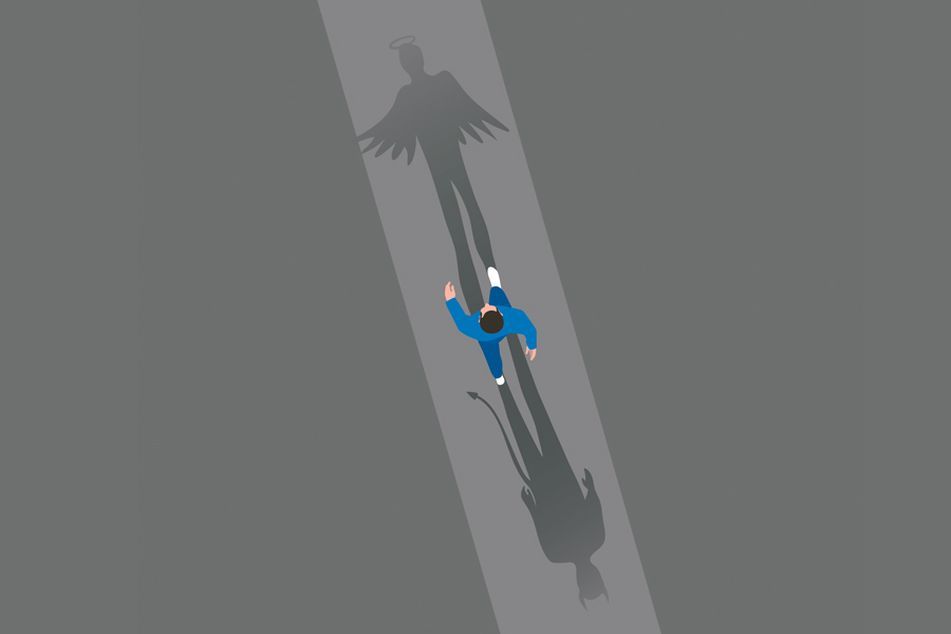

Are record keepers friend or foe to 401(k) advisers?

Record keepers are offering services to retirement plan participants that are raising the hackles of RPAs.

As they introduce new products and services, record keepers of defined-contribution plans are infringing on 401(k) advisers’ traditional turf and threaten to lure away clients.

Many retirement plan advisers and executives at large retirement-focused financial advisory firms agree that record keepers are getting more aggressive, primarily when it comes to offering services to 401(k) participants that overlap with advisers’ offerings.

“I would say that they’re getting a little bolder than they have in the past,” said Joseph DeNoyior, managing partner of Washington Financial Group. “A couple of the really big record keepers are pushing it pretty hard right now and it’s to the point where it’s in our face.”

Tim Rouse, executive director of the Spark Institute, a trade group for record keepers, said the competition has become more acute primarily in the area of financial wellness services. These programs take many forms, from one-on-one counseling to online education modules, but have the same primary goal: boost employees’ overall financial well-being.

Demand among employers has swelled for holistic financial-planning services, as employees have struggled to manage competing financial obligations — saving for retirement, health-care costs and college education while paying down student loan and credit-card debt, for example, Mr. Rouse said in an interview.

Wellness program

Nearly 25% of 401(k) plan sponsors offer a comprehensive financial wellness program — a 7-percentage-point increase over two years, according to the Plan Sponsor Council of America. More employees are also using such programs when they’re made available — 65% last year, up from 51% in 2012, according to PwC.

Many advisers have moved to fill that demand by offering more personal finance services, and some even offer them as a business line that’s separate from their 401(k) services. Record keepers are nudging further into the territory, with most, if not all, offering a financial wellness product at this point.

“It’s heating up,” David Hinderstein, president of Strategic Retirement Group Inc., said of record-keeper competition. “They’re getting way more aggressive.”

The competition extends beyond financial wellness, advisers said. Most record keepers, for example, also offer managed accounts, which build an asset allocation for 401(k) participants in a fiduciary manner. These services compete with advisory firms that build their own managed account programs and offer participant advice services.

The threat has existed for several years, but some record keepers such as Fidelity Investments have begun adding more personal financial planning features, which compete more squarely with advisers’ participant services. Some providers, such as Empower Retirement and Schwab Retirement Plan Services Inc., offer adviser-managed accounts, in which the adviser provides the fiduciary investment selection underlying the managed accounts.

Mr. DeNoyior said he witnessed record keepers’ mindset firsthand after being hired by an employer to conduct an independent search for its new 401(k) provider. A few record keepers indicated they’d be able to manage all of the adviser’s responsibilities if the employer were to ever fire its adviser, he said.

“They couldn’t wait to replace [the adviser],” said Mr. DeNoyior, who wasn’t the plan’s full-time adviser.

There are some advisers who feel they’re at least partly to blame for record keepers’ infringement because they’ve continually negotiated lower and lower record-keeper fees on behalf of clients.

“I think we have driven record-keeping costs down dramatically,” said Randy Long, managing principal at SageView Advisory Group.

While advisers are also feeling some fee pressure, record keepers “are feeling it way more than the advisers are,” Peter Demmer, CEO of consulting firm Sterling Resources Inc., said in an interview.

Seeking revenue streams

Median record-keeping fees have fallen by half over the past decade — to $59 per participant in 2017 from $118 in 2006, according to consulting firm NEPC. That dynamic has led record keepers to seek out additional revenue streams, which has put them in competition with advisers.

“It’s definitely become almost a three-way competition for revenue,” Mr. Demmer said, referring to advisers, record keepers and asset managers.

Fee compression, he said, has resulted primarily from a Department of Labor fee-disclosure initiative in 2012 and the “almost unprecedented” shift toward index funds from actively managed investments. A number of lawsuits have also targeted plan sponsors for alleged excessive record-keeping and investment management fees.

However, the competition cuts both ways, said Mr. Rouse of Spark — some large advisory shops have infringed on record keepers’ turf, too. For example, advisers have taken a more active role in participant servicing by building call centers that field participant questions and requests, responsibilities traditionally handled by the record keeper, Mr. Rouse said.

Some advisers, typically those who don’t specialize in retirement plan advice and don’t offer financial wellness and managed accounts, for example, would benefit from being able to leverage record keepers’ products to present new services to clients.

And while some advisers may reserve their individual advice services for high-net-worth participants, record keepers need to address the entire employee population of a company — hence the debut of broad services that all participants can use.

Not all advisers are incensed about record keepers’ branching into new areas of the market.

“I don’t worry about the record keepers,” said Rick Shoff, managing director at Captrust.

“What I always say [to clients] is, ‘Do you really want your record keeper giving advice?’” Mr. Shoff said. “No, why would we want that, right? So I think if we’re out there presenting the solutions better, we’ll win. If we don’t, then shame on us.”

Jamie Greenleaf, principal at Cafaro Greenleaf, agreed, saying “They don’t do a good job of it, which I think will be our saving grace.”

Learn more about reprints and licensing for this article.