Blackstone makes more real estate moves

"Interest rates aren’t going down anytime soon," said James Corl of Cohen & Steers.

Leading through innovation – with Tom Ruggie of Destiny Wealth Partners

Uncover the key initiatives behind Destiny Wealth Partners’ success and how it became one of the fastest growing fee-only RIAs.

Raymond James notches wins in the Sun Belt with advisor additions

Together, the ex-Merrill Lynch advisor in Florida and the Wells Fargo alum in New Mexico reported managing $250M in assets.

Huntington names new head of wealth business

Eyeing growth in the wealth sector, the financial services company is elevating Melissa Holding to the role as a tenured leader steps down.

MyVest announces tax-aware portfolio transition upgrades

The fintech firm’s latest update simplifies processes for legacy portfolios, with features for tax-efficient transition management.

Will the surge in Treasury yields slay the bulls (again)?

So far in 2024 the rise in the 10-year Treasury yield has not significantly impinged on the market’s bullish behavior.

Most workers, retirees have retirement income confidence

New EBRI research sheds fresh light on sentiments around inflation, Social Security benefits, and use of guaranteed income products.

Stocks rise following hot March inflation

The S&P 500 is poised to extend gains on tech earnings while short-term Treasury yields fell following brisk rise in Fed’s preferred inflation gauge.

Credent Wealth Management attracts two new partner-advisors

Indiana-based $2.5B RIA has added 12 firms since it was founded in 2018.

Women may gain from wealth transfer, but it won’t solve the big issues

Penny Finance report highlights ongoing challenges in gender wealth gap.

Tech rally fuels equities rally, commodities gain

But there are headwinds including US data, Japan intervention.

Bad day for Bitcoin, net $218M withdrawn from ETFs

Hong Kong will become latest market to launch crypto ETFs.

UBS share buybacks may be at risk from regulators

The banking group may need an extra $20B buffer under new rules.

‘Make sure clients know what they own and why’

Industry executives discuss being highly selective in private credit and the rise of hybrid ETFs.

Tech-heavy advisor practices have a performance edge: Cerulli

Survey research finds heavy users tend to grow faster as advisors report greater operational efficiency and productivity in serving clients.

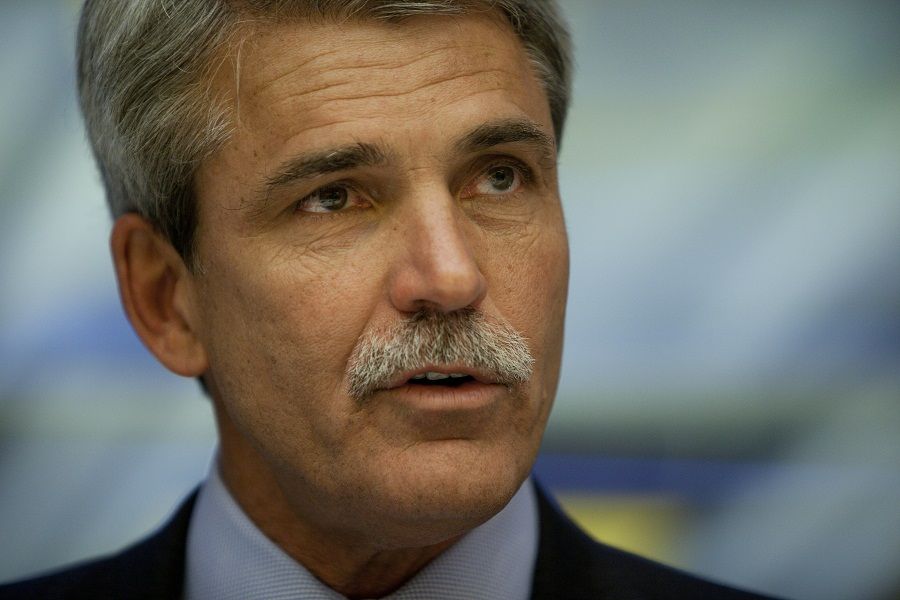

Fed will cut once before presidential election, says Howard Lutnick

Cantor Fitzgerald’s chief executive predicts the central bank will “show off a little bit” just before voters head to the polls.

Trust & Will forges strategic partnership with LPL

The digital estate planning platform is set to triple its reach as it rolls out across LPL’s network of more than 22,000 advisors.

Wealth Enhancement Group lands $502M powerhouse team

The national wealth firm is snapping up a hybrid RIA from Raymond James, establishing its fourth foothold in Maryland.