Displaying 250 results

Current rally: Too far, too fast, too little real recovery

The stock market rally has gone too far too fast, and on too little real economic recovery, claims Tom Samuels, manager of the Palantir Fund (PALIX), a global long/short fund from Palantir Capital Management Ltd.

Best sovereign-debt bet? Not Uncle Sam

As the U.S. economy continues its slow crawl toward recovery, the global bond market remains rich with opportunities,…

Next wave of investing opportunities? ‘Boring’ companies

The next wave of opportunities in the equity markets will be big, “boring” companies that have been largely overlooked in the current rally, according to hedge fund manager Joel Hirsch.

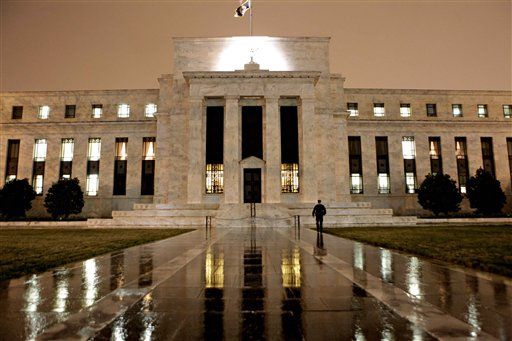

Don’t fight the Fed, says CLS’s Guenther

The top-down investment strategy continues to be “don't fight the Fed,” according to Dennis Guenther, who manages a total of $2 billion for CLS Investments LLC.

Aim’s Tyler Dann: Why health care sector is rife with opportunity

With Congress advancing its controversial 1,900-page health care reform legislation, Wall Street has pushed health care sector stocks into value territory, according to Tyler Dann, co-manager of the $4.8 billion Aim Charter Fund CHTRX.

John Wenker: Commercial real estate a flop, but REITs are hot

If commercial real estate is in such bad shape, why are real estate investment trusts thriving?

Joel Hirsh: In equities, big and boring is best

The next wave of equity opportunities lie in big, “boring” companies that have been largely overlooked in the current rally, according to hedge fund manager Joel Hirsh.

Robeco Investment Management’s Feeney still bullish on stocks despite S&P 500’s run

While some investors are predicting an imminent and sustained market downturn, Jay Feeney, chief investment officer at Robeco Investment Management, still sees plenty of upside for stocks.

Advanced Equities’ Wright: Recovery not forthcoming

Financial advisers and investors must bear in mind that consumers won't be in a position to support their normal share of economic growth, according to Brian Wright, head trader and co-portfolio manager with Advanced Equities Asset Management.

ING’s Uri Landesman: predicts unemployment will peak by February

Investors should be careful not to let the “sticker shock” of the latest unemployment data derail them from their long-term investment strategies, said Uri Landesman, head of global growth at ING Investment Management Americas.

Gannett Welsh’s Fox: Don’t oversimplify the fixed-income portion of a client’s portfolio

Fixed-income investors focused on the direction of interest rates run the risk of making big mistakes, warns portfolio manager John Fox, co-head of fixed income at Gannett Welsh & Kotler LLC.

Bull Path’s Kaimowitz: Valuations will get squeezed

The strong likelihood that both interest rates and taxes are rising will soon put a squeeze on company…

Tyler Dann: Why health care sector is rife with opportunity

With Congress advancing its controversial 1,900-page health care reform legislation, Wall Street has pushed health care sector stocks into value territory, according to Tyler Dann, co-manager of the $4.8 billion Aim Charter Fund (CHTRX).

Cleo Chang: Finding opportunity in volatility

A focus on market volatility has become a driving force behind the Direxion/Wilshire Dynamic Fund (DXDWX), according to portfolio manager Cleo Chang.

Wilshire’s Cleo Chang: Finding opportunity in volatility

A focus on market volatility has become a driving force behind the Direxion/Wilshire Dynamic Fund (DXDWX) DXDWX

First American Funds’ Tim Palmer: Bet on financial sector’s high-grade bonds

With the economy in recovery mode, Tim Palmer, a senior portfolio manager with First American Funds, has zeroed in on the financial sector's high-grade bonds.

Advanced Equities CIO: Investors must now think outside the box with commodities

Growing demand for commodities in emerging and developing markets requires a new way of analyzing commodity investment strategies, according to Thomas Samuelson, chief investment officer at Advanced Equities Asset Management.

ING’s Uri Landesman: The easy money’s been made; now the markets face a test

Investors will be paying close attention to the direction of the equity markets in the coming days in light of the recent market volatility that has tested the strength of the eight-month rally, according to Uri Landesman, head of global growth at ING Investment Management Americas.

Evergreen’s Margie Patel: Why equities are still the better bet

Even though equities are already riding the stock market's rally since March, they're still too attractive to ignore, according to Margie Patel, who manages nearly $1 billion in two balanced funds for Evergreen Investments.

Genworth CIO Tim Knepp: If you’re looking for stability, infrastructure is the answer

Global infrastructure investments could represent an opportunity at this stage of the stock market rally, according to Tim Knepp, chief investment officer of Genworth Financial Asset Management Inc., which has $7 billion under management.