Dodd’s dud? ‘Fed-as-consumer-watchdog’ plan greeted with howls

Bankers. Business groups. Consumer advocates. They all lined up to bash the Conn. Senator's latest proposal for financial reform.

Getting new regulations to govern Wall Street boils down to this: If everybody hates a compromise, can it still work as a deal?

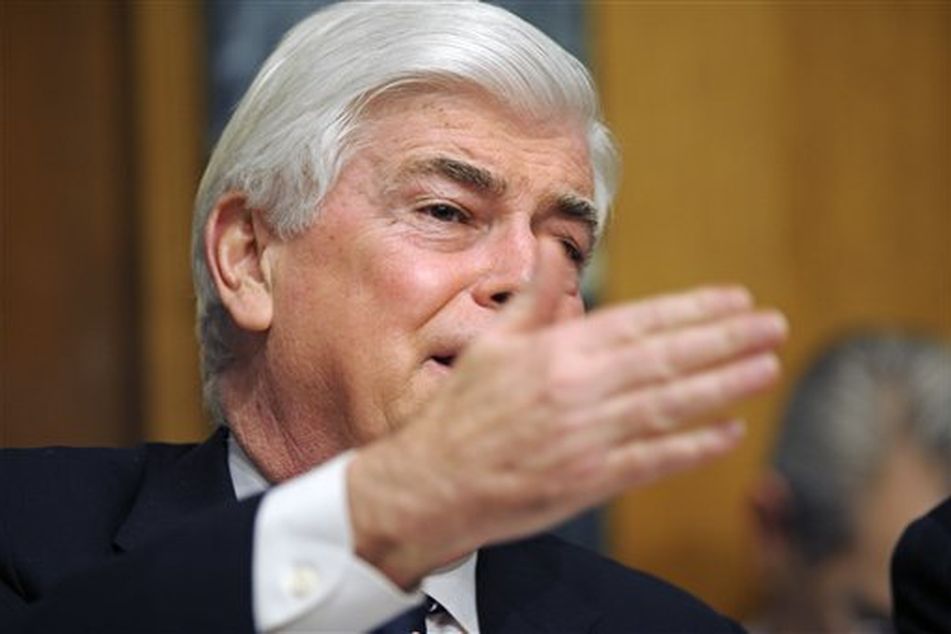

Sen. Christopher Dodd, D-Conn., the chairman of the Senate Banking Committee, and Sen. Bob Corker, R-Tenn., a committee member, thought they had the makings of a bipartisan solution with a plan to place a beefed up consumer watchdog entity inside the Federal Reserve.

It wasn’t what President Barack Obama initially wanted. He had called for a freestanding Consumer Financial Protection Agency.

It wasn’t what the banks wanted. They wanted existing bank regulators to handle consumer protections.

But the Fed-housed consumer agency — an idea proposed by Mr. Corker — met little initial support Tuesday among Banking Committee Democrats or Republicans, or among two natural foes — business groups and consumer advocates.

“It’s got to be a joke,” said Rep. Barney Frank, D-Mass., who shepherded the House version of the regulatory bill to passage last December. The House bill called for a freestanding Consumer Financial Protection Agency with the power to regulate and enforce its regulations. Mr. Frank said the idea of placing consumer protections in the Fed should be tested in a Senate vote, not inserted in negotiations.

The proposal is a significant departure from Mr. Dodd’s initial regulatory plan and it represents a reversal of fortune for the Fed. A bill Mr. Dodd proposed last November would have stripped the Fed of its role supervising state chartered banks and bank holding companies, created a single overarching banking regulator, and, like the House, set up a stand alone consumer agency.

“Chris Dodd had a very good proposal,” Mr. Frank said. “I would hope there would not be any pressure on Chris to give in without bringing it to a vote.”

But House Majority Leader Steny Hoyer, D-Md., was more conciliatory, saying the key test was whether the bill strengthened consumer protections. “We’ll have to see what the Senate does to effect that end, even if they don’t use the means that we use,” he said.

Under the new Corker proposal, the Fed would likely have to retain some of its bank supervisory powers. Two sources briefed on aspects of Mr. Corker’s proposal said it also would eliminate another Obama demand — that states have the right to override federal law with their own tougher consumer regulations. The sources spoke on condition of anonymity because of the sensitivity of the negotiations.

That would be a sizable victory for banks, who have lobbied heavily to retain federal pre-emption over state regulations.

The new entity would have its own president-appointed head, and it would have autonomous power to set consumer protection regulations. Before enacting rules, however, it would have to consult with bank regulators.

Those details remained in flux as Mr. Dodd and Mr. Corker continued to seek support. Both voiced optimism on Tuesday, even though aides said hopes of having a bill ready this week were slipping.

A key figure in the Senate outcome is Sen. Richard Shelby of Alabama, the top ranking Republican on the Banking Committee. While Mr. Dodd has been negotiating directly with Mr. Corker, a junior senator from Tennessee, Mr. Shelby has also been involved in talks, either directly with Mr. Dodd or with Mr. Corker.

Mr. Shelby said putting an autonomous consumer finance regulator within the Fed would be like “moving the Department of Agriculture to the Pentagon and housing it over there and yet be autonomous. “I don’t see why that accomplishes much,” he said.

Sen. Mike Johanns of Nebraska, a Republican on the committee, said that even though Mr. Dodd was negotiating with Mr. Corker, Mr. Shelby’s support was essential.

“I just don’t think you get a bill done without Sen. Shelby blessing that bill,” Mr. Johanns said.

Democrats on the committee, many of them critics of the Fed’s past performance on consumer protections, also reacted coolly. For them, the consumer agency didn’t seem autonomous enough.

“The question I would raise is, why the Fed?” said Sen. Jeff Merkley, D-Ore. “Why put consumer protection back in the Fed after it’s been so woefully neglected.”

Sen. Sherrod Brown, D-Ohio, said he, too, had concerns about placing a consumer protection division within the Fed. “We’ve seen in the past that it hasn’t worked when consumer protection is not primary for any agency, for any group, that it get shuttled aside,” Mr. Brown said.

Added Sen. Chuck Schumer, D-N.Y.: “I am very leery of any consumer regulator being placed inside the Fed.”

Consumer groups were downright dismissive: “A consumer financial protection agency in the Federal Reserve is an oxymoron,” said Robert Weissman, president of Public Citizen.

Ryan McKee, senior director of the U.S. Chamber of Commerce’s Center for Capital Markets was equally downbeat: “Proposals that simply house the CFPA within another federal agency but continue to give it the same broad and overlapping regulatory authority will not fix the CFPA nor the harmful impact it will have on small businesses and consumers.”

Learn more about reprints and licensing for this article.