Displaying 34 results

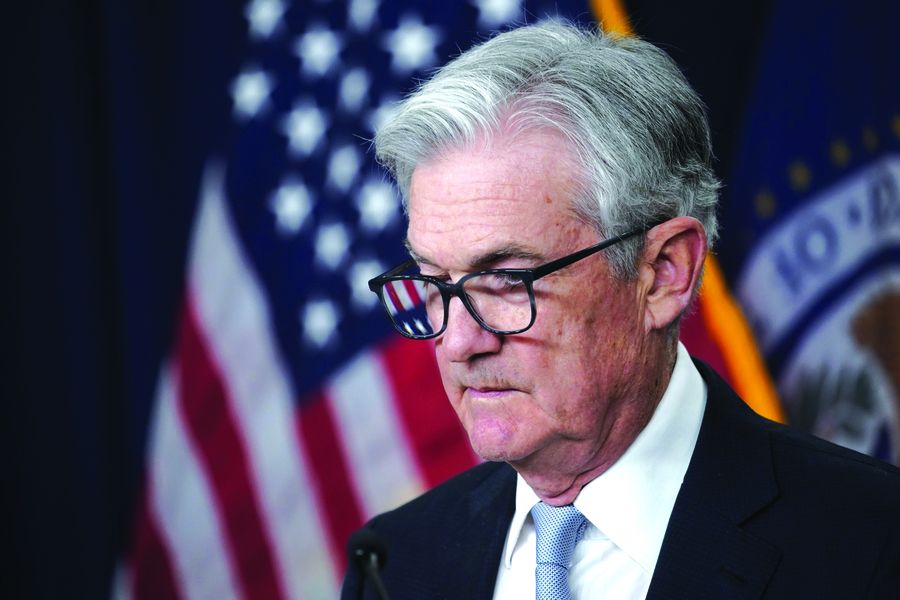

Powell indicates delay in Fed rate cuts

The Fed chair said that if price pressures persist, the central bank can keep rates steady 'as long as needed.'

Fed rate cuts may not come until summer at the earliest

Jerome Powell set a dovish tone in an interview Sunday on CBS' 60 Minutes.

Stocks lower ahead of Fed Chair Powell’s speech

Fed chair is set to speak at 9.15 a.m. ET, with other officials also scheduled.

Powell sees more rate hikes ahead

The timing of additional increases will be based on incoming data, Powell said in his opening statement.

Don’t misread the Fed’s pause in June as the end of higher rates

Scrambling to stay ahead of the central bank's next move, advisors and market watchers think the Fed is trying to keep the markets on their toes.

Financial advisors torn between trusting the Fed and trusting the bond market

The money flowing into Treasuries has some market watchers believing that the Fed's next move will be a rate cut, and that it could come as soon as June.

Bond market anticipates Fed policy doing damage

Federal Reserve Chair Jerome Powell warned of a return to bigger interest-rate hikes to cool inflation and the economy.

Federal Reserve raises rates by a quarter point

Chair Jerome Powell and fellow policymakers lifted the Fed’s target for its benchmark rate to a range of 4.5% to 4.75%.

Fed raises interest rates by half point as it signals borrowing costs will head higher next year

Chair Jerome Powell said ‘we still have some ways to go’ after the FOMC raised its benchmark rate to a 4.25% to 4.5% target range.

Recession may be necessary trade-off to regain control of inflation, warns Powell

Federal Reserve officials raised rates 75 basis points and forecast a further 1.25 percentage points of tightening before year end.

Fed hikes interest rates by 75 basis points for the third consecutive time

The decision to raise rates was unanimous and officials forecast they would reach 4.6% in 2023.

Powell warns rates will stay high for some time

The Federal Reserve chair pushed back against the notion that the central bank would soon reverse course.

Economy shrinks for second straight quarter, pumping up recession angst

Inflation undercut consumer spending and Federal Reserve interest-rate hikes stymied businesses and housing.

Fed raises rates by 75 basis points for second straight month to curb surging inflation

Chair Jerome Powell says Fed will slow the pace of rate hikes at some point and would set policy on a meeting-by-meeting basis.

Fed expected to deliver largest back-to-back rate hike in decades

The FOMC is expected to raise rates by 75 basis points with investors seeking signs of a downshift in September.

Powell’s bond market recession indicator Is sending a warning

A vast swathe of the US yield curve inverted in recent weeks as recession fears spurred investors to pile into longer maturities.

Fed to inflict more pain on economy as it readies big rate hike

A growing number of analysts say it will take a recession — and markedly higher joblessness — to ease price pressures significantly.

Fed could weigh historic 100 basis-point hike after inflation scorcher

Futures priced roughly a one-in-two chance of such a hike after consumer prices rose a hotter-than-forecast 9.1% in the year through June.

Stock funds see exodus as recession fears grip investors

Equity funds see $16.8 billion outflows while bonds saw redemptions of $23.5 billion.

Bond market losses just beginning as Fed sets path to 4% yields

Investors also dumped European bonds after a surprise Swiss rate hike, putting Germany’s five-year yield on track for its biggest jump since 2011.

- 1

- 2