eMoney names Fidelity’s Ed O’Brien as new CEO, replacing Mike Durbin

The new exec is taking place of founding chief executive Edmond Walters, who stepped down in September

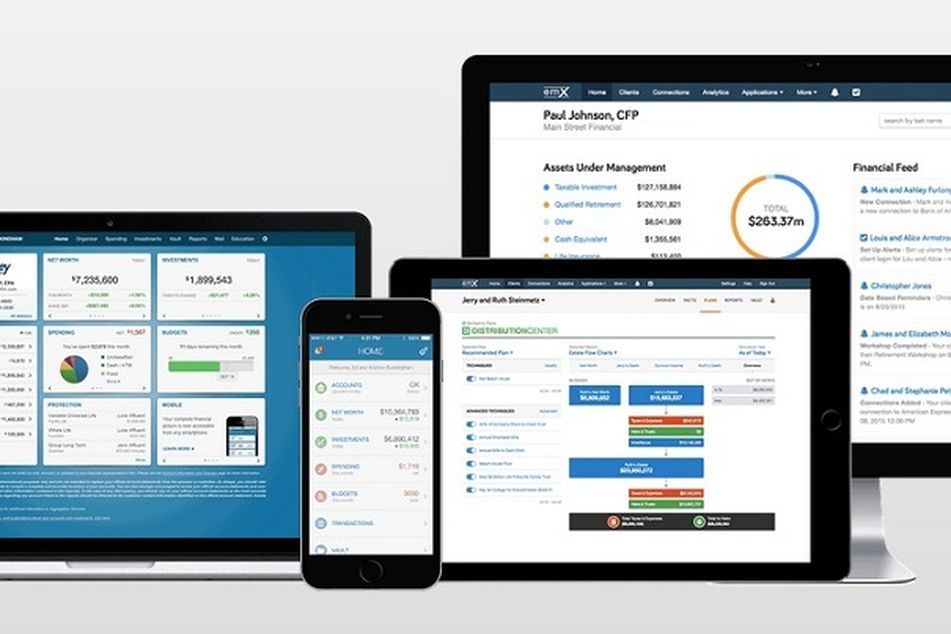

Financial planning software provider eMoney has named a new chief executive, Ed O’Brien, senior vice president and head of platform technology for Fidelity Institutional.

Mike Durbin, president of Fidelity Wealth Technologies, had been acting as interim chief executive of the company after Edmond Walters, founding chief executive of eMoney, unexpectedly stepped down in September.

Mr. O’Brien is starting his new position effective immediately, and will now report to Mr. Durbin, who will return to his position at Fidelity.

Last year, Fidelity acquired the Radnor, Penn.-based technology company.

Mr. O’Brien has been at Fidelity for more than 30 years, focusing on development of technology platforms for financial advisers. During this time, he has worked on Fidelity’s WealthCentral, as well as AdvisorTech, a platform for advisers in Japan, South Korea and Germany. He has served as president and board member for the Providence Society of Financial Analysts.

“The appointment of Ed as the CEO of eMoney is the right choice as the firm continues to reset the industry’s expectations for disruptive innovation,” Mr. Durbin said in a statement. “I’m confident he will help us further establish eMoney as the strongest ally of advisers seeking to meet the growing high-tech and high-touch expectations of their end-clients.”

Learn more about reprints and licensing for this article.