Displaying 115 results

Retirement accounts surged on strong 2023 markets: Vanguard

The study shows that 43 percent of participants raised their deferral rates last year, marking the highest level since Vanguard began tracking the metric.

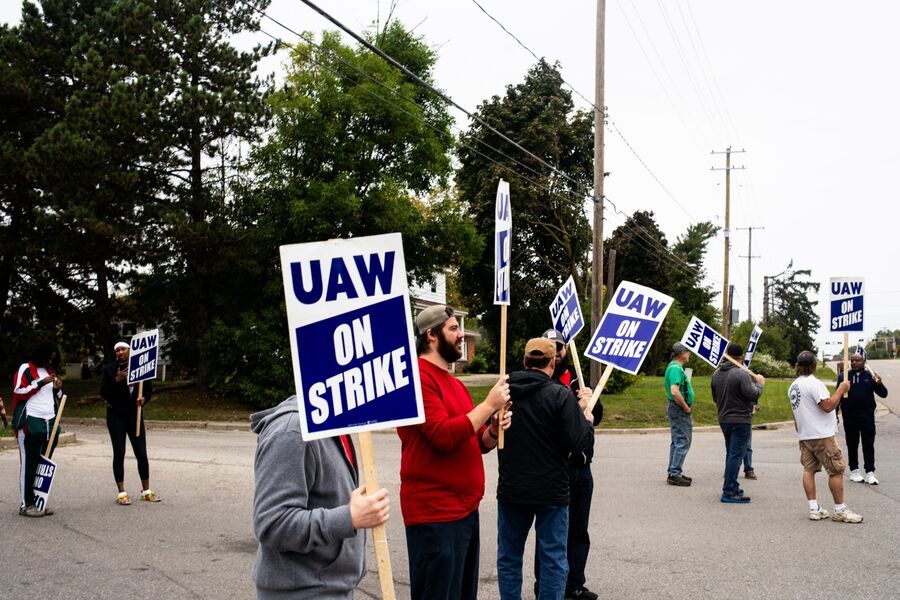

UAW wants pensions back. Automakers really don’t

Most companies don't offer pensions, and many that once did are transferring the liabilities to insurance companies.

Democratic bill would require spousal consent for 401(k) distributions

Legislation would extend spousal protections used in pensions to defined-contribution plans.

Fidelity added $90 billion in DC plan assets in 2021

The fund giant says it also added $20 billion in defined-benefit assets last year.

Tax hikes could fall away as Democrats shrink Build Back Better bill

But an executive at Schwab says increasing the top capital gains rate and lowering the estate tax exemption could make it into a compromise measure.

Institutional investors less confident about meeting return targets

Yield generation is the top challenge, a Fidelity survey shows; 40% of those surveyed say they have to take on more risk to achieve the same returns.

Consolidation, wellness and micro market top of mind for record keepers

Looming over the RPA Record Keeper Roundtable and Think Tank was the convergence of wealth, retirement and health at work.

Target-date funds hold 27% of 401(k) assets, study finds

The funds are most popular with younger plan participants; 62% of those in their 20s hold the funds, compared with 50% of those in their 60s.

House committee approves auto-IRA legislation

Two Democrats joined all Republicans on the panel in opposing the measure, which is designed to expand workplace retirement savings and would impose a tax on businesses that don't set up plans.

Koch, Voya settle 401(k) fee lawsuits

Koch will pay $4 million in a case alleging excessive record-keeping fees, and Voya reached a confidential agreement in a separate lawsuit. Yum Brands was also sued by a participant who claims he was wrongly classified as an independent contractor and denied retirement benefits.

Is your 401(k) ESG? There’s a certificate for that

Dalbar rates 401(k)s with up to five stars and tells plan sponsors what they can do to improve their plans on the basis of environmental, social and governance criteria.

If rates stay low, expect retirement security to take a hit

Some of the factors that have led to the current low-interest-rate environment could remain in play for years, according to an analysis of existing research recently published by the Society of Actuaries.

Legislators ask GAO to review target-date funds

The heads of the Senate and House committees overseeing labor want to know whether TDFs are working as advertised.

House panel unanimously passes SECURE 2.0

The bill, which advances to the House floor with a strong bipartisan push, would raise the RMD age from 72 to 75, among many other provisions.

For 401(k) savers, words matter

'Investment risk' doesn't mean the same thing to everyone, and some words work better than others, according to a report from Invesco.

House committee poised to advance SECURE 2.0 retirement savings bill

The bill, which builds on the SECURE Act, would raise the required minimum distribution age from 72 to 75 over 10 years.

How the 401(k) industry can help attract young advisers

Training advisers to be financial coaches or mentors is more appealing to the younger generation. Rather than cold-calling or selling insurance or high-priced annuities, these younger advisers would be contacting 'clients' of their firm with the blessing, and fiduciary oversight, of their employer.

House bill seeks to open 403(b) plans to CITs

CITs, which are bank products, have been gaining market share in 401(k)s for years, but they are not expressly permitted in 403(b) plans.

Many plan borrowers took more than they needed, survey finds

While the people who took loans or withdrawals as a result of Covid-19 are in a better place financially, they feel behind in their saving.

Potential Pru Retirement sale a cautionary tale of a 401(k) innovator

It is no wonder, but certainly disappointing, that one of the industry’s most innovative providers, Prudential Retirement, is reportedly exploring a sale. That highlights how much record keeping has become a commodity focused on scale and costs.