Ex-Sentinel Securities rep defrauded 9/11 widow: SEC

Regulator said James J. Konaxis churned victim's accounts, earning about $550K in commissions. l

Fund manager admits to adviser fraud, Ponzi scheme

Francisco Illarramendi, a hedge fund manager in Connecticut, pleaded guilty to fraud and two other men were charged with conspiracy in a U.S. probe of an alleged Ponzi scheme with potential investor and creditor losses of hundreds of millions of dollars, prosecutors said.

GAO skewers lending by plans

The Senate Special Committee on Aging and the Government Accountability Office have called upon the Labor Department to give employers guidance on securities-lending activities that are taking place within retirement plans

New Form ADV-2 adding costs, confusion

A new rule aimed at making the financial advisory business more understandable to clients is giving advisers a headache.

Rep settles charges he hoodwinked elderly nuns

SEC claims broker churned accounts of the Sisters of Charity

Pension plan tax breaks facing challenge

Corporate pension industry lobbyists are bracing for an attack on the tax breaks for pension plans as the White House and federal lawmakers struggle to slash the federal budget deficit

Goldman Sachs sued for alleged discrimination

The plaintiffs, H. Cristina Chen-Oster, a former vice president, Lisa Parisi, a former managing director, and Shanna Orlich, a former associate, seek class-action status to represent all female Goldman employees with those job titles.

Proxy firms may feel pinch under DOL proposal

Institutional Shareholder Services Inc., the nation's largest proxy advisory firm, could be forced to revise its business plan if the Labor Department adopts a proposal to expand the definition of “fiduciary.”

Retirement agenda set to take a backseat in gridlocked Congress

The split in control of Congress means that legislative gridlock will shift the lead on pension issues to executive-branch agencies over next two years, pension industry lobbyists said.

R.I. showering babies with cash for their 529s

The state will deposit $100 in a 529 account for any baby born after July 1, to encourage families to start saving for college.

N.Y. advisers in limbo because state doesn’t do exams

The Dodd-Frank regulatory-reform law aims to reduce the SEC's examination responsibilities by shifting some 4,000 investment advisers to state registration, but New York state may gum up the law's intent.

Incite: Regulators need babes, bucks, and a share of the spoils

Forget new regulations -- just dangle a bigger bone in front of Wall Street watchdogs

True financial reform? OMG! Female teens may hold the answer

The teen game platform omgpop.com offers some useful lessons on how to get market participants to change their behavior.

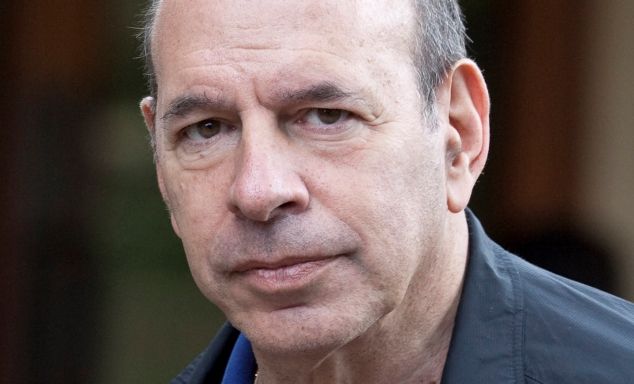

Financial adviser to the stars gets long run in prison

Kenneth I. Starr sentenced to more than seven years in jail for fraud; clients included Sylvester Stallone, Wesley Snipes

SEC’s civil suit against Goldman Sachs hits funds

Count mutual funds and their investors among the big losers in the legal battle between the SEC and The Goldman Sachs Group Inc.'s broker-dealer unit.

Senators aim to put squeeze on Antigua over Stanford assets

Eight U.S. senators want Congress to oppose International Money Fund and World Bank loans to the government of Antigua and Barbuda until that government compensates victims of Stanford Financial Group. Stanford International Bank was located in Antigua.

Secondary market for annuities comes under pressure

The nascent secondary market for annuities and their guaranteed benefits could be stunted as the result of a vote last week by state insurance regulators to allow carriers to terminate the annuity benefits if a client sells the contract.

‘Virus’ to blame for rash of bank robberies in Colorado?

With a nearly 30 percent jump in bank robberies last year when compared with 2008, banks in Colorado are being encouraged to report suspicious people entering their banks as a way to discourage would-be bank robbers.

Employees name investment adviser in 401(k) suit

New targets have surfaced for lawsuits over 401(k) fees: small retirement plans, their investment advisers and service providers.

ICI: Transaction tax would take big bite out of fund returns

High on the mutual fund industry's “to do” list is defeating legislation that would impose a $150 billion-per-year tax on securities transactions.