Finra’s Ketchum: We can oversee advisers, too

SRO crowd: Ketchum one of many to testify today

SRO crowd: Ketchum one of many to testify today

SRO's boss will tell Congress self-regulator 'uniquely positioned' to monitor investment advisers

The head of Wall Street’s self- funded regulator said the group would be ready to assume oversight of investment advisers in addition to broker-dealers if that’s what Congress decides.

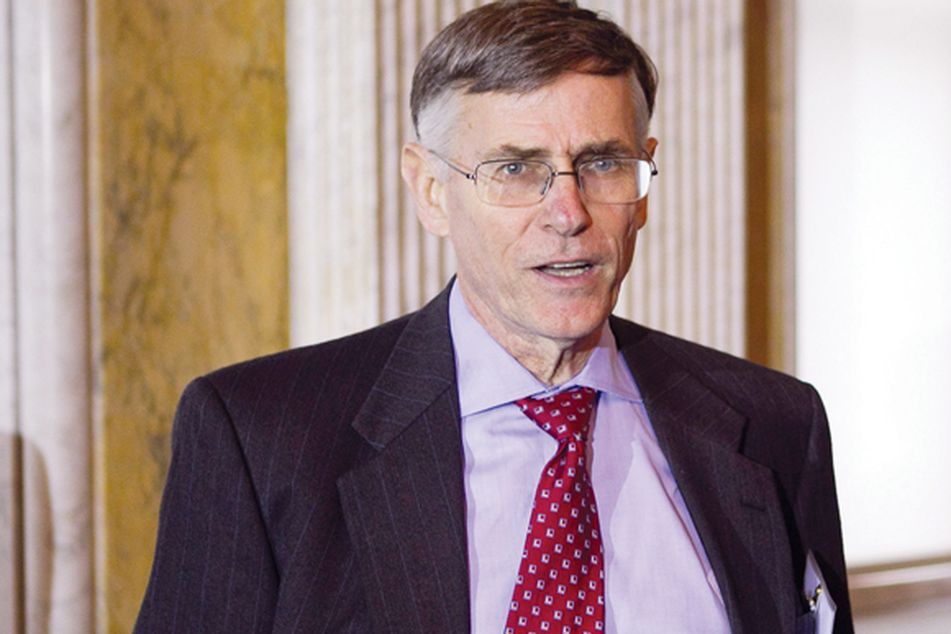

Richard Ketchum, chairman and chief executive officer of the Financial Industry Regulatory Authority, said in testimony prepared for a U.S. House hearing today that the group would set up a new unit to oversee advisers.

Finra “would establish a separate entity with separate board and committee governance to oversee any adviser work, and would plan to hire additional staff with expertise and leadership in the adviser area,” Ketchum said in the prepared statement for a panel of the House Financial Services Committee.

The chairman of the committee, Representative Spencer Bachus, an Alabama Republican, has drafted a bill that would put one or more self-regulatory groups in charge of overseeing retail advisers, under the authority of the Securities and Exchange Commission. That bill and proposed new standards for how broker-dealers treat their clients are to be examined by lawmakers at today’s hearing of the capital markets subcommittee.

Ketchum called the bill “a thoughtful approach to addressing the critical need for increased adviser regulation.” He said a self-regulator for investment advisers is “the most practical and efficient way to address this critical resource and investor protection issue.” He said Finra is “uniquely positioned” to be involved in such a system.

Madoff

Last year’s Dodd-Frank Act directed the SEC to look into the practices of financial advisers in the wake of the 2008 credit crisis and high-profile frauds such as the Bernard Madoff Ponzi scheme. The SEC conducted a study that concluded the regulator needs to fix its inability to inspect a sufficient number of investment advisers on a regular basis.

The report presented a few options, including using new SEC fees to pay for an expanded inspections program or moving investment advisers under a self-regulatory organization.

David Bellaire, general counsel and government-affairs director for the Financial Services Institute, an advocacy group for independent broker-dealers and advisers, said in an interview that investor protection would be “enhanced” by having a single self-regulatory organization such as Finra.

“A fractured regulatory oversight creates dark corners for people to hide,” Bellaire said.

In contrast, David G. Tittsworth, executive director of the Washington-based Investment Adviser Association, said his group favored “an appropriate user-fee provision” to allow the SEC to remain as the advisers’ direct regulator.

Broker Standards

In another Dodd-Frank mandate, the SEC is studying a tougher conduct standard for brokers. An agency study released in January, also being examined today, concluded brokers should operate under a parallel standard to registered investment advisers, putting their customers’ interests first when doling out personalized advice.

“People that are doing the same things should be subject to the same laws and regulations,” said Tittsworth, whose group lobbies for SEC-registered investment advisers.

The SEC plans to propose the fiduciary duty before the end of the year, according to its Dodd-Frank rulemaking calendar. John Nester, an SEC spokesman, declined to be more specific about timing.

“It could do some harm, particularly to the middle-income market,” Terry K. Headley, president of the National Association of Insurance and Financial Advisors, said of a fiduciary standard for brokers. His group isn’t “diametrically opposed” to the idea. He said it is concerned that it could limit consumer access to less expensive, commission-based services traditional to brokers.

Suitability

Supporters of the higher standard cite the public’s frequent inability to tell the difference between types of investment advice, as noted by the SEC. Broker-dealers are now held to a “suitability” standard, in which they only must recommend a product consistent with their clients’ goals, strategies and risk tolerance. Under a fiduciary standard, a broker would have to show that the investment is the best choice for the client.

“Regulatory standards in this area are notably weak and inconsistent, promoting investor confusion and setting an unreasonably low bar for professional conduct,” said Barbara Roper, director of investor protection for the Washington-based Consumer Federation of America, in testimony prepared for the hearing.

–Bloomberg News–

Learn more about reprints and licensing for this article.