Displaying 2691 results

Going under the hood of the new DOL fiduciary rule

The Labor Department has just revealed its controversial new rule intended to raise investment advice standards on retirement accounts. Sign up for our webcast taking a deep dive into how the changes will affect your business. Register now for this free webcast here)

Crazy season for advisers who prep client tax returns

Their offices are abuzz on Saturdays, and regular planning meetings with clients and prospects are put off until after the April 18 filing deadline.

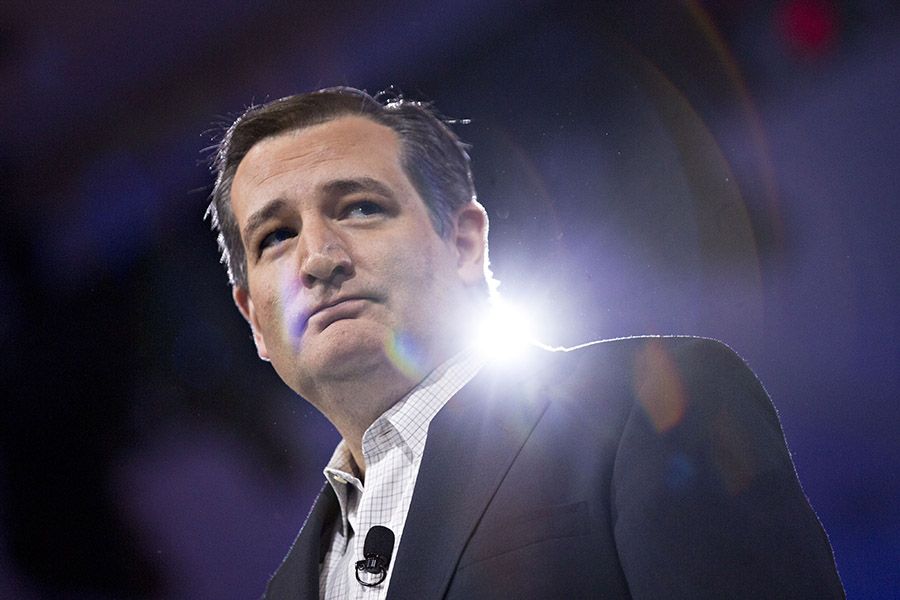

Ted Cruz, gaining anti-Trump momentum, seen as friend of financial industry

Republican presidential nominee is a foe of regulation and has offered a tax plan that could appeal to advisers.

When Social Security is a family affair

Claiming benefits early may make sense when kids are involved.

When delayed retirement credits are delayed

Some Social Security beneficiaries must wait an additional year for full payment.

As retirement-savings plans go, planning to work longer is a mistake

Breakfast with Benjamin Investors assuming they will be able to continue working well beyond normal retirement age doesn't mesh with a frequent reality.

Mass confusion over new Social Security rules

April 29 deadline applies only to file-and-suspend strategy, not spousal benefits.

IRS to March Madness office pool players: Gambling winnings are taxable

Breakfast with Benjamin An estimated 70 million Americans will wager $9.2 billion this year through March Madness office pools, but keep in mind that any winnings are taxable.

Advisers who ignore ETFs are missing out on the product evolution, and so are their clients

Plus: El-Erian's gloomy forecast, what it will take to save Social Security, and it's time to start taking cannabis investing seriously

For survivor benefits, timing is everything under new Social Security rules

The Social Security Administration's file-and-suspend guidance injects some confusion regarding the choice between survivor and retirement benefits.

Qualified charitable distributions not always the best way to give

While a QCD can provide a real tax benefit to some IRA owners, in most cases keeping the RMD and giving appreciated securities to charity will be a better tax strategy.

Is your 529 college plan one of the four with Morningstar gold?

Improvements to some plans include lower fees and an added layer of investment consultants.

Hedging the risk of Congress going after Roth retirement accounts

Breakfast with Benjamin Is it time to start hedging the risk that Congress might renege on its Roth promise?

How employment affects Social Security

Benefits may be reduced if you claim before 66 and continue to work.

How the 2016 presidential candidates stack up with advisers

A look at White House hopefuls' positions on issues impacting financial advice.

Distinguishing tax efficiency from after-tax returns

Breakfast with Benjamin When it comes to mutual funds, it's important to understand the difference between tax efficiency and after-tax returns.

Social Security issues new file-and-suspend guidelines

April 29 deadline looms for those who want to take advantage of current rules.

Market volatility signals it’s time to take another look at Roth conversions

Advisers should be considering a “re-characterization,” or undoing, of clients' Roth conversions, which essentially converts the Roth money back to pre-tax money.

Aequitas Capital alts platform implodes, while investors and advisers are kept in the dark

Breakfast with Benjamin The collapse of alternative investments platform Aequitas Capital Management continues to unfold, while investors and advisers are kept in the dark.

Putting ETF liquidity concerns in perspective

Breakfast with Benjamin The lessons that were learned from the August 24th flash crash.