Scott Mather: Pimco Foreign Bond Fund

Don’t attribute the success of the Pimco Foreign Bond Fund to great geographic allocations. “If you just…

Don’t attribute the success of the Pimco Foreign Bond Fund to great geographic allocations.

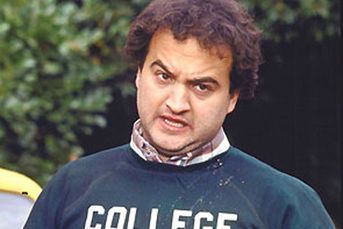

“If you just allocate so much to a region or sector, that is a traditional approach, but it is suboptimal,” said Scott Mather, 43, a managing director and head of global portfolio management at Pacific Investment Management Co. LLC. “We decompose any investment into risk factors, isolate the risks we want to take and exclude those we don’t. It is a much more granular approach to managing a portfolio.”

DIFFICULT CONCEPT

While that concept is difficult to explain, Mr. Mather said it is at the heart of his fund’s performance and explains why it has consistently outperformed its benchmark and other foreign bond funds.

The $4.9 billion asset fund gets the top five-star rating from Morningstar Inc. and substantially beat its benchmark, the JPMorgan GBI Global ex-U.S. FX NY Index, over one, three and five years. Lipper Inc. ranks the fund 15th out of 104 in one-year performance, fourth out of 92 in three-year annualized performance and seventh out of 62 over five years annualized.

The fund’s current top weightings are Japan, with 40.2%, and Germany, with 23.7%. It has a big share in Italy, with 9.6%, and Eastern Europe, with 5.7%. But the country allocations could be part of a hedge rather than a vote on the credit quality of that country, Mr. Mather said.

“We look at currency risk, bond risk, credit risk in each region,” he said. “Maybe we are hedging our euro exposure in the E.U. In Japan, we are taking advantage of short-term opportunities in the cash market.”

What Mr. Mather wants to do is focus on the element he believes is mispriced and find a way to hedge the rest of the investment, sometimes by buying derivatives. With the world outside the U.S. his oyster, there are many ways to hedge the risk of purchases. His sweet spot in duration is one to three years, which is long enough to buffer market overreactions to the latest headline.

Mr. Mather said that some of his fund’s performance is due to the team at Pimco, the world’s largest bond fund manager.

“There is a lot of interaction across borders and groups on a daily basis,” he said. “It allows you to see the world through many lenses.”

Mr. Mather knew from an early age that he wanted a career with a lot of mental stimulation, even though it meant leaving his hometown.

“Roseburg, Ore., was a great place to grow up, but there is not a lot to do there and not enough mental excitement,” Mr. Mather said. “My family worked in the lumber mills; it’s tough work and I saw the toll that took on them.”

Arriving at The Wharton School of the University of Pennsylvania, Mr. Mather studied engineering and finance in a combined program.

“I think engineering is a great background for anyone who wants to get into finance,” he said. “It trains your mind to be comfortable with an analytical approach.”

After school, he decided to give finance a try, with the idea that he would move to engineering if it didn’t work out. He never looked back.

Learn more about reprints and licensing for this article.