Finra sues smoothie-throwing broker for ducking cash reporting rules

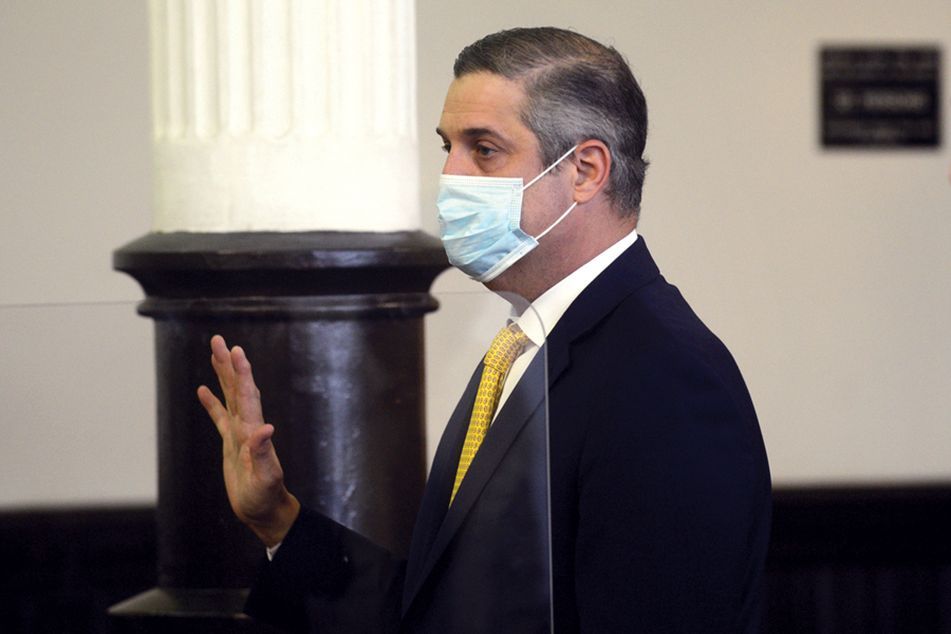

James Iannazzo stands in Superior Court in Bridgeport, Connecticut, March 9, 2022 (Ned Gerard/Hearst Connecticut Media/pool photo)

James Iannazzo stands in Superior Court in Bridgeport, Connecticut, March 9, 2022 (Ned Gerard/Hearst Connecticut Media/pool photo)

James Iannazzo made cash transactions totaling close to $846,000 to avoid detection, the regulator alleges.

Former Merrill Lynch broker James Iannazzo, who was fired in 2022 after his tirade at a smoothie shop in Connecticut went viral, now faces allegations that for more than six years, while employed at Merrill, he made a series of cash deposits and withdrawals to evade triggering federal rules linked to anti-money laundering requirements, according to a complaint filed Friday by Finra’s enforcement department.

A bank must electronically file what is known as a Currency Transaction Report for each transaction of more than $10,000. According to the Financial Industry Regulatory Authority Inc. lawsuit, from December 2014 to March 2021, Iannazzo restructured 368 cash deposits and withdrawals over $10,000 into smaller transactions over several days at the same bank. He also allegedly withdrew more than $10,000 in cash in one day using two different financial institutions, and repeatedly used his Merrill Lynch account.

The transactions allegedly totaled close to $846,000, according to the complaint. Finra alleges that Iannazzo’s conduct in the matter violates industry rules and standards of “conduct in the business,” known as Rule 2010.

Iannazzo could not be reached at his office in Westport, Connecticut, where he has been registered with Aegis Capital Corp. since March 2022.

Finra opened its investigation into Iannazzo’s cash transactions last fall. According to the complaint, the cash was used to pay for a pool and other home improvements; by paying in cash, vendors also ducked a 6.35% local tax.

Iannazzo first gained notoriety in the financial advice industry when Merrill Lynch fired him in January 2022 after he was involved in a disorderly incident at a Connecticut smoothie shop.

He had been working at Merrill Lynch in Stamford since 1996 and regularly made Barron’s ranking of top advisers for Connecticut.

Iannazzo was arrested by local police after erupting at a Robeks smoothie store, throwing a drink at an employee, hitting them and demanding to know who made a smoothie that contained peanuts and caused his child’s severe allergic reaction, according to the Fairfield police.

Iannazzo also made comments to an employee referencing their immigration status, according to the police. A video of the incident, in which Iannazzo repeatedly uses profanity and calls one employee an “immigrant loser,” caused a firestorm at the time on social media platforms.

Months later, he agreed to do a rehabilitation program, sidestepping a criminal conviction, and settled with one of the Robeks’ employees for $7,500.

Will AI remain one of the market’s ‘megatrends’?

Learn more about reprints and licensing for this article.