Displaying 28149 results

Blackstone makes more real estate moves

"Interest rates aren’t going down anytime soon," said James Corl of Cohen & Steers.

Huntington names new head of wealth business

Eyeing growth in the wealth sector, the financial services company is elevating Melissa Holding to the role as a tenured leader steps down.

Credent Wealth Management attracts two new partner-advisors

Indiana-based $2.5B RIA has added 12 firms since it was founded in 2018.

Women may gain from wealth transfer, but it won’t solve the big issues

Penny Finance report highlights ongoing challenges in gender wealth gap.

Fed will cut once before presidential election, says Howard Lutnick

Cantor Fitzgerald’s chief executive predicts the central bank will “show off a little bit” just before voters head to the polls.

Raymond James’ CEO shrugs off DOL rule

"It doesn't look too problematic at all," Paul Reilly said.

Cetera names new head of corporate development

With a successful record at Avantax, Wall Street veteran Michael Molnar is set to lead the RIA's M&A and advisor succession planning strategy.

IRS wants to streamline tax disputes with new focus on alternative programs

Alternative Dispute Resolution Program Management Office formed.

Concurrent invests in tomorrow with leadership hires

The hybrid RIA appoints industry vets to its bench as it emphasizes commitment to growth, next-gen talent, and succession.

New DOL rule no big deal, says Stifel’s Kruszewski

"It appears to be less restrictive than what was proposed," says CEO.

Concord ups the ante on Hipgnosis takeover battle

The music rights investor increased its bid to own the London-listed company’s enviable library of songs from iconic acts.

Future Proof unveils plans for Miami event

The Future Proof Citywide Event next year will assemble over 2,500 stakeholders across the wealth, alternatives, and fintech spaces.

Tifin taps another LPL leadership alum to its C-suite

The leading AI and wealth technology provider has announced Jeannette Kuda as its new chief operating officer.

Millennials, Gen Z starting earlier on ‘serious’ financial planning

Compared to boomers, younger generations are getting quicker starts to equipped themselves for their financial journeys.

Carson Group welcomes new CFO to executive leadership team

Carson Group has hired Daniel Applegarth from Orion Advisor Solutions…

Retirement income from four sources is expected by half of future retirees

Advisors should help clients consider retirement surprises, survey suggests.

Nationwide’s Eric Henderson set to step down

The president of the financial giant’s annuity business is exiting at the end of 2024, capping off a transformative four-decade career.

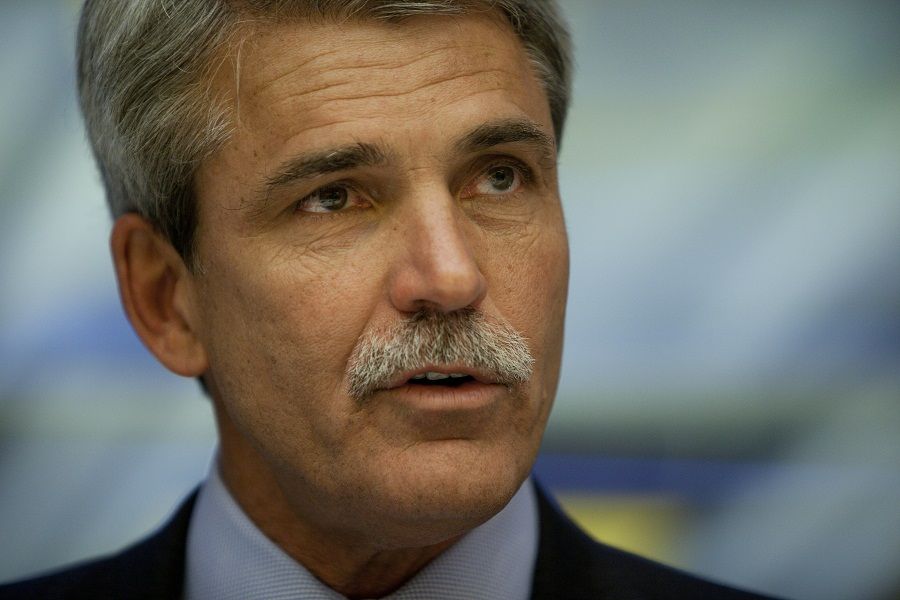

Advisor recruiting getting “irrational,” says Ameriprise CEO

"I do believe that the market is very competitive," says Ameriprise CEO Cracchiolo.

Showtime for HSBC’s wealth strategy as it unveils NYC office

The banking services giant is making a statement to high-net-worth and ultra-affluent individuals with its flagship center in New York.

Fidelity hits HSA record amid assets, adoption boom

Firm is now the second-largest provider of health savings accounts, with HAS assets quadrupling to $24B since 2020.