Behind the business case for more female advisors

As women amass more wealth, there’s a market for female financial advisors. Now it’s a matter of meeting the demand.

From head count to AUM and board members, there are a multitude of ways to measure the progress of women in the wealth management business.

Karen Altfest, executive vice president of Altfest Personal Wealth Management, has her own proprietary method for calculating female advancement in the financial advisory industry.

She counts lunches.

“There are many more women at financial planning and investment conferences now than there were when I started in the business, when I would typically count one woman and nine men at almost every lunch table. Now women hold steady at about a third of conference attendees,” Altfest said.

Founded in 1983, Altfest Personal Wealth Management has a 45-member staff, 19 of whom are women, overseeing assets under management of $1.6 billion. Among those employees is financial planner Jessica Nelson, who believes that the need for more women in the wealth management industry will continue to increase as women amass greater wealth.

“I find that many female clients are looking to work with women advisors,” Nelson said.

The numbers back up her observation. With a McKinsey study projecting that women will control $30 trillion in assets by the end of the decade, up from approximately $11 trillion today, there’s an urgent case for recruiting more women into the wealth management business.

“Without question, the industry is shining a bright light on the need to bring more women into the industry and to serve female clients better. This is coming in the form of women pioneers who have set the stage for younger generations to join the industry, male allies who are intentionally advocating for women at many levels, and companies that are designing environments that offer opportunities to women,” said Debra Brennan Tagg, president of BFS Advisory Group, which boasts seven women on a nine-person team overseeing $300 million.

In other words, there’s a market for female financial advisors. Now it’s a matter of meeting the demand.

BEHIND THE HIRING LINE

To change the gender distribution at those lunches so studiously watched by Altfest, advisory firms first need to adjust their hiring practices. And that starts at the top of the recruiting funnel.

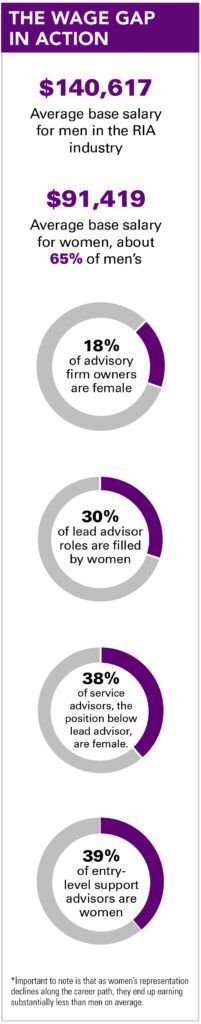

Today, 18% of advisory firm owners are female, according to the recent InvestmentNews Advisor Benchmarking Study. In the position of lead advisor, which is right below partner, the study showed female advisors represent 30% of incumbents. The position below lead advisor — service advisor — is 38% female, and the entry-level position of support advisor is 39% female.

Put simply, representation declines with every promotion, which is troubling.

It’s worth noting that this lack of promotion could be explained by saying that many women are joining the profession, and if given time, they will rise to partner level. Unfortunately, by comparison, in 2013, 25% of owners were female, which is more than today.

Stated plainly again, the industry is not making progress at all. It is traveling backwards.

Altfest says one reason why women remain deep in the minority is that many fail to consider a career as a financial advisor in the first place. After decades of being told they’re not able to make their own financial choices, she believes too many women have internalized such ridiculous notions.

“Actually, this is a great career for women,” she said. “At our firm, we mentor our women staff and want to help them be successful. Also, as a group, we may need to tell women to sharpen their elbows before they sit down at an advisory table.”

Cindy Boyle, president of Freehold Wealth Management at Stifel Independent Advisors, began her career in wealth management in 1977, a time when women professionals in the field were a rarity. She says pranks and biases against her from her male colleagues were common in her early years at Merrill Lynch, but she persevered and eventually rose above her tormentors through hard work and exceptional service.

In Boyle’s view, traditional views on women’s role in child care may have hindered women’s progress up the corporate ladder.

“While many companies have made efforts to address these issues, I think there are sometimes still limited options, especially for women starting out in their careers and negotiating a work environment that’s highly competitive,” she said. “Balancing family responsibilities with a demanding Wall Street job can be particularly challenging.”

Safety has also traditionally been a big issue holding women back from opting for a career on Wall Street. And it will continue to be until there is safety in numbers, says Robin Patin, senior director of wealth management at Choreo.

“Some financial advisors are asked to establish their practice and book of clients by literally knocking on doors. There are safety concerns with that approach. Not many women will want to show up unannounced at a residence or business,” Patin said. “That can be a deal breaker for many women who are considering the industry.”

STORMING THE OLD BOYS’ CLUB

Another issue holding women back from executive positions in the financial industry is the perception that women in power are overly assertive or difficult to work with. This stereotype can deter women from pursuing leadership roles in the financial world, as it perpetuates the idea that women in power are seen as an exception rather than the norm.

“The industry still grapples with outdated notions of a male-dominated old boys’ club, which can create a hostile environment for women seeking advancement,” said Freehold’s Boyle.

Her solution to combat this perception is for women on Wall Street to come together to fight prejudice and preconceptions, creating a more inclusive and supportive environment.

“Just as female elephants encircle a vulnerable sister to protect her from predators, there is a need for women in the industry to support each other in breaking through these barriers,” Boyle said.

She believes mentorship relationships can promote this solidarity, providing valuable guidance, support and networking opportunities that can accelerate a woman’s career.

Not that men don’t have a place in advancing the careers of women. They need to be allies and advocates too, says BFS’s Tagg.

“Our industry has many male allies who make room for women to succeed, but we need so many more to really make a widespread, permanent, meaningful change,” she said.

Tagg added that corporations also need to put greater intention behind bringing more women to the industry. And it’s not merely to check a box, but because “it’s good for their business, both from a client experience and [for] the bottom line.”

The media can do its part too, in her opinion, by highlighting successful women in wealth management so more females want to join the field.

Most of all, Tagg believes that women in the financial industry need not only to attend those lunches that Altfest talked about, but also be willing to “flip the tables over” once they get there.

“It all needs to change,” she said. “We need to reimagine the beginning career path for our industry — less sales, more mentorship — then change the middle career path, allowing flextime for family and other priorities, and finally fix the later career path by making it as financially rewarding for women to be in leadership roles as it is for men to be in the same roles.”

How can advisors appeal to next generation of investors?

Learn more about reprints and licensing for this article.