Investing in rental homes remains profitable but rent growth has slowed

Report shows average US rent growth of about 28% since February 2020.

Investing in residential real estate for the rental market remains profitable overall, but investors may have to be patient for growth in rents to increase.

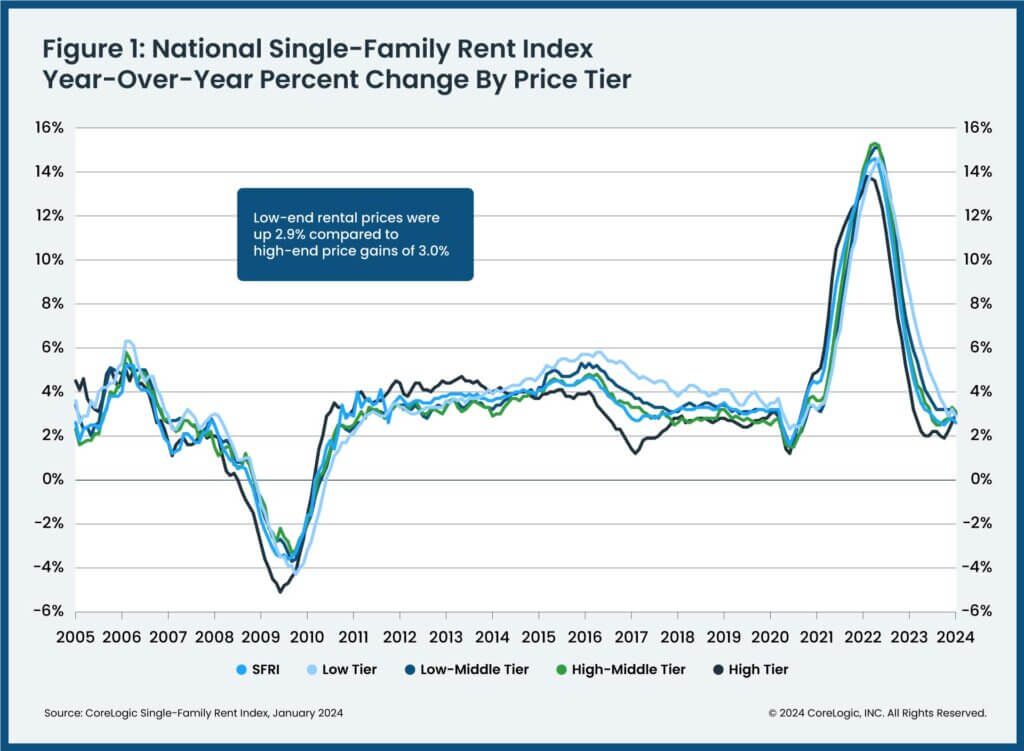

The latest Single-Family Rent Index from CoreLogic shows that year-over-year rent growth in January 2024 was 2.6% (below the 3.1% rate of inflation for the month), has been below 3% since summer 2023, and has not been in double digits since the fall of 2022.

But for those investors that have been in the market since the start of the decade or longer, the returns are more favorable at around 28% from February 2020 to January 2024 including a 29.5% increase for the lowest price tier (those 75% or less than the regional median).

“While annual U.S. single-family rent growth was a moderate 2.6% in January, that increase built on years of above-trend annual gains,” said Molly Boesel, principal economist for CoreLogic. “Furthermore, while rent growth is slowing, costs are still increasing across most of the country. The median rent on a three-bedroom property increased by over $100 in the past year and by more than $500 in the past three years.”

CoreLogic recently reported that US homeowners added a cool $1.3 trillion to their home equity in 2023, suggesting that many investors will have improved the value of their rental market assets.

As with most things real estate, the national average rent growth belies what’s happening in regional markets, with Honolulu leading the above-average cohort at 6%, followed by Seattle at 5.2% and New York at 5.1%. Conversely, four metro areas posted annual rental price losses: Miami (-2.4%); Austin, Texas (-2.3%); New Orleans (-1%) and Minneapolis (-0.9%).

Learn more about reprints and licensing for this article.