Whether it’s Mary Beth Franklin’s podcasts and columns, Ed Slott’s webcasts, Fred Barstein on retirement plans, or any of the top-notch reporting by Emile Hallez. The reason is clients always have questions and insecurities, according to Natixis’ Global Retirement Index report, released last Tuesday. That news comes in a country ranked 17th for retirement security in the world.

As Emile Hallez reports: “The U.S. ranked higher in the category of finances in retirement, 11th, than it did overall. The country’s ranking in the health category has fallen significantly over the past two years, from 10th in 2019 to 17th this year, in part as a result of the number of deaths caused by Covid and the resulting decrease in life expectancy. The U.S. didn’t even make the top 25 countries in material well-being, with income inequality being a factor. In quality of life, the country was ranked 21st.”

If you’ve read our work on InvestmentNews or RPA Convergence, you know that no matter the area, improving retirement security in the U.S. requires expanding access to savings, and it requires a concerted effort among policymakers, employers and the financial services industry.

The full Natixis report speaks to areas that can be addressed to improve retirement security, and there’s plenty of evidence of what needs to be done. But resolving the issue requires the courage for those parties to step up and to do the work.

LifeMark Securities has faced scrutiny in the past for its sales of GWG L bonds.

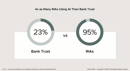

New data from F2 Strategy shows 95% of RIAs are using AI - four times the adoption rate of banks. Trust companies account for 90% of firms not using AI, raising alarms about their ability to stay competitive.

The ex-registered broker facilitated a series of transactions, including nine trades totaling nearly $130,000 and eight withdrawals amounting to $85,000, for a fourteen-month period after the client's death.

The wealth tech giant is offering advisors a natural, intuitive way to use AI through its new business intelligence and insights engine features.

Sometimes letting clients lead conversations, rather than having all the answers, can be the most powerful trust-builder.

How intelliflo aims to solve advisors' top tech headaches—without sacrificing the personal touch clients crave

From direct lending to asset-based finance to commercial real estate debt.