Boom in new ETFs defies saturation warnings

'Is this the year of the bond ETF? Certainly flows seem to be shouting that from the rooftops,' says VettaFi's Lara Crigger.

Money management firms launched new exchange-traded funds at a rapid pace last month, shaking off fears that the $7 trillion industry is already overrun with low-cost investment vehicles.

Sixty-nine new ETFs came to market in September, making it one of the busiest months since at least 2016, data compiled by Bloomberg show. It was also the only month since September 2021 when there were more than 50 launches.

A number of the new ETFs centered on the fixed-income market, though the list also includes international and commodities-focused funds. Matthews and Capital Group each rolled out five ETFs, while Brookstone Capital Management added eight to its lineup.

“It’s just exhibiting the affinity investors have for ETFs and issuers coming to address those needs — from all across the capital markets spectrum, too,” Todd Sohn, ETF and technical strategist at Strategas Securities, said of the raft of launches.

The newcomers — which spanned the spectrum of passive and active vehicles — are entering into an highly competitive space, with more than 3,200 ETFs already in existence.

The rapid expansion has raised the question of whether the market is already too saturated with offerings, given that there are so many devoted to stocks, bonds and numerous tailored niches like investments in space or innovation. That means it’s far from certain that any new launches will attract investor attention or money. In fact, a number of companies have been culling their lineups, with some liquidating funds that launched during the pandemic’s stock-market heydays but failed to materialize meaningful flows.

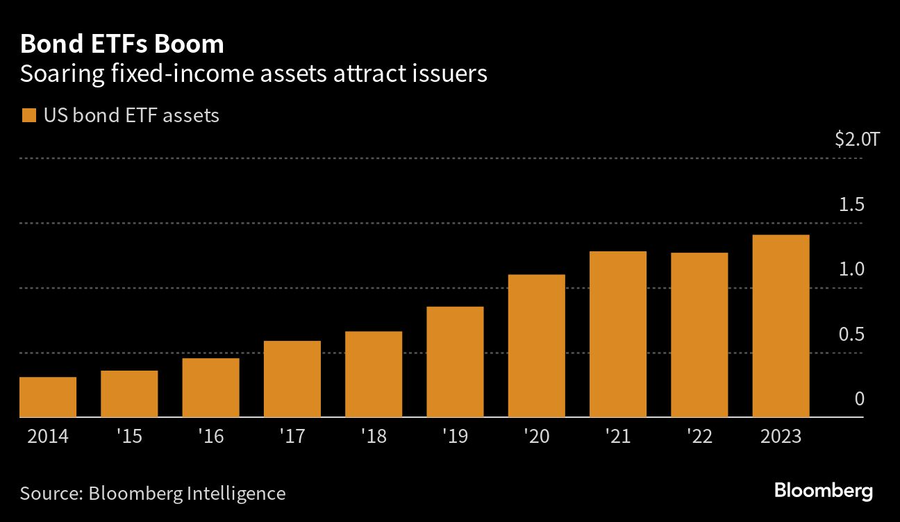

A slew of last month’s rollouts focus on the fixed-income market, with Dimensional and Capital Group among those that debuted short-duration ETFs. Such funds have drawn massive inflows this year, with ultra-short government bond funds — those with maturities of less than one year — seeing more than $30 billion come in as yields hold at high levels.

“Is this the year of the bond ETF? Certainly flows seem to be shouting that from the rooftops,” Lara Crigger, editor-in-chief at VettaFi, said in an interview. “In terms of money going into the ETFs, it’s favoring short-term ETFs, ultra-short-term cash-like instruments.”

Meanwhile, despite September’s rocky stretch for markets, stocks are up this year. And such up markets tend to drive companies to put out more products, said Bloomberg Intelligence’s Athanasios Psarofagis.

“Launches tend to mimic the market performance, slowing when markets drop and picking up when they rally,” he said. “The good run this year has brought issuers back.”

[More: All Schwab’s bond ETFs now cost just 3 basis points]

Sam Bankman-Fried believes he can prove his innocence, ‘SBF’ author says

Learn more about reprints and licensing for this article.