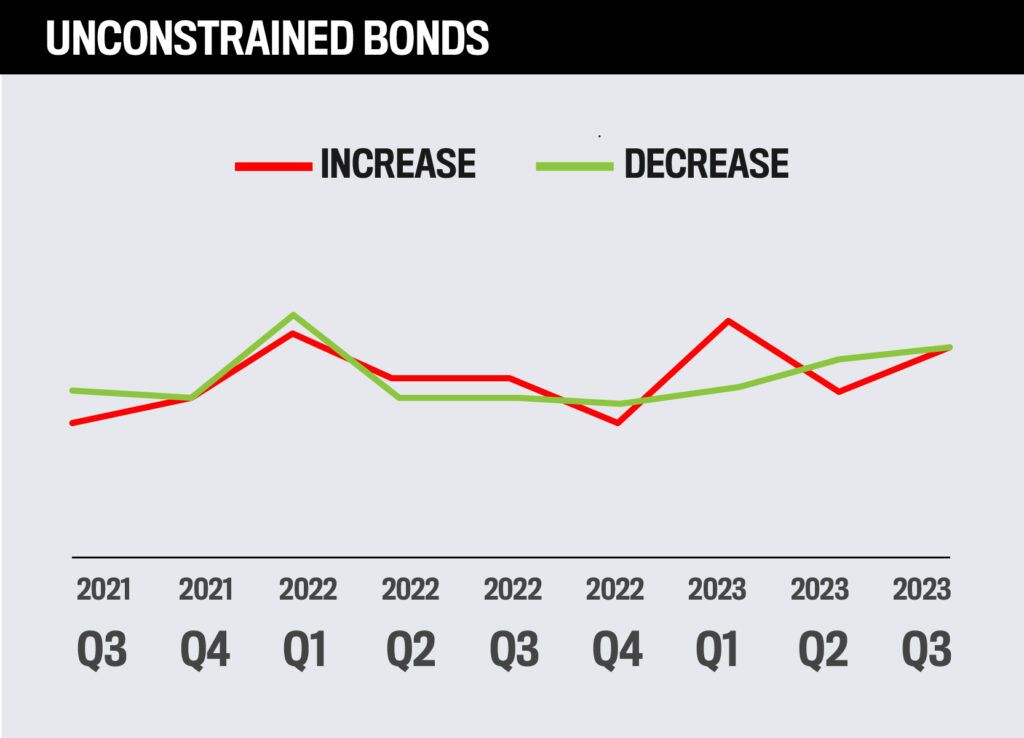

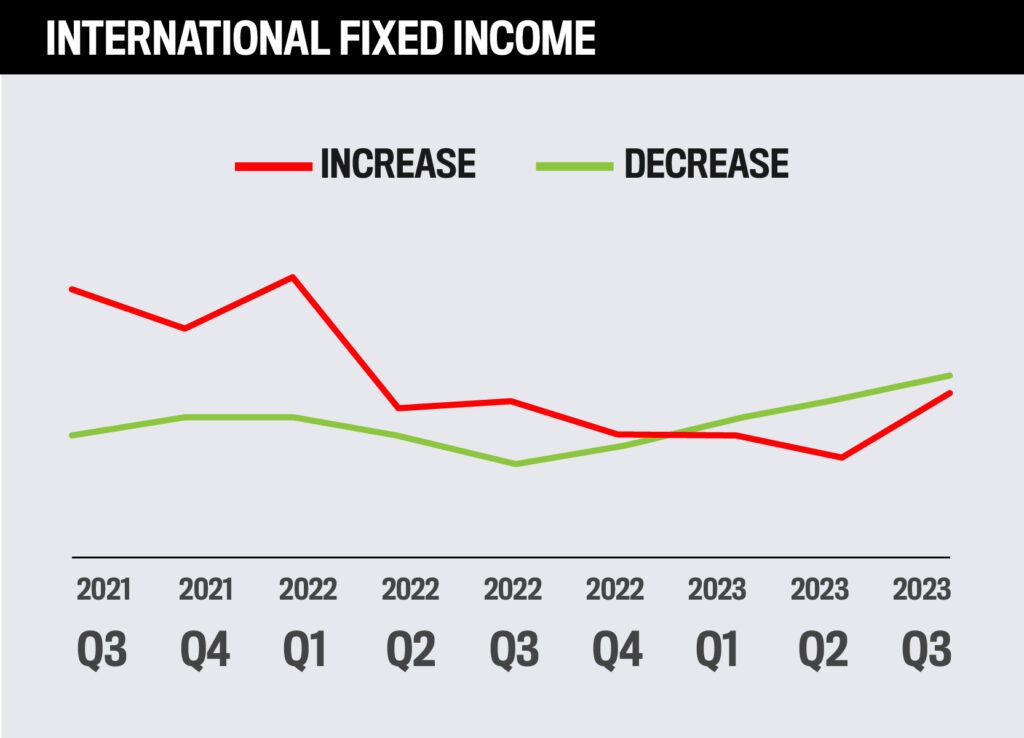

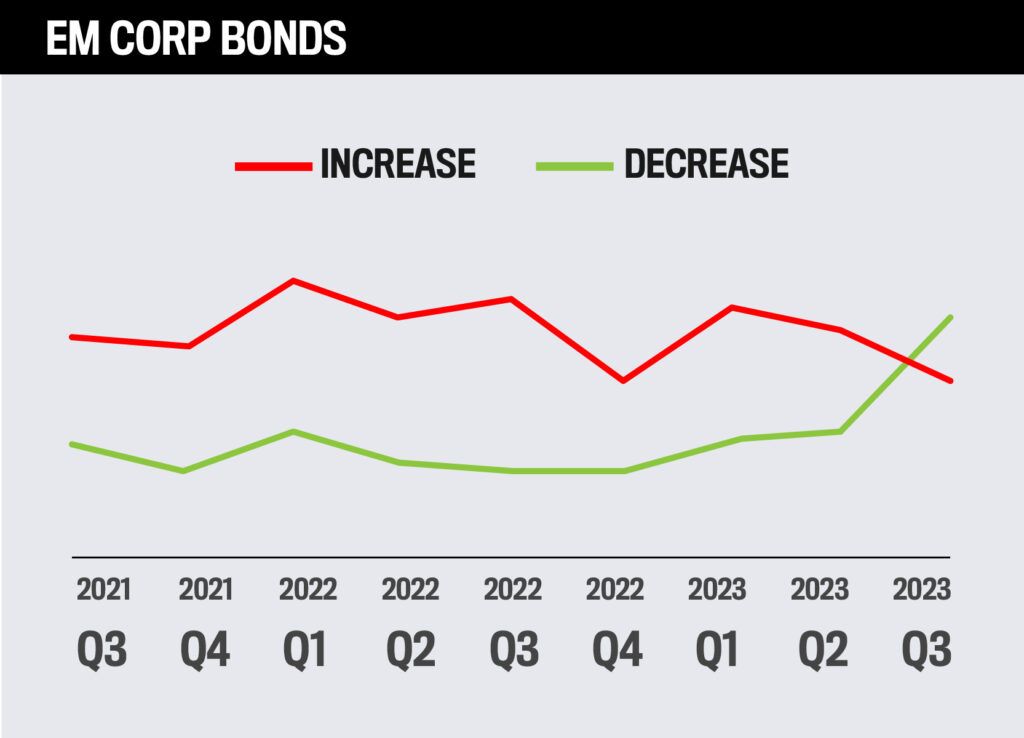

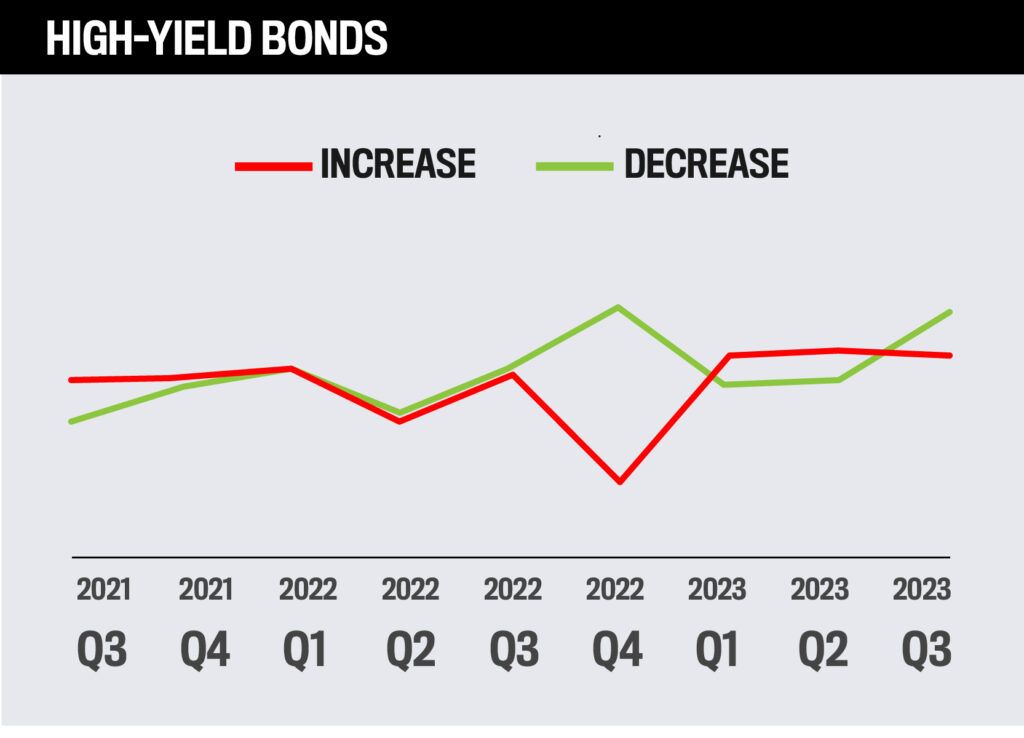

Fixed Income

How advisors plan to allocate assets to fixed income over the next year

Within fixed income markets, U.S. fixed income is expected to see the most investment among financial professionals over the next year, while emerging market corporate bonds are expected to see the least.

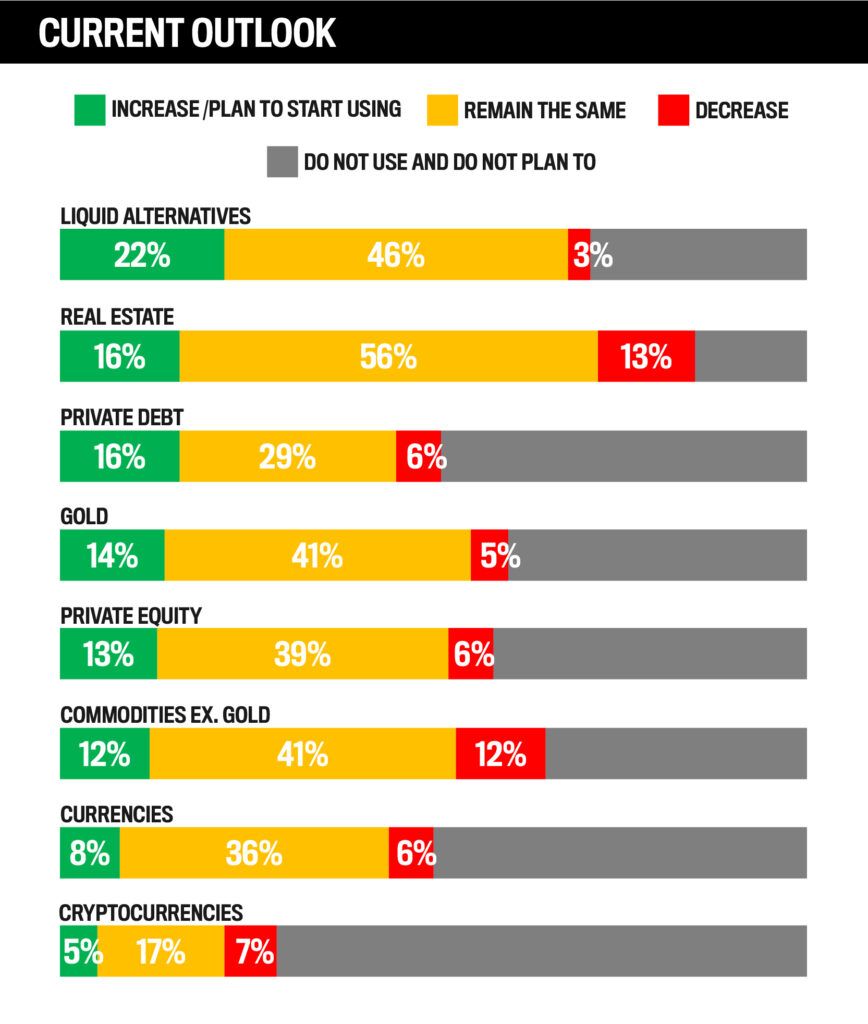

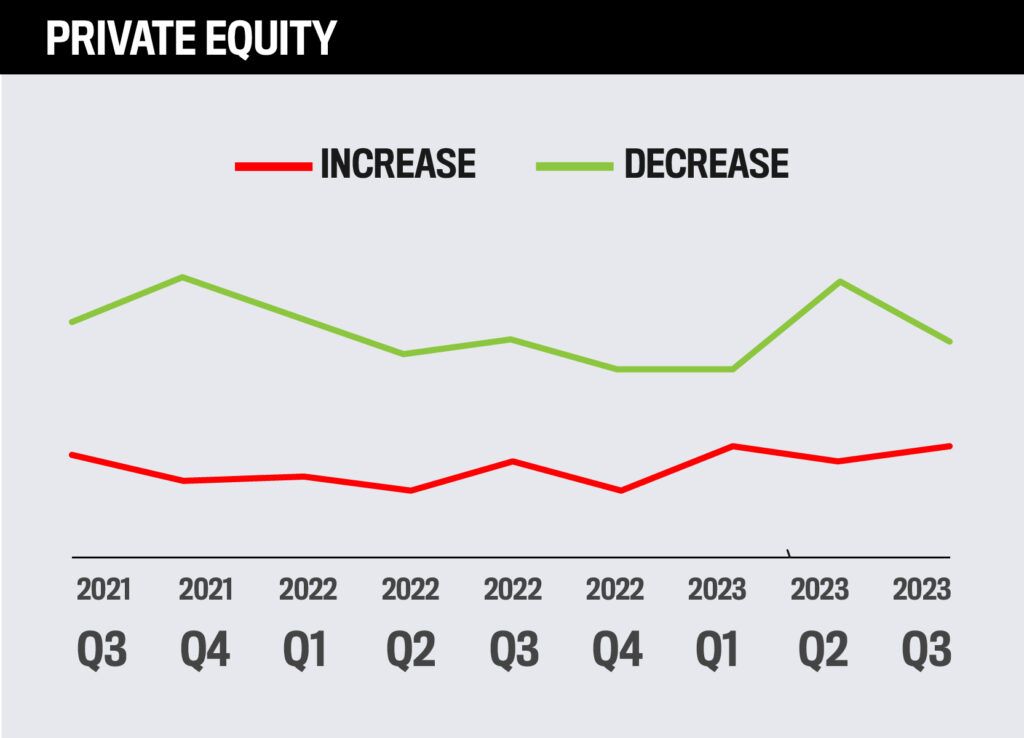

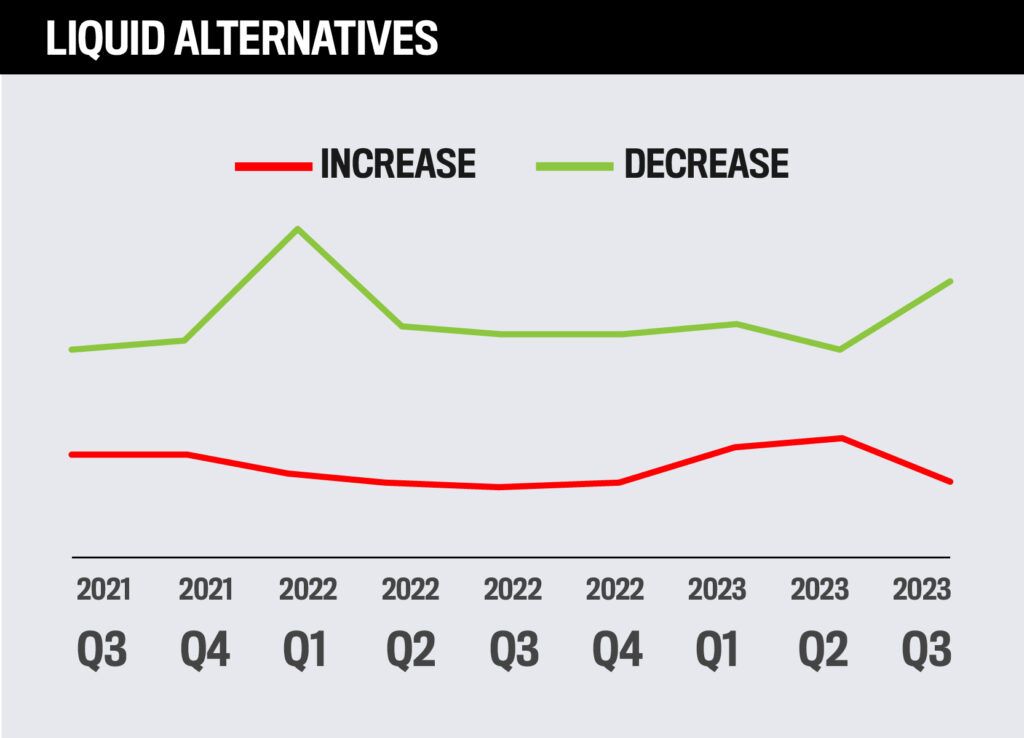

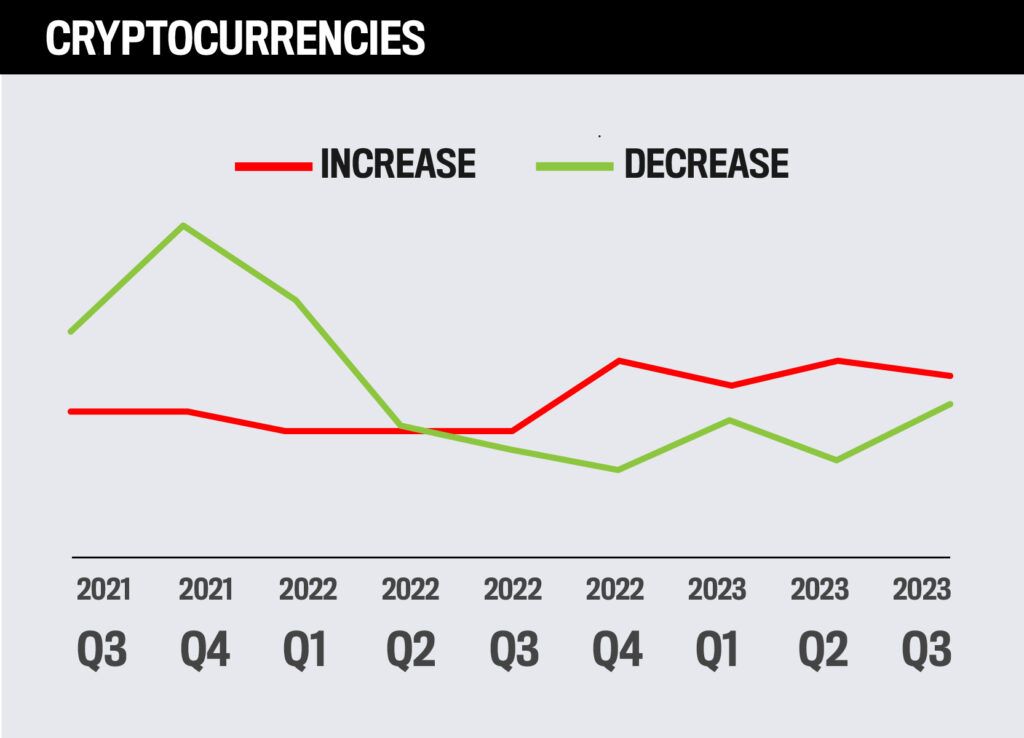

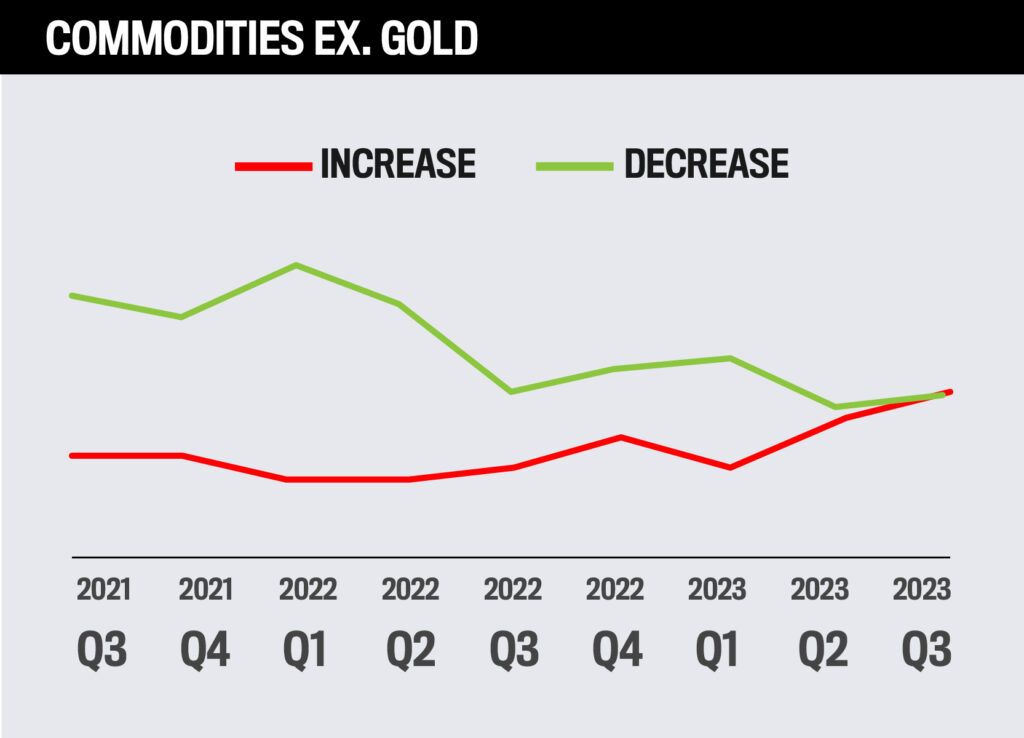

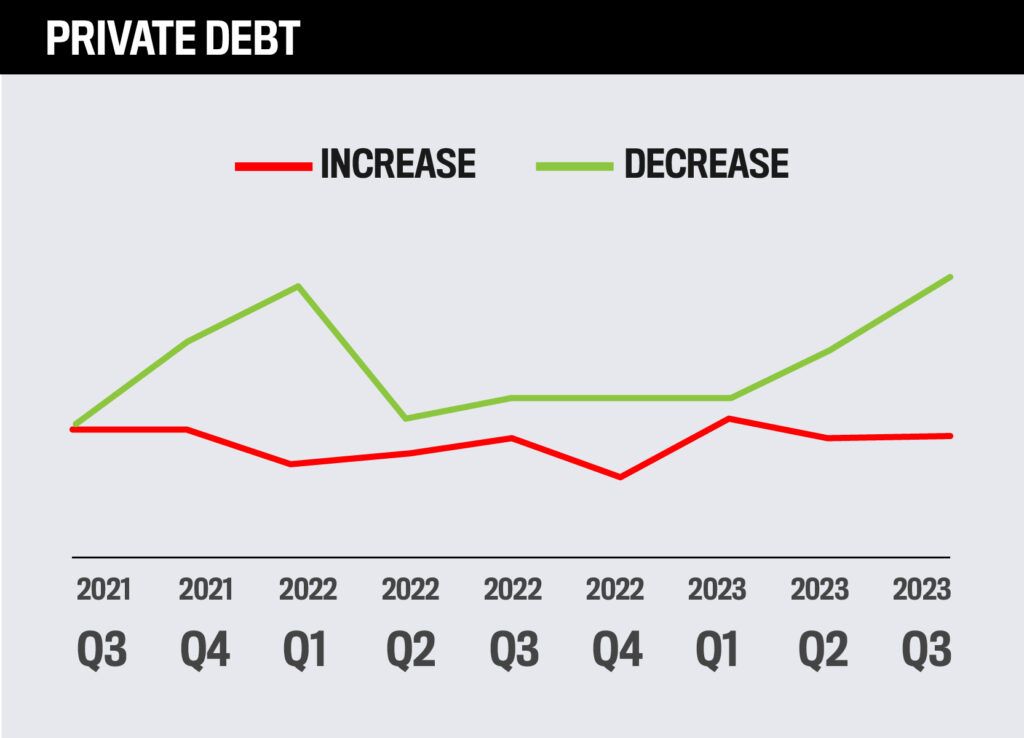

Alternatives

How advisors plan to allocate assets to alternative assets over the next year

Within the alternatives category, liquid alternatives are expected to see the most investment among financial professionals over the next year, while cryptocurrencies are expected to see the least.

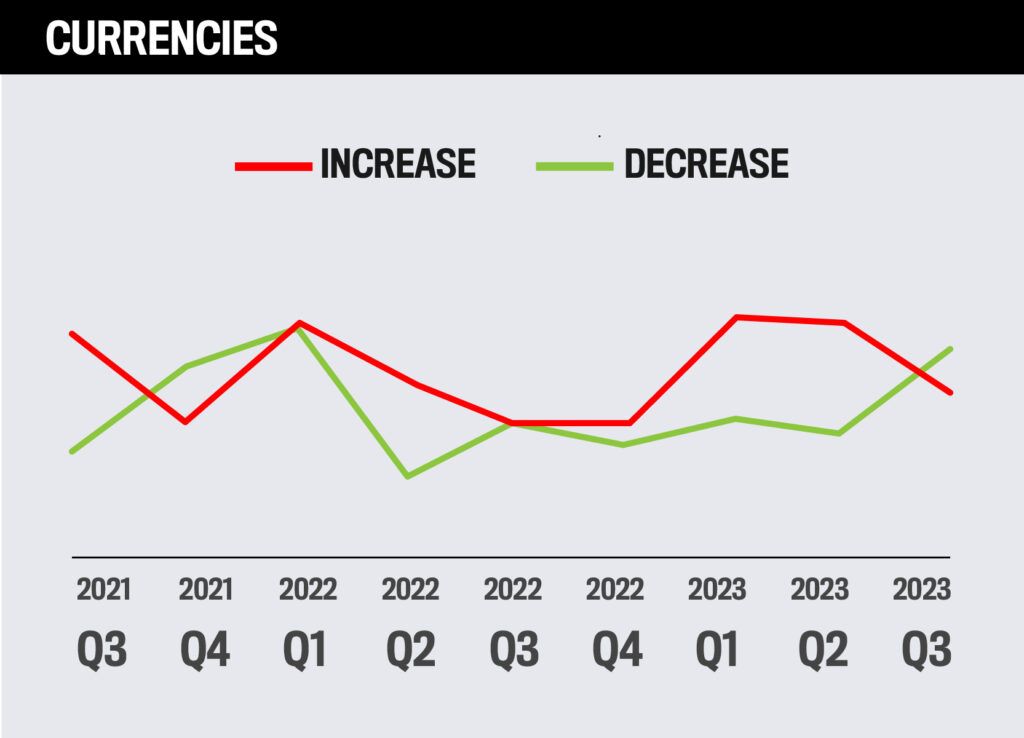

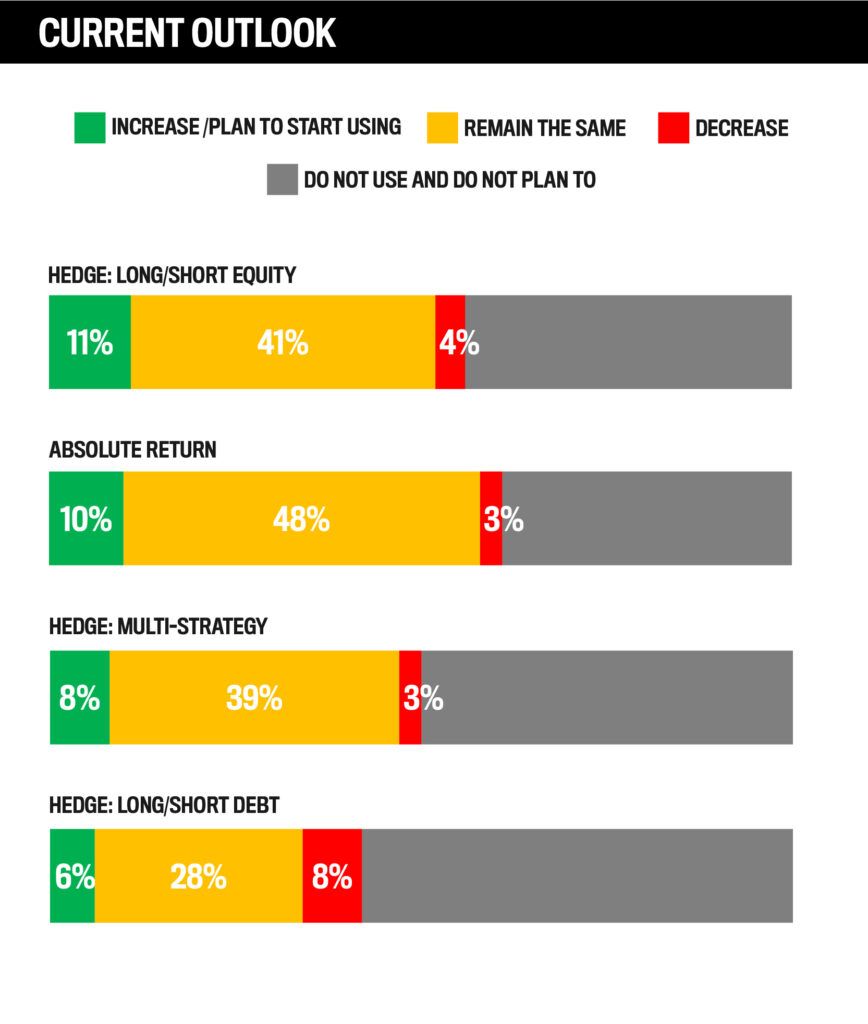

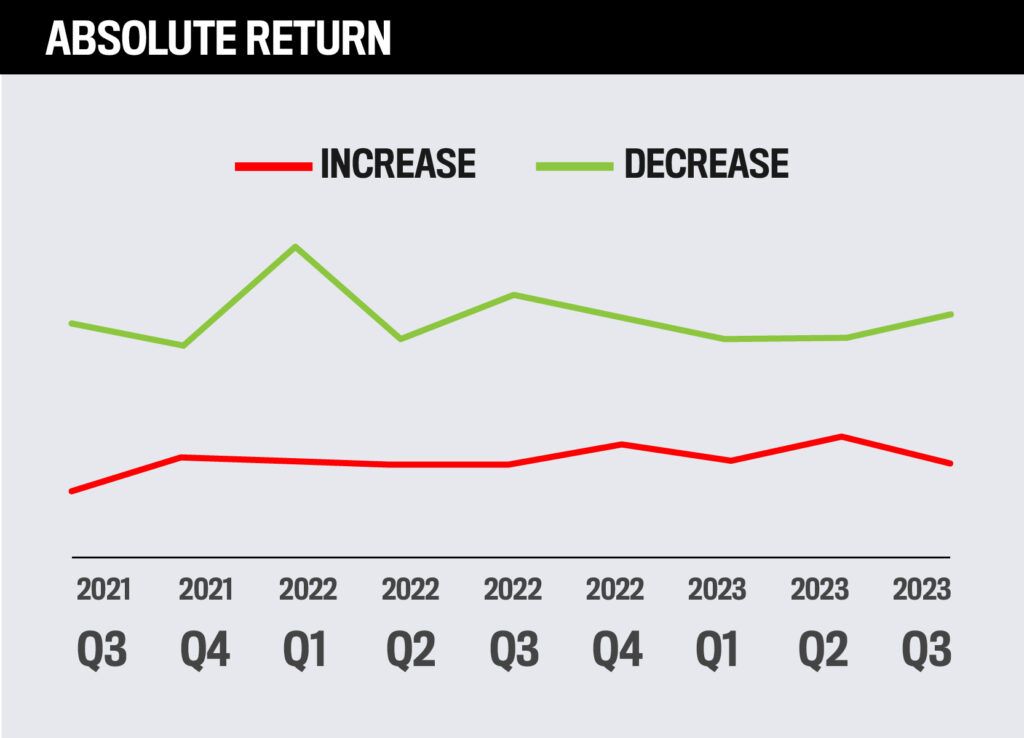

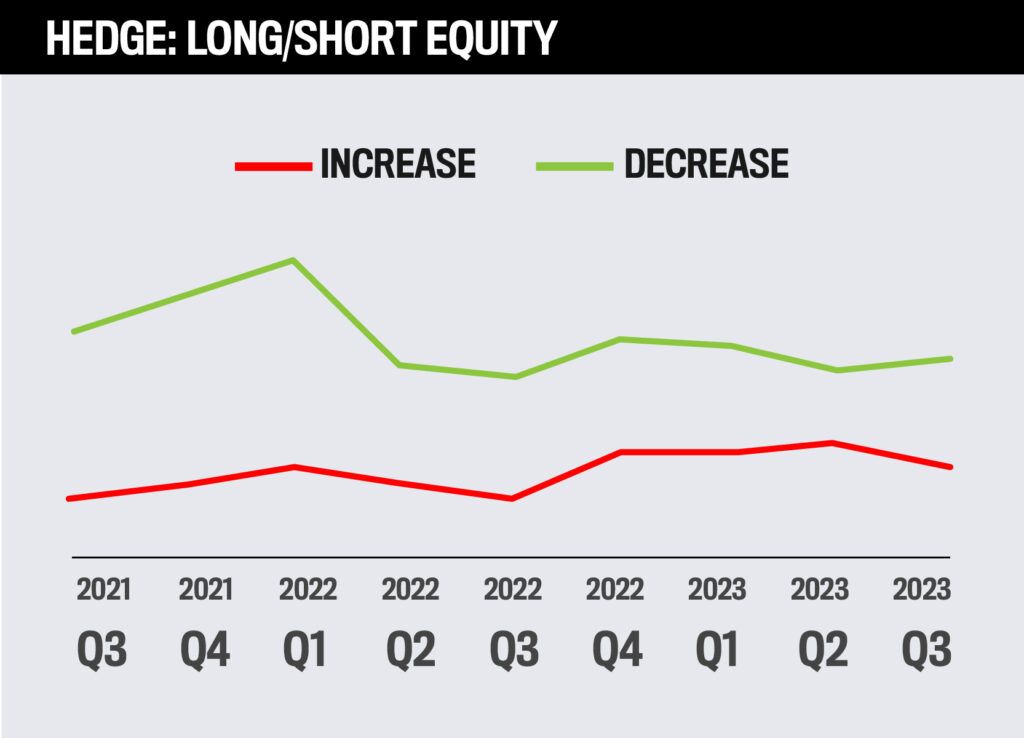

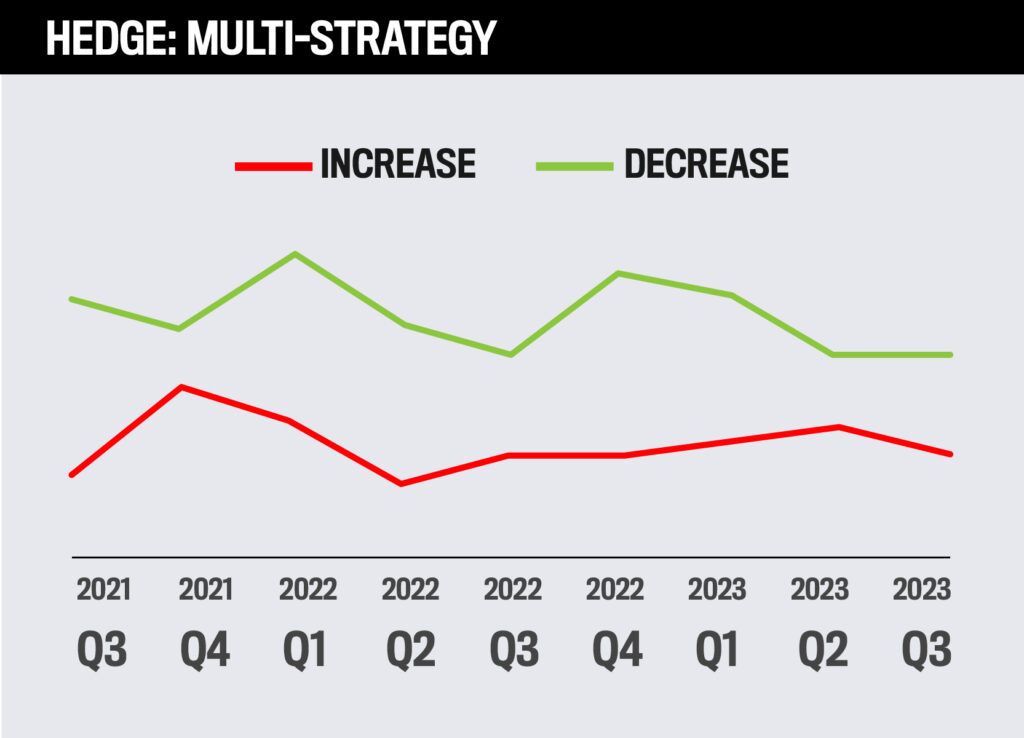

Advanced Strategies

How advisors plan to utilize advanced strategies over the next year

The most popular advanced strategy is currently long/short equity hedging, while the least popular is long/short debt hedging.

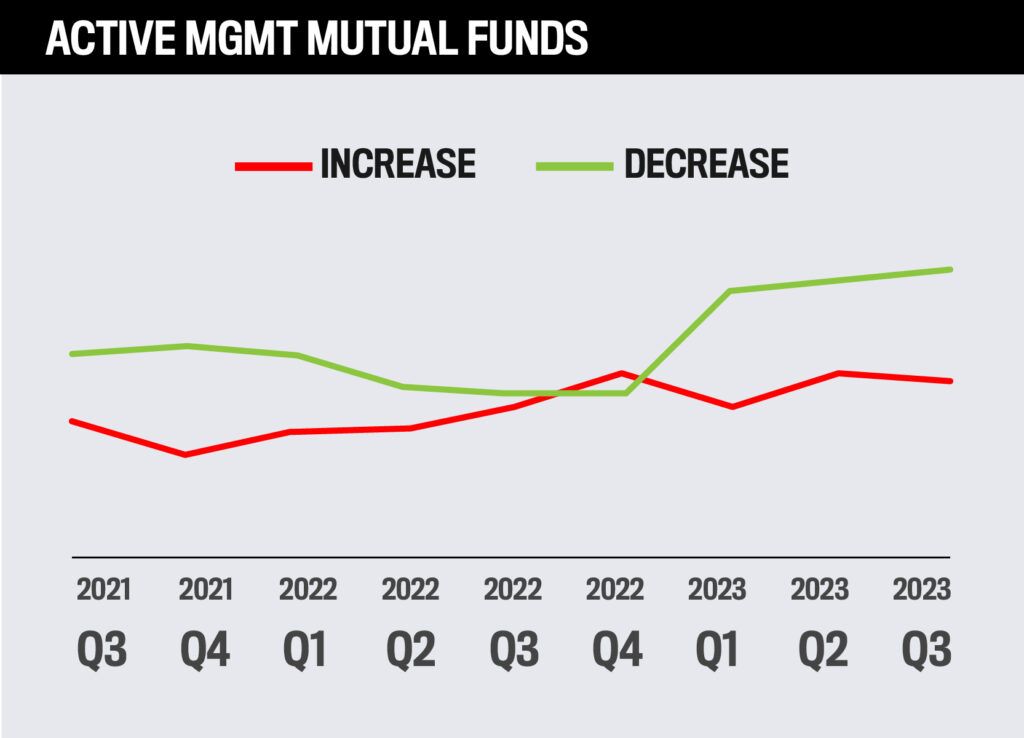

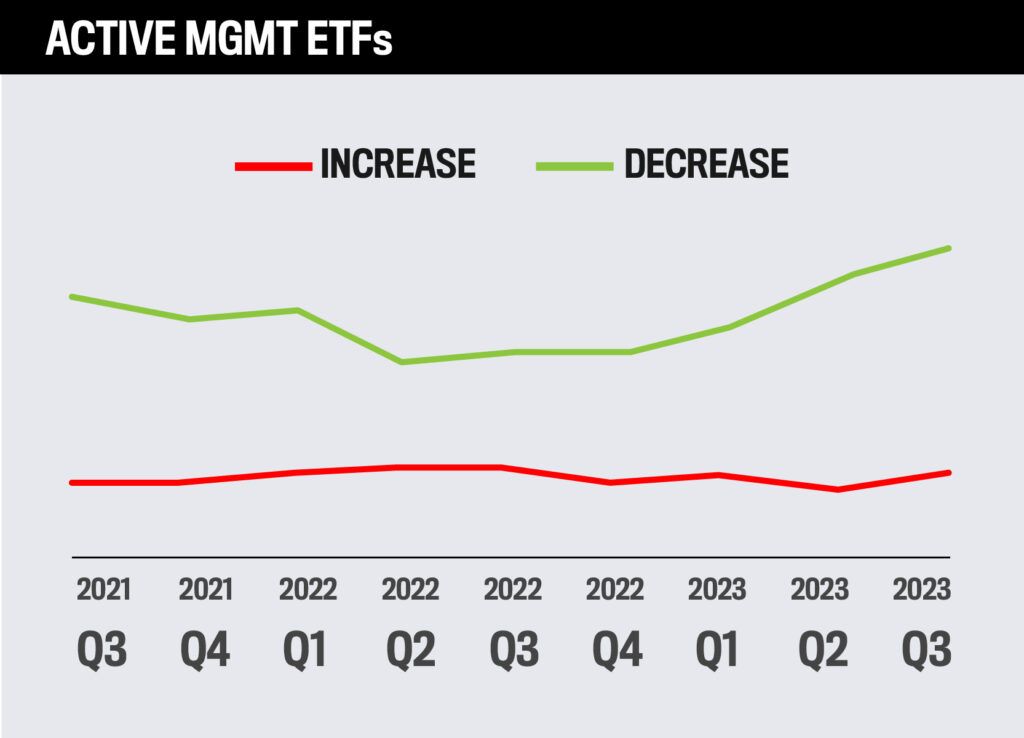

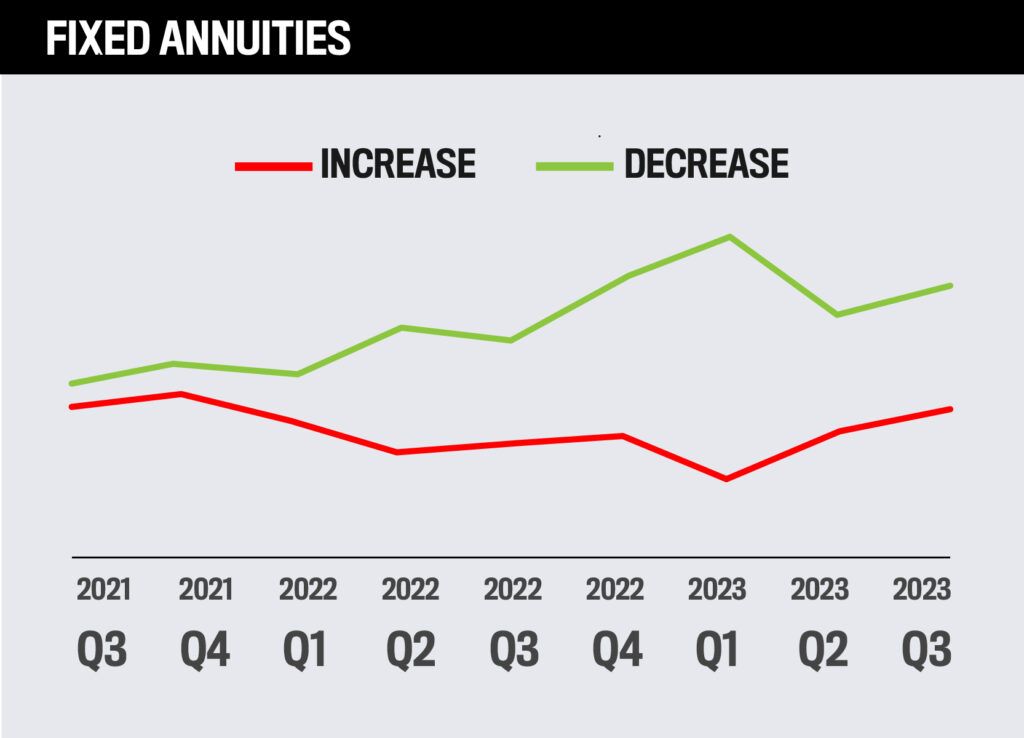

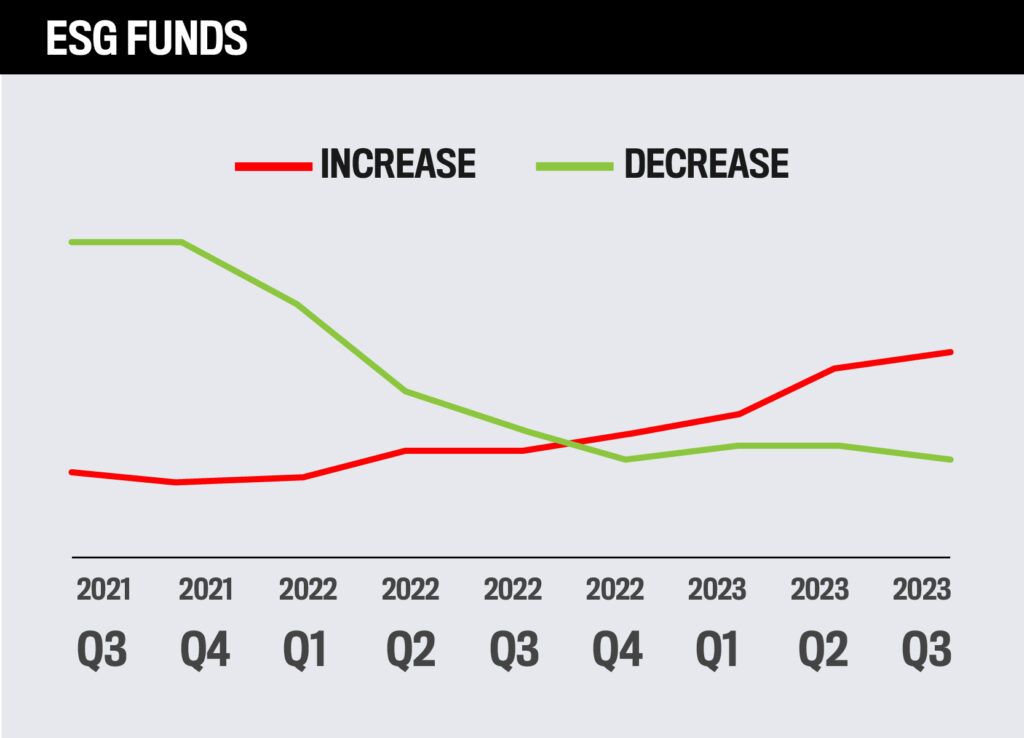

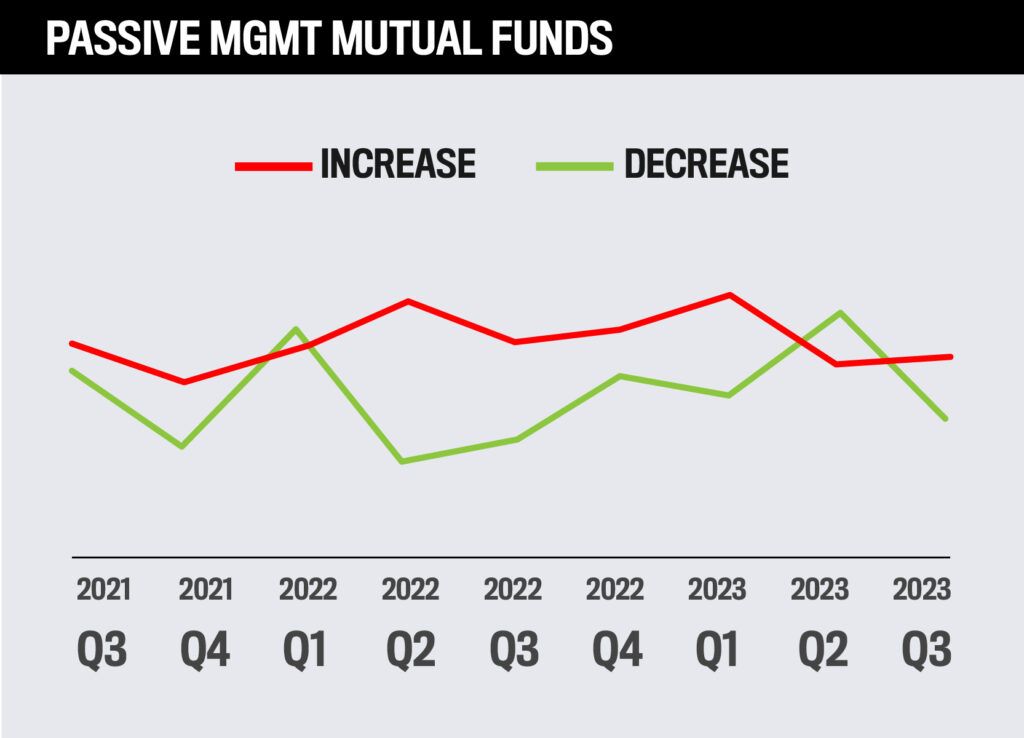

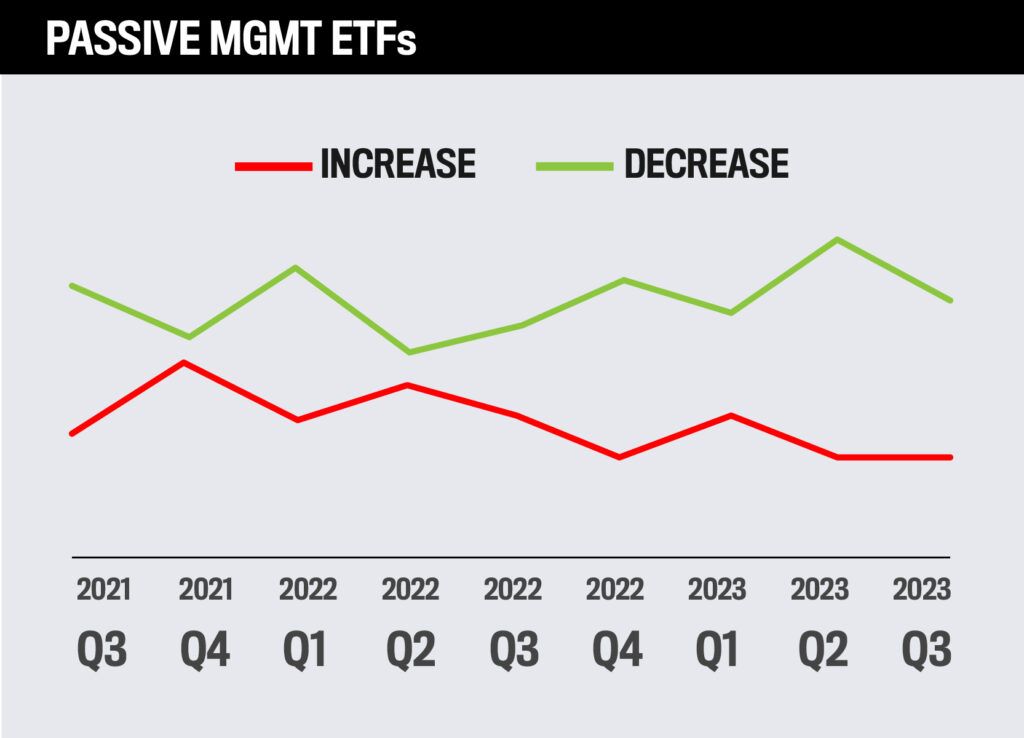

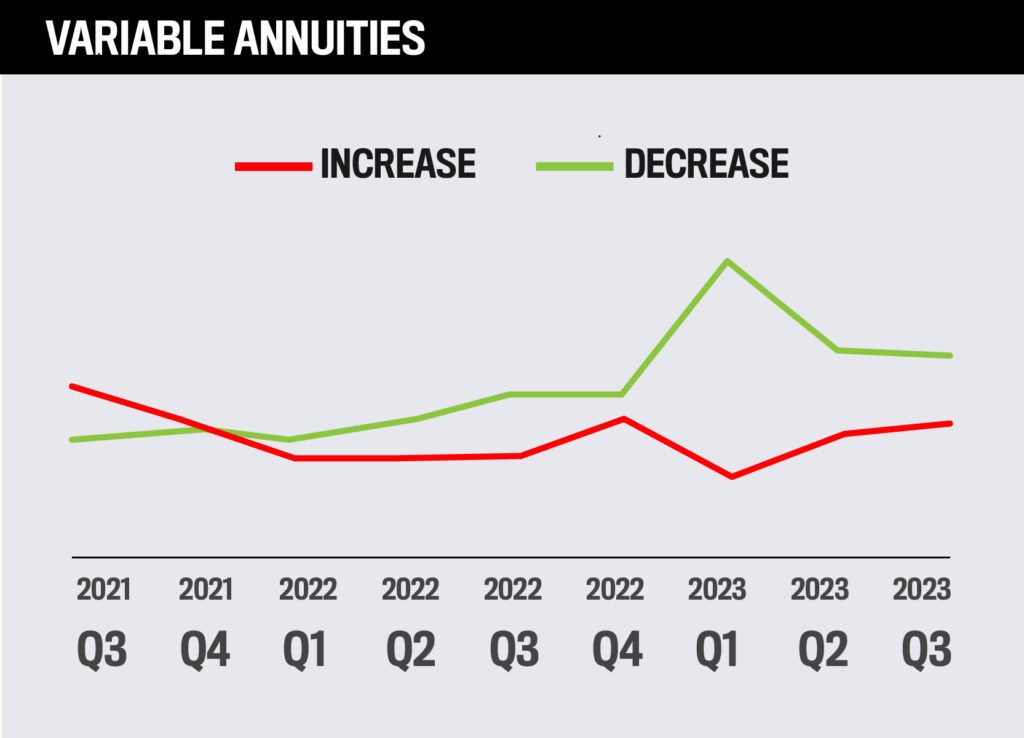

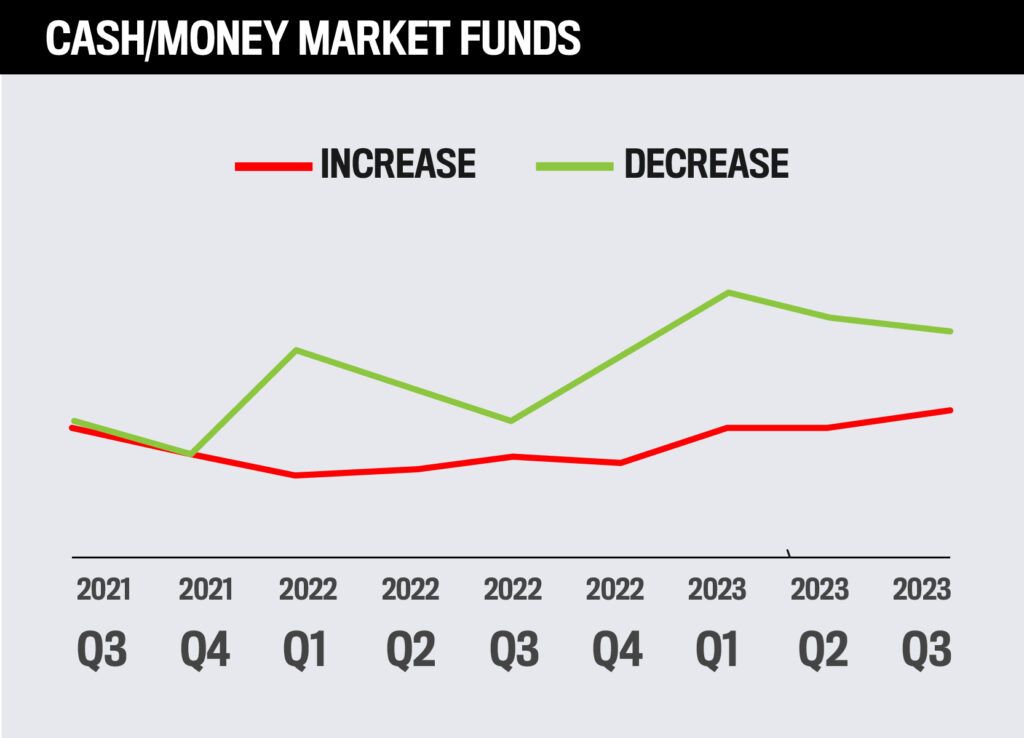

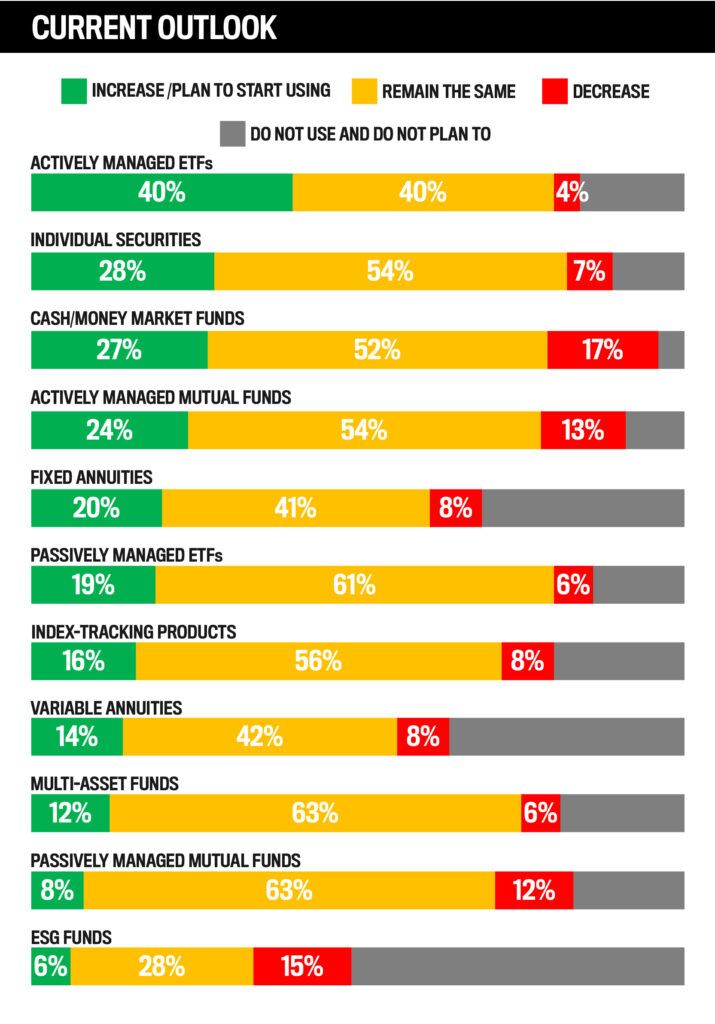

Other Products and Strategies

How advisors will use fund, annuity and other investment products over the next year

Actively managed ETFs are currently expected to see the most increase in usage among advisors over the next year, while ESG funds are expected to be used less.