Famed investor made $2B bet against large caps last week — and won: Sources

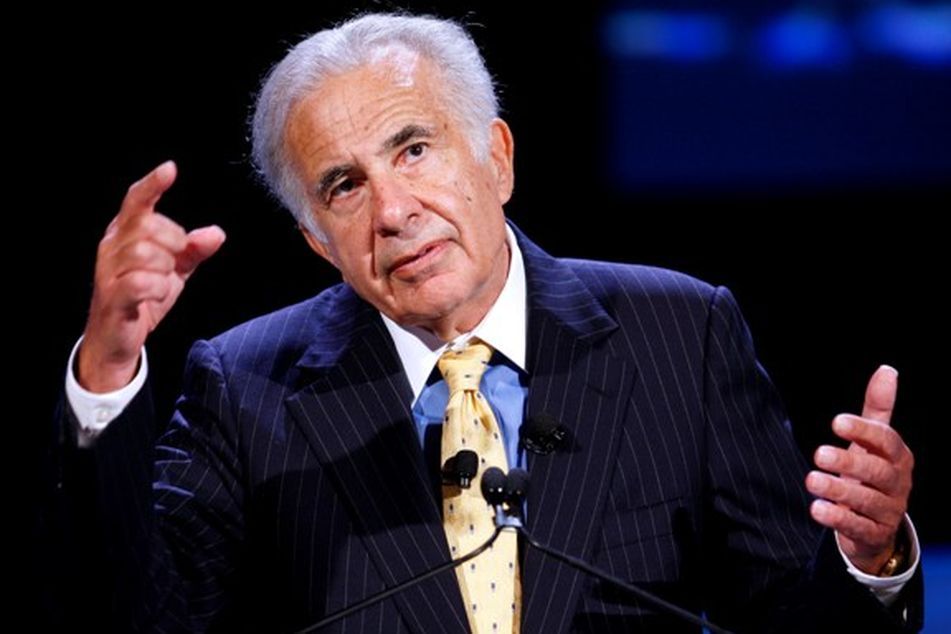

Icahn: Pursuer of Clorox cleaned up last week (Photo: Bloomberg News)

Icahn: Pursuer of Clorox cleaned up last week (Photo: Bloomberg News)

Carl Icahn said to have made $100M shorting the S&P 500

Activist investor Carl Icahn made a $2 billion wager last week on a decline in the benchmark Standard & Poor’s 500 Index, a hedge for his stock holdings that generated more than $100 million in profit as equities fell, according to two people with knowledge of the trade.

Icahn, as part of the investment, increased borrowing by almost 55 percent to $2.65 billion as of Aug. 17 from the prior week, according to a regulatory filing two days later. His funds added the almost $940 million in loans primarily to provide collateral for the bet, said the people, who asked not to be named because Icahn’s strategy and results are private.

It’s common for big investors such as hedge funds to short the S&P 500 Index (SPX) if they expect stocks to drop or to protect against potential losses in an equity portfolio. Icahn, a New York-based billionaire who takes stakes in public companies and frequently pushes for changes designed to boost their market value, held more than $11 billion of stocks as of June 30, according to an Aug. 15 filing with the U.S. Securities and Exchange Commission.

Market volatility has soared this month, with the Chicago Board Options Exchange Volatility Index, known as Wall Street’s “fear index,” jumping 35 percent to 42.67 on Aug. 18, the third-highest close of 2011. During the second week of August, the S&P 500 rose or fell by more than 4 percent on four of five trading days.

Clorox

Clorox Co. (CLX) has declined about 14 percent since Icahn’s July 15 offer to acquire the manufacturer of bleach and cat litter for $10.2 billion, or $76.50 a share. Icahn, who owns about 9.4 percent of the Oakland, California-based company, raised his bid on July 20 to $80 a share, or $10.7 billion.

Forest Laboratories Inc. (FRX), another of the billionaire’s holdings, has fallen about 18 percent since closing at $40.17, a 52-week high, on July 1. He holds 9.2 percent of the New York- based drugmaker.

Keith Schaitkin, deputy general counsel at Icahn Capital LP, declined to comment on the S&P bet, which was at least Icahn’s second big win of the week. On Aug. 15, Google Inc. said that it would buy Motorola Mobility Holdings Inc. for $12.5 billion, or $40 a share. Motorola Mobility jumped almost 56 percent that day, adding about $457 million to the market value of Icahn’s 11.3 percent stake in the mobile-telephone company.

Icahn’s funds generated a gross return of about 21 percent in the first six months of the year, according to a Form 10-Q that his holding company, Icahn Enterprises LP (IEP), filed with the SEC earlier this month. That compared with a 6 percent return including dividends by the S&P 500.

Debt Crisis

Icahn, 75, became more bearish last week, based in part on the outlook for the European debt crisis and the U.S. economy, according to the people with knowledge of his trading. The firm established its short position on Aug. 16, the day after the S&P 500 rose above 1,200, and reaped the benefits of the index’s 6 percent decline during the remainder of the week. Based on a $2 billion bet, that decline would generate $120 million in profit.

Icahn shorted the market using financial derivatives with a face value of more than $2 billion, including futures contracts on the S&P 500, according to the people. Derivatives require a cash outlay that is smaller than the notional amount. A derivative is a financial instrument whose value is derived from another security or benchmark, such as stock indexes or interest rates.

Icahn continues to hold the short position, they said, meaning he would see further gains if the market continues to fall and be exposed to losses should it reverse itself.

–Bloomberg News–

Learn more about reprints and licensing for this article.