Bitcoin’s worst week since March rattles faith in crypto

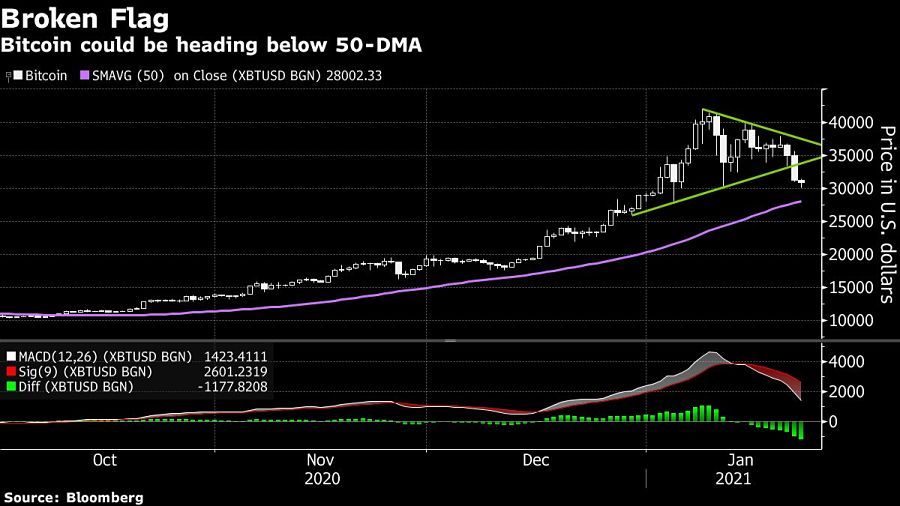

Prices for the digital asset have tumbled 14% this week, marking the steepest decline since March, with Bitcoin near $31,000 Friday. Commentators have cautioned that a sustained drop below $30,000 could presage further losses.

The sharp sell-off in Bitcoin this week is stoking fresh questions about the sustainability of the cryptocurrency boom.

Prices for the digital asset have tumbled 14% this week, marking the steepest decline since March. Bitcoin was steady on Friday, holding near $31,000. Commentators have cautioned that a sustained drop below $30,000 could presage further losses.

“Being Bitcoin, a 10% range intraday is a mere flesh wound to the digital asset, in a world where tradable versus investible is seriously blurred,” said Jeffrey Halley, senior market analyst at Oanda Asia Pacific Pte. The digital coin could “easily be $35,000 again tomorrow or could drop through $30,000 and test notional support at $27,000.”

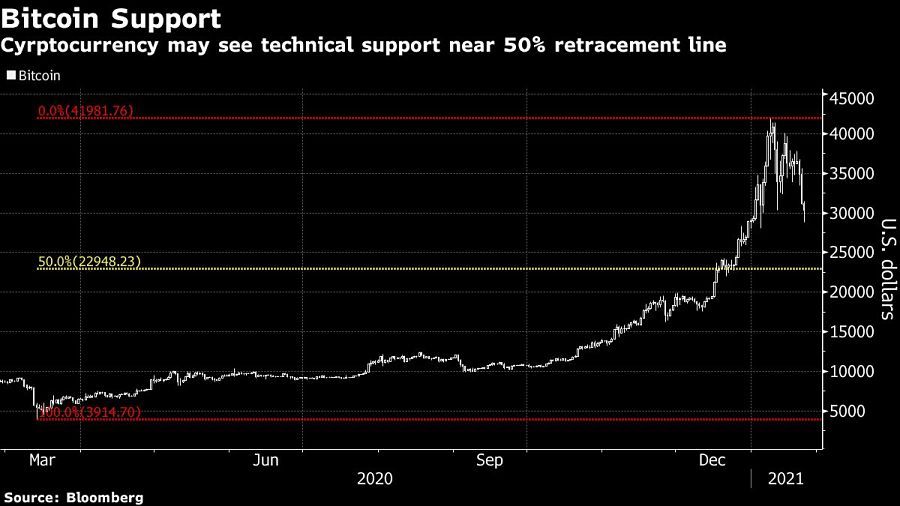

Bitcoin’s surge to a record of almost $42,000 on Jan. 8 embodied the embrace of risk in financial markets awash with stimulus. Some argue Bitcoin is also becoming a more mainstream investment with a role to play in hedging risks such as dollar weakness and faster inflation. Others see little more than speculative mania since the digital coin has more than tripled in the past year.

Pinpointing who is mainly responsible for the Bitcoin rally is one of the many crypto mysteries — Bitcoin funds, momentum chasers, billionaires, day traders, companies and even institutional investors have been cited.

For instance, Grayscale Investments, which is behind a popular Bitcoin trust, saw total inflows of more than $3 billion across its products in the fourth quarter. This week, BlackRock Inc. dipped its toe into the crypto universe for the first time, saying cash-settled Bitcoin futures are among assets that two funds were permitted to buy.

Recent comments by Janet Yellen may be among the reasons for this week’s Bitcoin swoon, said Jehan Chu, managing partner with blockchain advisory firm Kenetic Capital in Hong Kong. In her Senate confirmation hearing, Yellen noted cryptocurrency as an area of concern for terrorist and criminal financing.

Describing such fears as “unfounded,” Chu said that a “natural correction” is underway and that profit-taking won’t “reverse the unprecedented assimilation of Bitcoin into Wall Street’s DNA, leading to $100,000 levels this year.”

Some strategists are more skeptical. For instance, UBS Global Wealth Management recently warned that there’s nothing stopping a wipeout in big-name digital currencies eventually amid regulatory threats and central bank-issued competitors.

“Over the past few days, Bitcoin has been trading approximately 30% lower than the most recent all-time highs, and we’ve seen Asia take profits in Bitcoin in the lead-up to Chinese New Year,” said Fernando Martinez, head of Americas with crypto brokerage OSL. The next key level is $27,750 — if Bitcoin falls through that, it could retest $25,800, he said.

Bitcoin was trading at $31,649.45 as of 11:06 a.m. in London on Friday. The wider Bloomberg Galaxy Crypto Index was down 0.9%. Shares of cryptocurrency stocks, such as Japan’s Monex Group Inc., also slid.

[Video: RIA valuations holding up despite pandemic and firms paying more up front]

Learn more about reprints and licensing for this article.