Give us a break, active managers say

Seven portfolio managers share their outlooks for the rest of the year, generally agreeing that it's been hard for active managers to stand out.

Ten years into a historic bull market run that has proved an ideal environment for passive, index-based investing, active managers are champing at the bit for a break in the cycle that would let them strut their stuff.

“We need a bust,” said Andrew Slimmon, managing director and lead senior portfolio manager at Morgan Stanley Investment Management.

“I’m not so sure that passive isn’t going to continue to do fine, but the whole market will continue to levitate until we get to escape velocity,” he said, referring to a break from such guardrails as Federal Reserve monetary policy.

At a roundtable discussion hosted by InvestmentNews earlier this month, seven portfolio managers shared their outlooks for the second half of this year. They generally agreed that the surprising resilience of the financial markets and the economy, especially since the election of President Donald J. Trump, has made it hard for active managers to stand out.

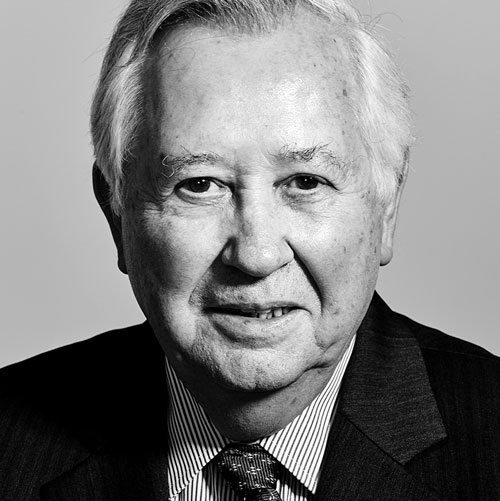

The markets and the economy continue to project a Teflon-like quality, whether they’re faced with trade tensions, uncertainty about Fed policy moves or the generally contentious state of Washington politics, said Ted Theodore, chief investment officer at TrimTabs Asset Management.

“This is the most hated bull market in my memory, and I will take the prize here for being the oldest [roundtable participant], 55 years in the business,” he said.

Mr. Theodore is upbeat on the outlook for U.S. markets, and among the indicators that he sees as bullish is the strength of the U.S. labor market.

“I’ve never experienced as good a labor market as we have today in the post-war period,” he said.

Mr. Slimmon, like most of the portfolio managers who participated in the roundtable discussion, is banking on the human tendency “of constantly reacting” to create opportunities for active managers.

The best recent example of an opportunity for active managers that was spawned by human behavior was the 20% peak-to-trough pullback late last year that dragged the S&P 500 Index down 6.2% for 2018. The S&P started this year with a 13% first-quarter rebound off that pullback at the end of 2018, but it has given back some of those gains in the second quarter.

The portfolio managers were optimistic about the opportunities for active management in the second half of the year.

“The good news is you’re coming out of a period that couldn’t have been any better for passive, so intuitively it must be good for active now,” said Matt Benkendorf, chief investment officer and portfolio manager at Vontobel Asset Management.

“If you look at what central banking policy has been around the world, it should be no shock that passive has done well,” he said. “I think we are probably in one of the most difficult investment environments we’ll ever see.”

The markets’ relatively smooth ride upward over the past 10 years has relaxed investors and advisers to the point where their biggest concern now is the “fear of missing out by not investing more,” Mr. Benkendorf said.

‘Walking right into the storm’

Just loading up indiscriminately on broad market indexes, he said, is tantamount to “walking right into the storm that we have right now where there’s a portion of the market you probably wouldn’t even want to touch. But the siren song is there pulling people in, and I think that makes it incredibly treacherous right now.”

Ankur Crawford, portfolio manager at Alger, agreed that risk has been quietly seeping into the broad markets as outperformance becomes concentrated among a small portion of companies.

“When we look at this active-versus-passive debate, we are actually quite excited because what we see is the composition of the Russell 1000 Growth Index, which is probably most under attack,” she said. “I don’t know if all investors appreciate the risk they might be taking, because approximately 27% of the Russell 1000’s growth is in five stocks.”

The concentration of market gains inside broad indexes like the Russell 1000 is comparable to what was happening in the stock market in 2000 during the tech bubble, Ms. Crawford said.

“In some cases, you might want to take that concentrated risk as a passive investor, but you should at least be aware of what you’re buying; it’s not just the market, you’re getting an outsized exposure to certain stocks,” she said. “We are pretty excited about this because we actually see large swaths of the market that you don’t want to be invested in right now.”

Toby Thompson, vice president and portfolio manager at T. Rowe Price Group, also sees “lots of risk” in the markets but has learned to navigate that risk at least partially by following the lead of the Trump administration.

“I think Trump looks at the equity market as his barometer, and I think he’s even said that,” Mr. Thompson said. “If the equity market does go down quite a bit, he will react somehow and try to get a trade deal. It may not be a good one, but we think he’s going to do something as we get closer to the election.”

To avoid having his portfolios whipsawed by geopolitical events, Mr. Thompson said he is holding more cash and “getting dry powder ready to take advantage of things we think the market could give us.

“We’re kind of favoring income over growth, so we are actually buying high yield,” he said. “It’s not super cheap, but we’d rather clip the coupon.”

Mr. Slimmon of Morgan Stanley cited the “Trump collar,” which he said was comparable to a “Fed put” strategy of investing based on the market’s predictable reactions to changes in monetary policy.

“I believe in the Trump collar,” Mr. Slimmon said. “If things are good, Trump will be aggressive on tariffs; if things are bad, he pulls back on tariffs.”

Mr. Slimmon said he is forecasting the effects of the president’s push on tariffs against China based on the level of the S&P 500 going into July.

“If we start the second half of the year back close to 3,000, then we’ve got an issue, because tariffs are going to impact the market,” he said. “But at 2,750, I don’t think that is a big risk to the market anymore.”

Mr. Theodore of TrimTabs argued that the markets shouldn’t feel that much of an impact from tariffs.

“Trade is not a big deal for the U.S., it just isn’t, and it’s even a smaller deal per company,” he said.

But Anupam Damani, portfolio manager for Nuveen’s global fixed-income team and head of its international and emerging markets debt sector team, sees two potential rounds of effects from tariffs.

“The first-round effects of tariffs are how it impacts inflation, prices, the hit to the companies and whatnot,” she said. “The second-round effect is a hit to confidence and a hit to business investment.”

Pandora’s box

Ms. Damani said the way the administration is using tariffs for both “economic and uneconomic reasons” could be opening a Pandora’s box.

“I think that is very significant; why would any company want to make any serious investment before the next presidential cycle?” she said. “I think that has to be taken into account in an economy where fiscal stimulus was already waning and at least the fixed-income market is telling you maybe the Fed went too far in its hiking cycle, so you will have a slowdown that the Fed will have to take into consideration.”

Considering the four basic engines of growth in the U.S. — consumption, investment, government spending and exports — Gautam Khanna, senior portfolio manager at Insight Investment, expects expanding tariffs will slow investment growth.

“The investment part is very confidence-driven,” Mr. Khanna said. “Certainly everything happening with trade and tariffs and the fact the president has opened up multiple fronts — it’s not just China, it’s Mexico, it’s Europe, it’s India, et cetera — that adds to the uncertainty, which perhaps causes the investment engine to slow down a bit.”

If uncertainty leads to volatility, Mr. Khanna said the economy could be hit by a slowdown in consumption and consumer spending, “which then plays into what happens in the second half from an earnings perspective.

“The U.S. economy is largely immune from trade, but the multinational companies are not,” he said. “Unlike Germany, which exports 40% of its GDP, it’s only 10% or 15% for the U.S., so it’s less relevant and we’re perhaps not as badly impacted. But that’s not the case for multinational corporations.”

Fed moves

In the category of bold predictions, Mr. Khanna said he wouldn’t be surprised if the Fed holds off on making any moves in the second half of the year. (The Federal Reserve left its key rate unchanged in its latest vote last Wednesday.)

“Even though we’re priced for two cuts, the Fed is saying they’re data-dependent, and short of the data rolling over, I don’t see why they should be cutting right here as the bond market is predicting,” he said.

Mr. Thompson of T. Rowe expects that Mr. Trump will “push us to the limit” toward a trade war with China.

“I predict China plays the long game with him, the markets really crater, and the Fed has to come in, do two cuts at least and maybe even start with a 50-basis-point cut,” he said. “And I think the market will react to that as positive. That’s why I think the market will actually end up positive, because either Trump’s going to back off late in the game and come up with a magical win, or the Fed’s going to come save things.”

Ms. Crawford of Alger also is expecting big things from Mr. Trump.

“I would say that Trump actually does pull off a landmark deal on tariffs, and I think in part because he has to as he enters the 2020 election cycle,” she said. “And that basically sets us up for an extension of this economic growth cycle for another year or two.”

Learn more about reprints and licensing for this article.