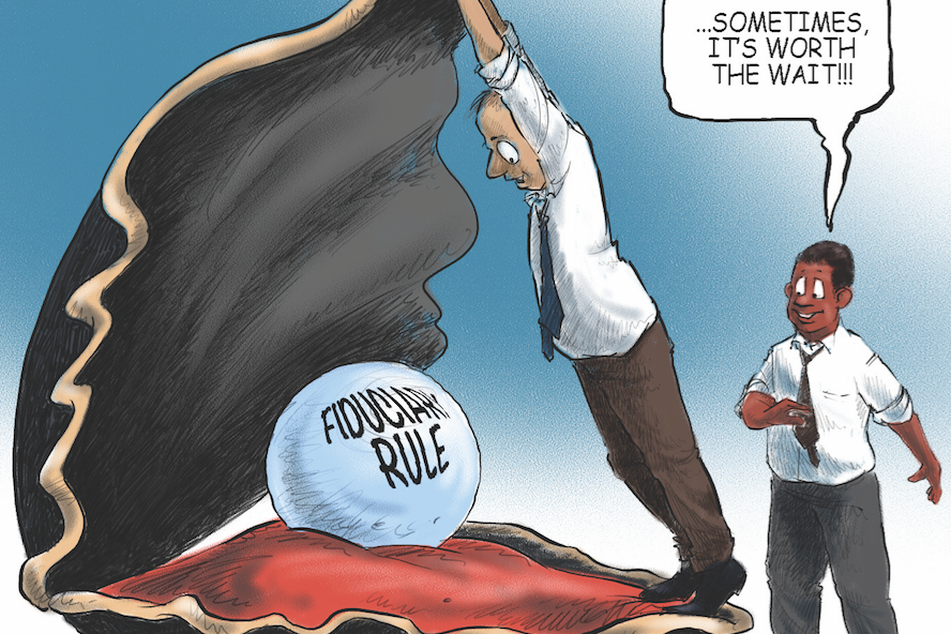

A DOL fiduciary rule everyone can live with

Final version includes a number of changes that address the most serious concerns of those who most vehemently criticized it.

For months, the Labor Department has been assuring members of the financial advice industry and other interested parties that it was listening to them and carefully considering the thousands of comment letters it received about its proposed fiduciary rule.

After reading the rule that the DOL released last Wednesday, which some have described as the most significant change in the retirement and IRA marketplace since the Employee Retirement Income Security Act of 1974, it is clear that the DOL was, indeed, listening.

The final version of the rule, which requires advisers to act in the best interests of their clients when giving retirement advice, includes a number of changes to the previous proposal that address the most serious concerns of those who most vehemently criticized it.

(More fiduciary coverage: The DOL rule broken down from every angle)

For example, some members of the brokerage community had complained that under the proposed rule, they would no longer be able to sell certain alternative investment products, such as nontraded real estate investment trusts and small business development companies. In addition, many expected that it would be all but impossible to sell proprietary products in the future.

DOL’S REVISIONS

In the final rule, the DOL made revisions and, in fact, went out of its way to assure advisers that all of these products will be able to be sold in retirement accounts, provided certain conditions are met.

Brokers also had complained that they would no longer be able to charge commissions and would have to adopt a fee-based model. The DOL clarified this issue through revisions and by providing examples of policies and procedures that are compatible with models that are com-mis-sion based. In another nod to its critics, the DOL extended the implementation period to 12 months from eight months. And some parts of the rule will not take effect until the beginning of 2018.

COMPROMISES

There are many, many other examples in the final rule where the DOL compromised and tried to make the regulation more palatable to the advice industry. Some supporters of the fiduciary rule complained last week that the DOL, in fact, went too far in trying to appease its critics.

Where do we go from here?

Clearly, after nearly six years of debate about this rule, it is time to move on. Some brokerage firms already have, drawing up plans to adapt to the fiduciary changes. Hopefully, the revisions introduced last week will make that work a little easier and a little less costly.

(Related read: DOL chief Thomas Perez gets high marks for delivering on fiduciary)

HARD-LINERS

To be sure, there still will be those for whom no number of changes or revisions will be good enough. These will include some members of the financial advice industry who have opposed the fiduciary all along and will continue to find fault with it. They may challenge the rule in court.

Certain members of Congress who are ideologically opposed to the idea of the government dictating to any industry how it should conduct itself will also no doubt continue to try to derail the rule.

In time, a consensus will emerge as to whether the DOL fiduciary rule was a success. Will it help Americans save more — and keep more — money for retirement? At the same time, will the financial industry find a way to adapt and thrive in a new environment?

Until then, the vast number of financial advisers, from both the broker side and the investment adviser side of the industry, will get back to work. For at the end of the day, acting in their clients’ best interest is not a burden to them, it is a privilege. After all, it is the reason that they became advisers in the first place.

Learn more about reprints and licensing for this article.