Displaying 250 results

Buy-and-hold is bunk, says Wealth Builders’ Schreiber

The portfolio manager says investors get squeamish when the during market drops, and often sell at big losses.

Should IPOs be treated like a separate asset class?

There is renewed life and strong momentum in the IPO market, but investors should not ignore some fundamental realities and patterns that newly public stocks tend to follow, according to Josef Schuster, manager of the Direxion Long/Short Global IPO Fund Ticker:(DXIIX).

Ex-Fairholme managers launch fund

Pitkowsky and Trauner unveil concentrated Goodhaven Fund; 'don't need to create an empire'

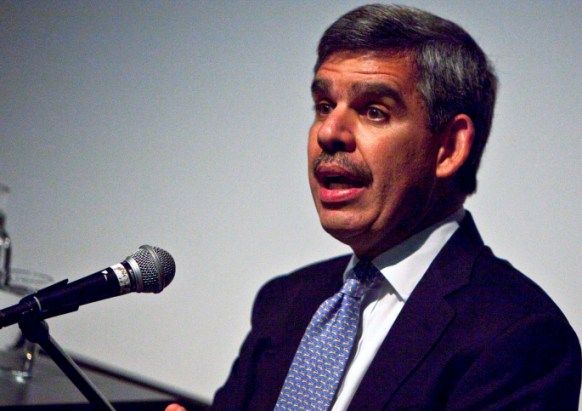

U.S. recovery could be rocking the global boat, El-Erian says

Government stimulus lifting America, but roiling economies of other nations, Pimco boss warns

Two ways to play the growing middle class: Philip Tasho

Agricultural commodities represents a creative way to invest in the world's emerging middle class, according to Philip Tasho, founder and chief investment officer at Tamro Capital Partners, which manages $1.4 billion in asset management.

Energy sector to stay white-hot?

The trend is your friend in the energy sector, where the rising price of oil appears to be laying the foundation for a prolonged investment opportunity.

Uri Landesman: How to hedge against Egypt risks

Investing in North American oil producers and even biotechnology companies are some of the ways to hedge the political unrest in Egypt, according to Uri Landesman, president of Platinum Partners LP, a $500 million hedge fund shop.

Bad press makes bank stocks a good buy, says equity researcher

Applied Finance Group's Resendes claims it's nearly impossible for BofA and others not to make money at current borrowing rates

Absolute-return strategy absolutely working for this fund manager

Stock picker Eric Cinnamond has been generating 12% annualized returns for more than a decade. Now, he's got a new fund — and new challenges

Goldman fund seeks to generate income, reduce worry lines

U.S. Equity Dividend and Premium Fund maxes out dividend income while hedging against downside risk

Israel as a hedge against volatility? Remarkably, yes

AmerIsrael fund's performance not correlated to U.S. equity markets; 'political hot potato'

New Franklin fund does global locally

Taps firm's asset management operations around the world

Muni bond meltdown? Why you don’t have to believe the hype

The recent wave of fear surrounding the municipal bond markets is overhyped, but the increased focus on the fiscal condition of state and local budgets is a good thing, according to Leslie Barbi, head of fixed income at RS Investments.

‘No limit to the upside of gold’: Midas’ boss

Thomas Winmill says a declining dollar could push the price of bullion sky-high

Panic in muni market signals a time to buy: Thornburg PM

The recent wave of panic sweeping across the municipal bond market is creating buying opportunities for professional money managers, according to Josh Gonze, manager of the $4 billion Thornburg Limited Term Municipal Bond Fund Ticker:(LTMIX).

Philip Tasho: Go large in 2011

A recovering economy is laying the foundation for a rally in large-cap stocks, according to Philip Tasho, chief executive and chief investment offer at Tamro Capital Partners LLC, a $1.3 billion asset management firm.

Build America Bonds an ‘investment no-brainer’

As lawmakers prepare to shelve the Build America Bonds program, investors should strongly consider purchasing the government paper, according to Peter Coffin, president of Breckinridge Capital Advisors Inc. But he also warns that the program's end will trigger uncertainty — and some near-term volatility — in the municipal bond market.

Euro debt crisis has hatched new buying opportunities: Payden’s Ceva

The current turmoil surrounding European sovereign debt is part of a new cycle that investors will have to learn to navigate, according to Kristin Ceva, manager of the $680 million Payden Emerging Markets Bond Fund Ticker:(PYEMX).

Tocqueville’s Sellecchia: Proceed with caution

At current valuation levels, the stock market needs to be approached with caution and patience, according to Vince Sellecchia, manager of The Select Fund (DESYX)

OppenheimerFunds’ Steinmetz hot on high-quality stocks, low-quality bonds

The best opportunities in the market right now are in “high-quality stocks and low-quality bonds,” according to Art Steinmetz, who took over this week as chief investment officer at OppenheimerFunds Inc.