Displaying 2691 results

Momentum building on tax reform

As senators invite the public to contact them with ideas on tax reform, advisers should speak up

Tax reform battle zeroes in on small businesses

Corporate-only tax reform faces resistance for leaving out sole proprietorships, partnerships, LLCs and S corporations.

Maxing out a 401(k) doesn’t mean you can’t keep saving for retirement

Breakfast with Benjamin: Having a maxed-out 401(k) is a good problem to have, but saving for retirement shouldn't end there.

Intra-family loans: Not your ordinary wealth transfer strategy

Another way to take advantage of low interest rates.

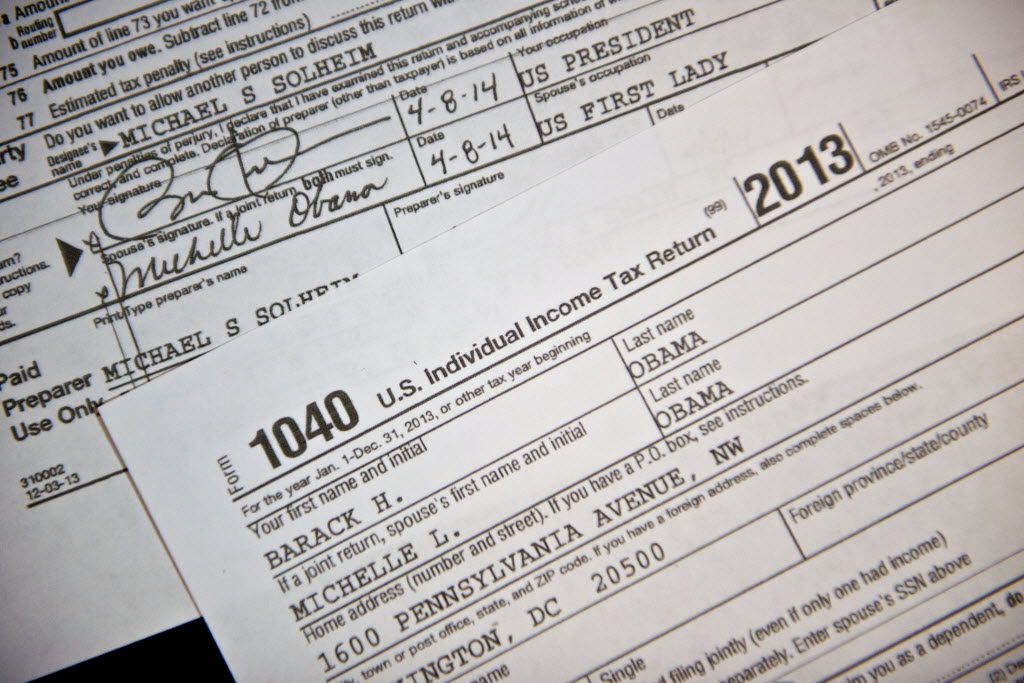

Line-by-line: Opportunities lie in your clients’ income tax return

Though the individual income tax return is a window into the past, what it reveals can shape savings and investment strategies into the future. Advisers can mine the 1040 for information and savings ideas for clients.

Senator questions widespread tax dodges used by wealthy

Calls for curb to 'egregious tax loopholes' that enable varying tax bills for investors with the same underlying assets.

Social Security’s negative returns

Payroll tax contributions exceed lifetime benefits for most workers. (Hear Mary Beth Franklin answer advisers' questions on Social Security today at 4 p.m.)

What Obama’s attempt to tax 529 plans says about the safety of Roth IRA assets

Changes could spark revolt, but 'when Congress needs dollars, they're going to get them,' one adviser says.

Rubio-Lee tax plan eliminates deductions and ties large, small business rates

Possible presidential hopeful seeks to simplify tax code with two rates for income taxes, one for corporate taxes.

Lengthy and painful tax season awaits Americans living abroad

Advisers need to be aware of the tax laws in foreign jurisdictions, as well.

Tax complexities delay distribution of 1099s

As brokerages feel pressure ramp up, forms coming later than usual.

Income from rental properties requires careful tax planning

Second homes can provide good income, but are clients ready for the tax filing and landlord burden?

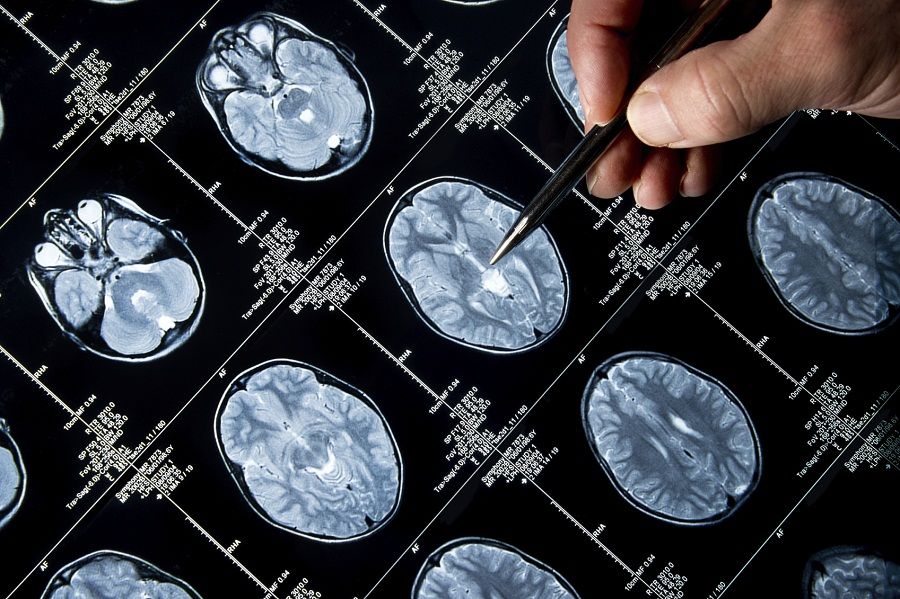

Oscars shine light on Alzheimer’s costs

Financial advisers can help clients take early steps to plan for the progressive disease.

House set to vote on making tax breaks for IRA charitable donations permanent

Advisers are hopeful that the House will approve making tax breaks for IRA charitable donations permanent, but are trying to keep expectations low.

Meet the 529 ABLE account: A new way to save for disabled beneficiaries

Clients with disabled children get a new vehicle

Morgan Stanley settles mortgage bond probe for $2.6 billion

Breakfast with Benjamin: Plus: Buffet's opaque empire, Obama's regulatory plans and New York's efforts to keep its meat hooks in tax refugees.

Who needs a cash balance plan? Not just New Jersey

A tussle over public pensions has thrust these defined-benefit plans into the spotlight.

The bond market and the Fed are suddenly marching in lockstep

Breakfast with Benjamin: The bond market and the Fed are suddenly marching in lockstep, with inflation clarity coming soon.

Social Security rules for divorced public employees

Benefit reductions apply only to workers who did not pay FICA taxes.

Nine tax-saving apps for advisers

Put down your box of receipts and check out these tools.