Displaying 20 results

Two-thirds of peak boomers are facing a retirement cliff

With an unprecedented wave of Americans set to retire, an analysis points to a looming generational crisis.

Companies transferred billions in pension assets to annuities. Here come the lawsuits

The law firm behind one of the cases is well-known for its 401(k) and 403(b) litigation: Schlichter Bogard.

3M to freeze its pension plan

The move follows a significant rise in the funded status of corporate defined-benefit plans.

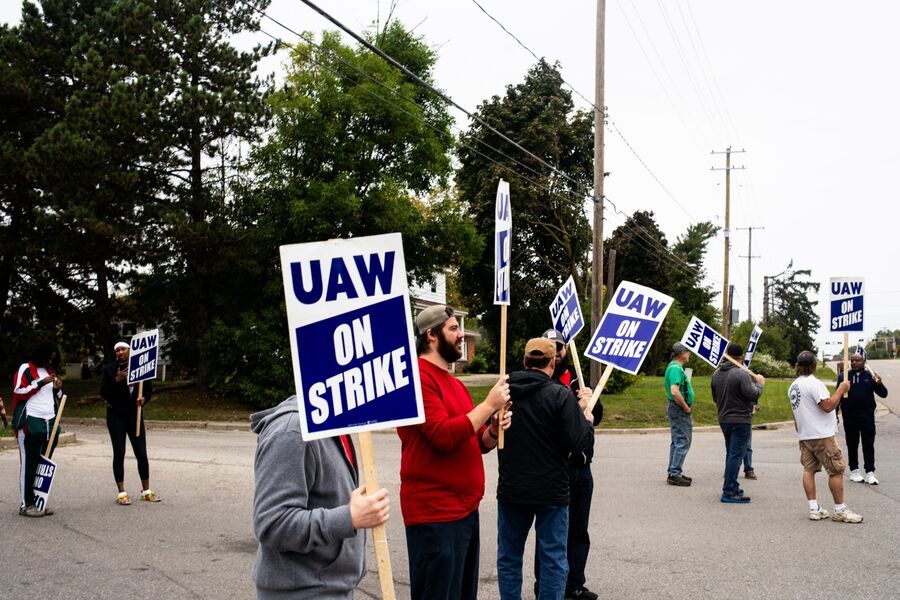

UAW wants pensions back. Automakers really don’t

Most companies don't offer pensions, and many that once did are transferring the liabilities to insurance companies.

To rethink our retirement ‘system,’ go Down Under

While American policymakers tend to ignore the approaches of other nations, looking at the Australian experience might make sense.

Fidelity added $90 billion in DC plan assets in 2021

The fund giant says it also added $20 billion in defined-benefit assets last year.

Institutional investors less confident about meeting return targets

Yield generation is the top challenge, a Fidelity survey shows; 40% of those surveyed say they have to take on more risk to achieve the same returns.

In-plan income is key to retirement security

Not having a retirement income solution within a DC plan is like having the pilots on a commercial flight parachute off midflight, forcing passengers to land the plane.

Demographics, Covid speed looming retirement crisis

A report from the Alliance for Lifetime Income calls for new retirement income model that includes annuities.

ESG credentials in demand by pension funds

Survey finds most institutional investors look for sustainable investing and diversity criteria when hiring equity managers.

New York slaps AIG with $12 million penalty over pension risk transfers

Regulators say the insurance company’s American General Life subsidiary operated in the state without a license, undertaking four large-scale pension risk transfers and bidding on others.

No excuse not to find missing plan participants

The Labor Department has stepped up its audits of plans that have lost track of participants, and noted last month that in 2020 alone, investigators had helped reunite missing participants with plan benefits “with a present value in excess of $1.4 billion.”

New York pension fund pledges net-zero emissions by 2040

The fund also said it may divest from the riskiest oil and gas companies by 2025

Benefits administrators plead guilty to $15 million embezzlement

The Texas couple made 90 unauthorized distributions from pension and retirement plans they ran

Public pensions see worst quarter since credit crisis

State and local government pension plans lost about 13% during the first quarter

COVID-19’s impact on DC plans may be manageable

Market volatility may be biggest factor in producing retirement shortfalls, according to the Employee Benefit Research Institute

Putnam, Emory University settle ERISA lawsuits

The investment firm will pay $12.5 million to put a 2015 case behind it, court records show

Market plunge chops pension funding by 9%

The sell-off in response to the pandemic has hit some industries' pensions plans, such as airlines', harder than others, two reports suggest

Senate coronavirus package would allow hardship early access to retirement accounts

Financial industry also pushes for temporary waiver on required minimum distributions

Pension risk transfers swelled nearly 70% in 2017

Employers have increasingly offloaded their pension liabilities to insurance companies as pensions have become costly to keep on the books.