Bond ETFs hammered by growing inflation bets

Price pressures are expected to rise now that Covid-19 vaccines are being rolled out and given the prospect of more fiscal and monetary stimulus.

Exchange-traded funds across the bond spectrum are bleeding assets as investors brace for higher inflation.

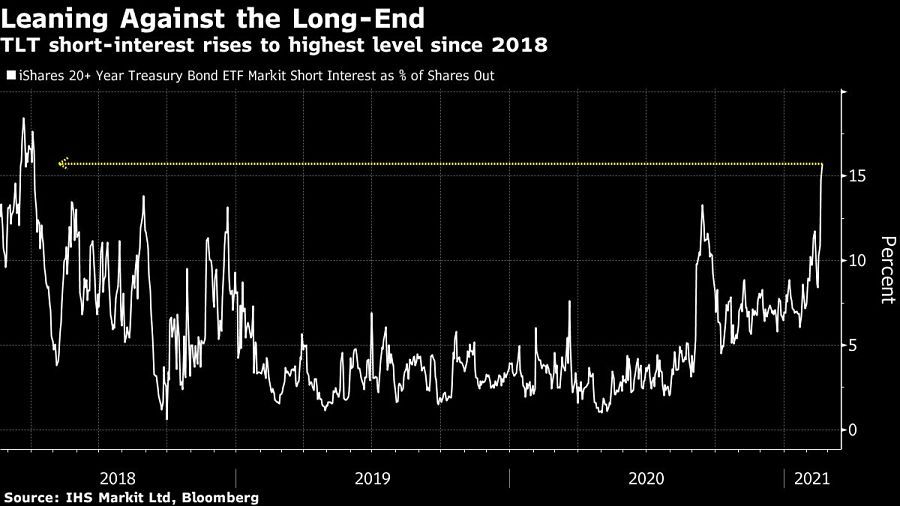

The $46 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) has lost $7.4 billion in six weeks — its worst-ever stretch of outflows, according to data compiled by Bloomberg. Short interest as a percentage of shares outstanding on the $14 billion iShares 20+ Year Treasury Bond ETF (TLT) is at a three-year high, IHS Markit Ltd. data show. Over $1 billion was pulled from the $10 billion SPDR Bloomberg Barclays High Yield Bond ETF (JNK) in the biggest weekly exodus since last February.

Underpinning the pain in bond ETFs is the building consensus that price pressures are poised to lurch higher. Covid-19 vaccine rollouts combined with the prospect of further fiscal and monetary stimulus have triggered bets on higher inflation, threatening to erode the value of future returns. Long-dated Treasuries have sold off in response, boosting yield curves, with the appetite for funds such as LQD and TLT souring.

“Flows follow returns,” said Michael Contopoulos, director of fixed income and portfolio manager at Richard Bernstein Advisors. “With the increase in Treasury yields, we’ve had a very poor period of total returns in investment-grade credit and government bonds.”

TLT has dropped over 9% in 2021 as the longest-dated Treasuries bear the brunt of the bond market sell-off. LQD’s outflows came after investors poured $14.9 billion into the fund in 2020. High-yield bonds have started to wobble as well, with JNK close to erasing its gains since the end of December.

Nearly $800 million exited from U.S. fixed-income funds last week as benchmark 10-year Treasury yields breached 1.3% for the first time since last March. However, inflation-protected funds absorbed about $660 million, bringing year-to-date inflows to $5.4 billion.

[More: Bond returns have 60/40 managers turning to FX]

With the Biden administration pursing a $1.9 trillion fiscal-aid package and the Federal Reserve seemingly sanguine about the risk of sustained inflation, there’s likely more losses ahead for bond traders, said Michael Kelly of PineBridge Investments.

Until the increase in long-term Treasury yields reaches a pain point for the Fed — potentially as high as 1.75% for 10-year bonds — that’s going to mean that “everything fixed income is bad,” he said.

“The policy mix was the pied piper for flows to go into the fixed-income market — one foot on the monetary accelerant and the other off the fiscal,” said Kelly, who leads PineBridge’s multi-asset group. “We’ve been reminded that that policy mix is shifting and so should portfolios. They are just way overexposed to the bond market.”

[More: Bond-based public program would save retirement, Ric Edelman says]

2020 brought human capital management practices into focus

Learn more about reprints and licensing for this article.