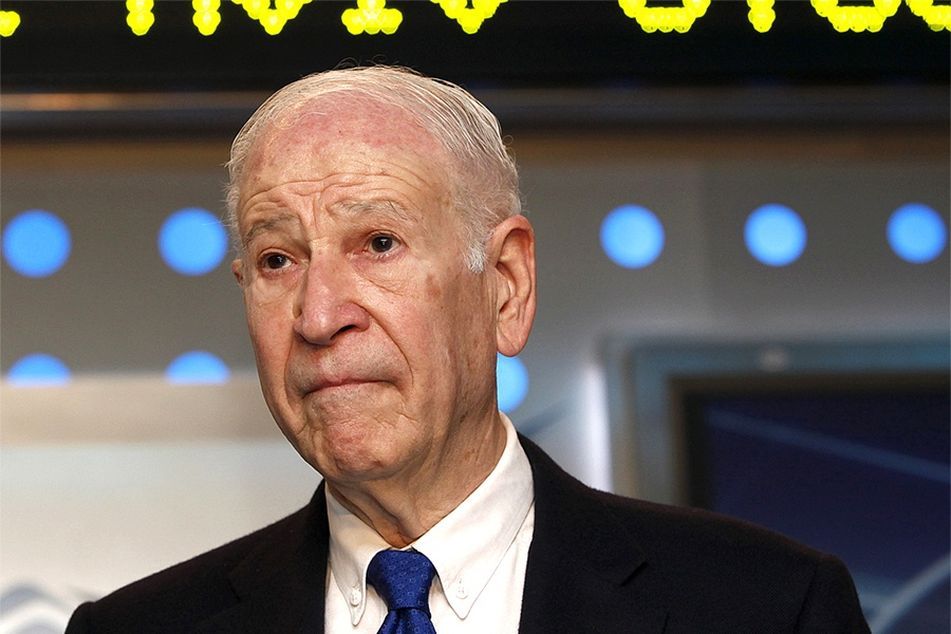

Phillip Frost sells most of his Ladenburg Thalmann shares

The SEC charged the firm's former chairman in September with fraud.

Months after being charged with securities fraud by the SEC, Phillip Frost, the former chairman of Ladenburg Thalmann Financial Services Inc. and the largest shareholder, has sold most of his stake back to the firm.

In a press release Monday afternoon, Ladenburg Thalmann said that it had repurchased close to 51 million shares from Mr. Frost, who owned 73.5 million shares earlier this year, according to a company filing with the Securities and Exchange Commission. The selling price was $2.50. The company also canceled stock Mr. Frost’s stock options.

Read more: (Chairman should leave Ladenburg Thalmann)

In total, Ladenburg Thalmann paid $130.3 million in cash and notes to purchase Mr. Frost’s shares.

Mr. Frost’s involvement and ownership of Ladenburg Thalmann has recently turned problematic. In September, the SEC charged Mr. Frost and nine others with fraud for their involvement in a pump-and-dump, penny stock scheme.

A week-and-a-half later, he resigned as non-executive chairman of the firm.

Spokespeople for Mr. Frost did not return a message Monday evening to comment.

“This purchase of the substantial majority of shares owned by Mr. Frost is in the best interest of our shareholders and is consistent with our stock repurchase efforts,” said Richard Lampen, the firm’s chairman and CEO in a statement.

Along with his role at Ladenburg Thalmann, Mr. Frost is a well-known biotech investor in South Florida. Since March 2007, he has served as chairman of the board and CEO of OPKO Health Inc., a multinational biopharmaceutical and diagnostics company.

Subsidiaries of Ladenburg Thalmann include five retail focused independent broker-dealers, including Securities America Inc.

Learn more about reprints and licensing for this article.