Ex-Stanford advisers targeted by SEC: Reports

Are financial advises who worked for R. Allen Stanford under scrutiny? (Bloomberg News)

Are financial advises who worked for R. Allen Stanford under scrutiny? (Bloomberg News)

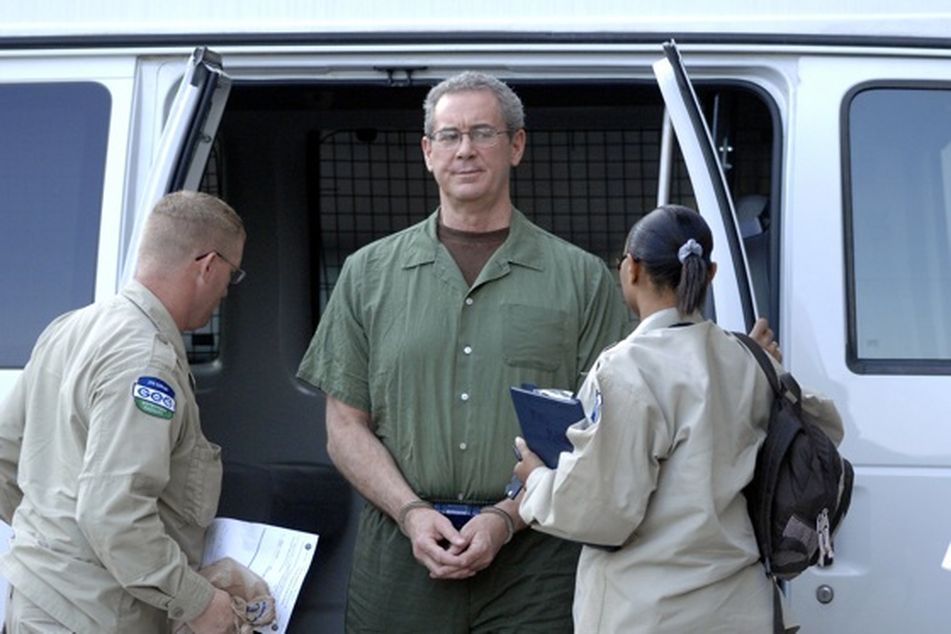

Patrick Cruickshank is one of at least four former Stanford Group Co. financial advisers and executives who may be sued by U.S. securities regulators for fraud, according to the Financial Industry Regulatory Authority Inc. and a lawyer for the brokerage's underwriter.

Patrick Cruickshank is one of at least four former Stanford Group Co. financial advisers and executives who may be sued by U.S. securities regulators for fraud, according to the Financial Industry Regulatory Authority Inc. and a lawyer for the brokerage’s underwriter.

Cruickshank, who is now a registered financial adviser with IMS Securities in Austin, Texas, was told in May that the Securities and Exchange Commission “intends to recommend that the commission file an action” against him for alleged securities law violations at the financial services company founded by R. Allen Stanford, FINRA disciplinary records show.

Danny Bogar, former head of the Stanford Group broker- dealer unit, has also been notified that the SEC may sue him as part of its investigation, according to the Financial Times.

In May, Lloyd’s of London lawyer Neel Lane, who handles requests for directors’ and officers’ insurance coverage by former Stanford brokers and executives, told a Houston judge that four ex-executives had been notified by the SEC that they might be sued in connection with the Stanford probe.

Stanford, four former colleagues and three of his companies were accused by the SEC in February 2009 of running a “massive” Ponzi scheme that bilked investors of more than $7 billion through the sale of bogus certificates of deposit at Antigua-based Stanford International Bank.

Deny Wrongdoing

Stanford and three of the accused executives deny all wrongdoing and are fighting parallel criminal charges brought against them in June 2009. Stanford’s former Chief Financial Officer James M. Davis pleaded guilty to the fraud scheme and is cooperating with the government.

Neither Cruickshank nor his attorney Brad Foster immediately returned calls today seeking comment on the SEC notices. Bogar’s attorney couldn’t immediately be located.

–Bloomberg News–

Learn more about reprints and licensing for this article.