Displaying 28145 results

Most US adults fear outliving their money more than death

Concerns about inflation, Social Security, and taxes are stoking Americans’ financial anxiety, Allianz Life survey shows.

Ron Carson stepping down as CEO of namesake RIA

The founder of the national wealth firm is handing over the reins to Burt White, former chief investment officer at LPL.

West Virginia stops banking with Citi, Northern Trust, over fossil fuels

The state treasurer added four financial services firms to a list of those ineligible to provide banking services to the state because he says they 'boycott' the fossil fuels industry.

Wealth Enhancement Group announces new leaders as client assets surpass $81B

BlackRock's former head of income investing is among the appointments.

Mesirow eyes organic growth, new products with strategy leader appointment

The firm's plans include further strategic hires and acquisitions.

Former Fed president James Bullard expects three rate cuts

Economic reports already justify cuts, the former central bank executive says.

Billionaire Branson’s SPAC deals have cost him dearly

British entrepreneur's net worth has tumbled around $5 billion.

Nearly half of US filers put off tax prep

A survey of more than 1,000 US adults offers glimpses of tax stress and procrastination as the April filing deadline looms.

Wells Fargo Advisors’ midyear pay tweaks

Broker-dealers are increasingly chasing registered investment advisor assets.

Millennials are dipping into retirement savings for housing costs

Across generations, the costs of rent and mortgages are challenging.

Up to 26M Americans could get student debt relief under new plan

President Biden hopes his alternative plan will pass scrutiny.

Steward Partners hails strong start to 2024 recruiting

The hybrid RIA expects its $1 billion haul of new client assets in the first quarter will set it up for a repeat of its robust 2023.

Dave Ramsey takes a jab at advisors’ future clients

Targeting a group who could turn into financial advisors' clients is a dubious marketing strategy, executives said.

Pennsylvania family office celebrates $5B AUM milestone

The CEO of the firm founded by former Wells Fargo private bank execs says its record two-year organic growth is due to its ‘truly independent, entrepreneurial approach.'

Climate Action 100+ signers colluding? No way, says Morningstar

Analysis of proxy voting records finds “a wide range of voting approaches” among asset managers and asset owners.

Big-name affiliation a big deal for the affluent: Cerulli

A large proportion of wealthy clients are more comfortable with advisors at national firms, according to new research.

MassMutual B-D gooses advisors with new bonus

MML Investors Services reps can earn an "advisor growth bonus" this year that rewards net new assets.

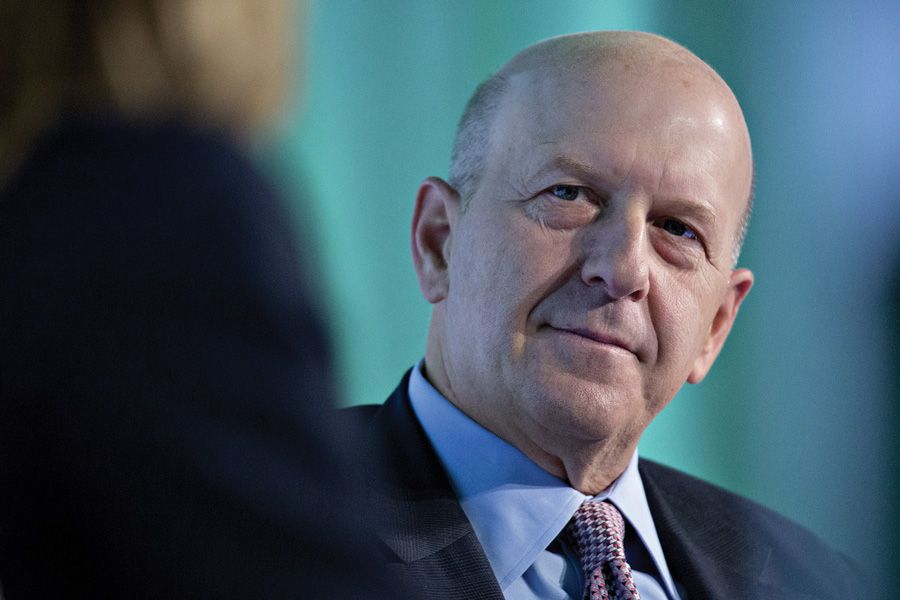

Just say no to Goldman’s executive comp plan, investors urged

Proxy voting firm cites ‘significant disconnect between pay and performance’ following CEO Solomon’s $31 million payday.

Kiss banks $300M with sale of song catalog

The band is also selling its name and image rights to Abba Voyage firm.

Washington advisor claims victories in Hightower noncompete saga

The legal skirmish has taken several turns, including a temporary restraining order and a decision kicking the case back to the state level.