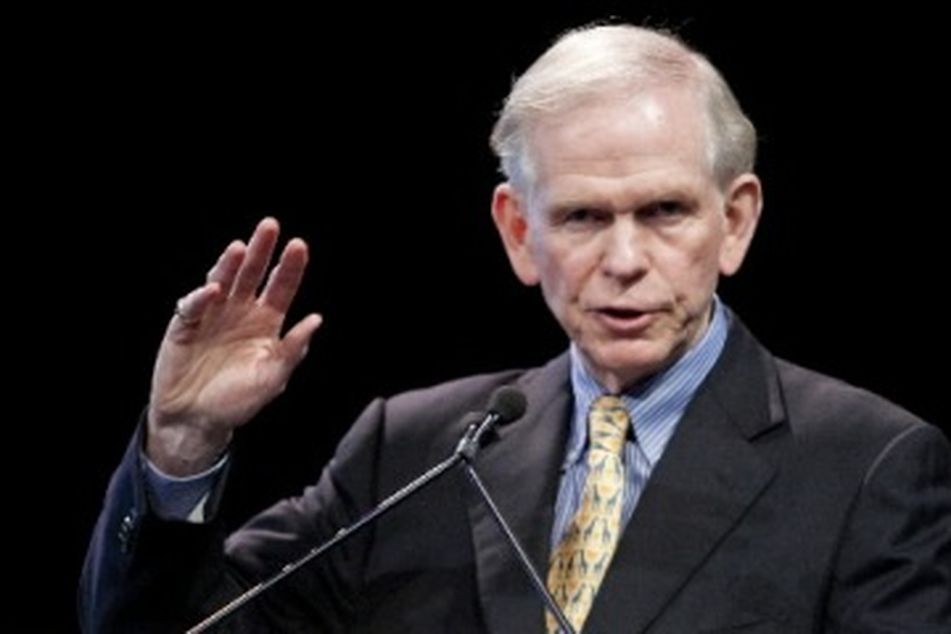

Jeremy Grantham: Stocks on the verge of being ‘dangerously overpriced’

Jeremy Grantham, chief investment strategist at Grantham Mayo Van Otterloo & Co., said the Federal Reserve's attempt to boost the economy could push U.S. stocks to a level where they will be “dangerously overpriced.”

Jeremy Grantham, chief investment strategist at Grantham Mayo Van Otterloo & Co., said the Federal Reserve’s attempt to boost the economy could push U.S. stocks to a level where they will be “dangerously overpriced.”

The Fed’s decision to purchase Treasuries and flood markets with cheap money will drive investors out of cash and encourage them to speculate in stocks, which are already overvalued, Grantham said in an interview with the CNBC cable television network.

“The S&P is already overpriced and if you push it up another 20 percent it becomes dangerously overpriced,” Grantham said in the interview, which was posted today on the network’s website. “In the not-too-distant future stocks will crack again.”

The Fed’s policies also drive up commodity prices, create fears of inflation and heighten tensions with countries concerned that the decline in the value of the dollar will hurt their exports, said Grantham, whose Boston-based firm manages more than $94 billion. Grantham, 72, accurately predicted in 2000 that U.S. stocks would lose money in the coming decade.

Grantham said the fair value of the Standard & Poor’s 500 is at 900. The index closed yesterday at 1218.71, having gained 17 percent since the Fed Chairman Ben S. Bernanke hinted in August that the central bank may take new action to boost the economy.

$600 Billion Program

At 900, the S&P Index would imply a price-to-earnings ratio of 11.3, according to data compiled by Bloomberg. The average over the past 20 years is 20.6.

The Fed said on Nov. 3 that it will buy an additional $600 billion of Treasuries through June in a bid to bring down borrowing costs and stimulate economic growth and job creation. The decision bolstered stock and bond markets, and helped leveraged-loan prices stage their longest rally since before Europe’s sovereign debt crisis roiled markets in April.

Chinese, German and Brazilian officials have criticized the Fed’s decision, saying it would drive down the dollar and fuel speculative flows of capital that risk asset bubbles.

“We are in a currency war in a way,” Grantham said. “I hope it stays mild.”

The Dollar Index, which tracks the dollar against the currencies of six major U.S. trading partners including the euro and yen, slid on Nov. 4 to the lowest level since December 2009.

Grantham said that technology stocks were overvalued in the late 1990s and recommended investors avoid Japanese stocks in the late 1980s, ahead of their plunge at the end of 1989.

By his own admission, his warnings often come as much as two years too early.

“We win all the bets but we are horrifically early,” he said in a February interview.

Bloomberg

Learn more about reprints and licensing for this article.