Displaying 230 results

No plan to end payroll tax permanently, White House says

Trump has suggested getting rid of the taxes several times recently, a move that threatens the solvency of Social Security and Medicare

Trump says he’s considering capital gains tax cut

The president could issue an executive order that indexes capital gains to inflation, which would cut investors' tax bills

IRS gives businesses a break for donations related to SALT cap

Businesses that donate to charities in exchange for a state tax credit can deduct those costs from their federal taxes, according to new regulation

Trump’s payroll tax deferral raises red flags on Social Security

The president is relying on an expansive and controversial reading of executive power that likely will face legal challenges

Pass it along

Wealth transfer isn’t just for the well-heeled anymore as business owners and families of wide-ranging income levels embrace the latest strategies to keep intergenerational assets in the family — and out of the hands of the IRS

RMD relief is here — but only until Aug. 31

Act now to return unneeded required minimum distributions taken prior to the CARES Act

New York state legislature considers tax on stock trades

The pandemic has left the state facing a projected four-year deficit of $61 billion

With Democrats gaining steam, financial services ponder potential transaction taxes

Proponent say a levy on trades is harmless. Opponents call it a dangerous friction

Revamping portfolios with risk-smart, tax-smart building blocks

Investors are painfully aware their retirement plans need a do-over. Here's the best approach

IRS widens eligibility to undo RMDs

Those who took required minimum distributions in January are allowed to undo them, and the timeframe for doing so extends through Aug. 31

Tax refunds for IRAs? How about groceries instead?

If the CARES Act stimulus checks are any indication, more people will need the money for basic expenses

Tax planning is a hot topic amid a pandemic and a looming election

Most advisers expect tax rates to go up, but opinions vary on how and when to plan for it

4 unusual IRA issues related to deaths in 2020

New tax rules for this year may change the results that you expected

Crisis can be a catalyst to clarify goals, create sustainable impact

While charitable giving will remain an ongoing need, now is also the time for more robust legacy and generational wealth transfer planning

Roth conversions pick up amid expectations that taxes will rise

The stock market declines helped by shrinking the value of accounts, as well as the tax bill for converting assets

The ABCs of coronavirus-related distributions

Who qualifies to pull money penalty-free from IRAs and company retirement plans under the relief provided by the CARES Act

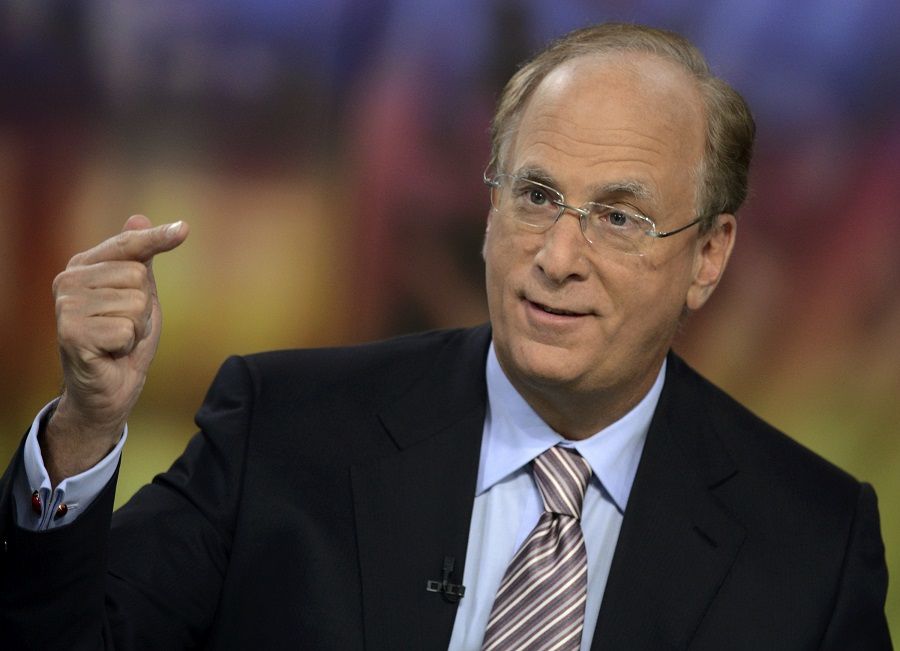

BlackRock’s Fink sees mass bankruptcies, higher taxes

The CEO sees taxes rising for individuals and companies, and predicted the corporate rate will be raised from the current 21% up to 28% or 29%

Advisers should be able to use the pass-through deduction

Amid the unprecedented economic disruption, independent contractor financial advisers are among the small business owners adversely impacted

Restore the tax deduction for advisory fees

During these challenging times, it is more important than ever that we protect and expand access to financial advice

Wealthy shielded billions with Trump tax break

Opportunity zone funds have taken in over $10 billion, and more than $3 billion of that was invested since January