Icahn, BlackRock’s Fink battle over high-yield ETFs

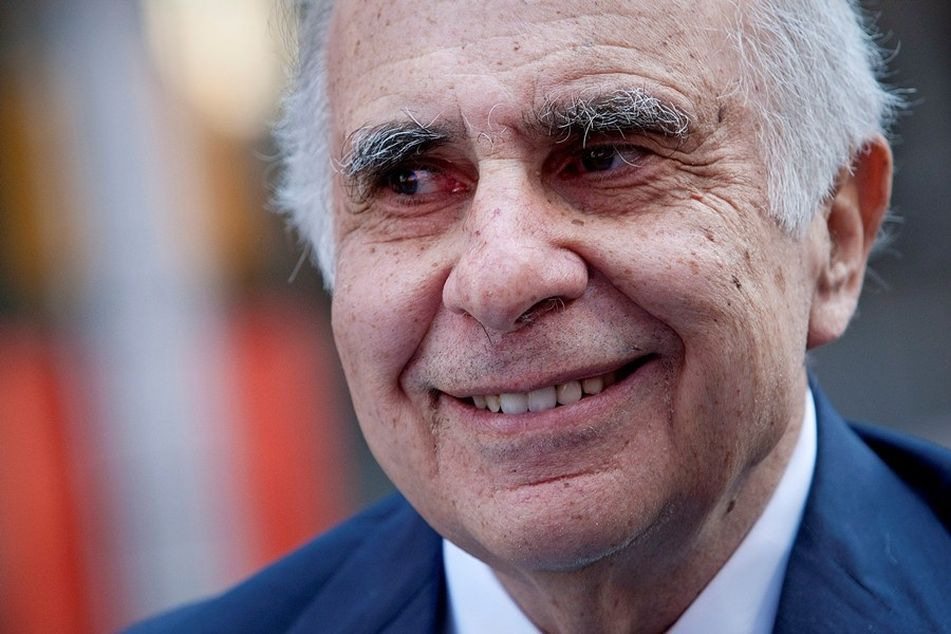

Carl Icahn

Carl Icahn

Carl Icahn criticized asset management firms such as BlackRock for selling ETFs that give an illusion of liquidity for “extremely illiquid, and extremely overpriced” securities such as high yield bonds. But BlackRock CEO Larry Fink disputed the characterization.

Carl Icahn criticized asset management firms such as BlackRock Inc. for selling exchange traded funds that give an illusion of liquidity for “extremely illiquid, and extremely overpriced” securities such as high yield bonds.

The billionaire investor, who has said in the past that he’s betting against the high-yield market, told BlackRock Chief Executive Officer Laurence D. Fink at the CNBC Institutional Investor Delivering Alpha Conference that such instruments are “extremely dangerous.” Mr. Fink disputed the characterization.

“This thing is going to go over this cliff and you know what’s going to destroy it? They’re going to hit a black rock,” Mr. Icahn said at the conference Wednesday in New York.

The debate between Mr. Fink, head of the world’s largest money manager, and Mr. Icahn, an outspoken shareholder activist known for pushing companies to boost their stock price, wasn’t the first time the two have disagreed. Mr. Fink, in an April letter to chief executive officers of the biggest U.S. companies, criticized activists for pushing stock buybacks and hindering long-term strategic investments. Mr. Icahn in May said Mr. Fink is protecting underperforming executives with his campaign.

“I just totally disagree with Carl’s characterization,” Mr. Fink said Wednesday. “ETFs create more price transparency than anything that’s in the bond market today. To trade ETFs at every minute of every day you have to have a valuation of every bond at every minute.”

HIGH-YIELD CRASH

During a lengthy exchange, Mr. Icahn reiterated his warning that high-yield debt will eventually crash when interest rates rise, leaving investors in related ETFs without buyers for the securities. Mr. Fink disagreed, arguing that rising interest rates would stoke demand for credit.

Mr. Icahn has repeatedly warned over the past year about dangers in the high-yield bond market. He told CNBC last year that bonds are in a bubble and he was betting against them.

“I think the high-yield market is in a bubble,” he said. “I think that is a no-brainer.”

He said during an episode of “Wall Street Week” that aired May 31 that the high-yield market was more dangerous than the stock market. He said that he uses credit-default swaps to bet against high-yield bonds.

High-yield bonds have returned 2.7% this year after gaining 2.5% in 2014, according to Bank of America Merrill Lynch Index data.

Mr. Fink said while he sees Federal Reserve Chair Janet Yellen starting modest rate increases in September, interest rates won’t rise much.

“We don’t see rates moving up that much,” he said. “I would like to see her raising rates” as the economy strengthens.

Learn more about reprints and licensing for this article.