Federal Reserve holds rates at zero; some advisers call it a lost opportunity

Central bank cites cloud of concern over weakness of the global economy, surging U.S. dollar and sleepy economy, but some advisers said the Fed should have lifted rates.

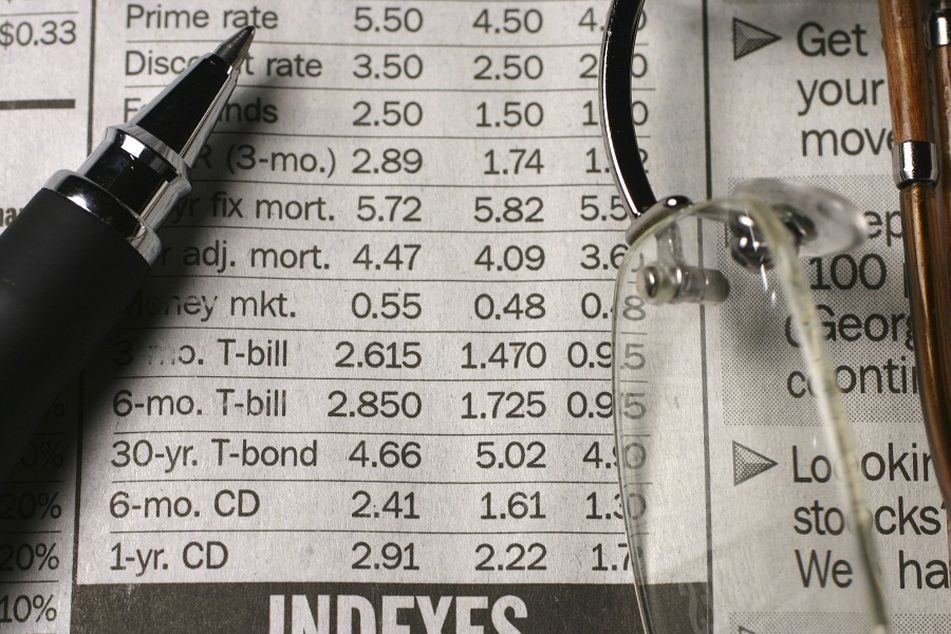

In what has been the most anticipated Federal Reserve decision in recent history, the central bank announced Thursday that it would leave interest rates unchanged, describing the current federal funds rate of between zero and 0.25% as appropriate.

The announcement was made amid a cloud of concern over the weakness of the global economy, the surging strength of the U.S. dollar, and the sleepy economy, which has failed to recover fully from the 2008 financial crisis.

In explaining the move to continue to sit on rates, the statement from the Fed pointed out that “recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.”

The statement added that the Federal Reserve Board “expects that, with appropriate accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the committee judges consistent with its dual mandate.”

COVER FOR DOVISH STANCE

Wayne Schmidt, chief investment officer at Gradient Investments, said the Fed’s reference to the global economy provided some cover for the continued dovish stance, but he also acknowledged the weakness of the U.S. economy as the most significant factor is leaving rates at zero.

“The world is on shaky ground right now and we have no inflation in the U.S.,” he said. “We know we’re below the Fed’s 2% inflation target and this hasn’t really been an economic rebound, because we’re kind of just moving sideways.”

Stocks, which hovered in negative territory all day leading up to the 2 p.m. EDT announcement, initially dipped then immediately rebounded on the news.

“I think this was a lost opportunity for the Fed to move rates at this time,” said Brad Friedlander, managing partner and head portfolio manager at Angel Oak Capital Advisors. “The market has proved it can stomach some volatility, and I don’t believe the market would interpret a rate hike at this point as the Fed moving too early. I think it would be translated as a vote of confidence.”

ADVISERS UNFAZED

On Wednesday, financial advisers were generally unfazed by the decision of the Fed not to move off its historic point of zero.

“I think the Fed is impotent, and it feels like they aren’t going to have a significant impact beyond some short-term knee-jerk market reactions,” said Ian Weinberg, chief executive at Family Wealth & Pension Management.

As the Fed’s decision grew nearer, there was growing debate over whether the Fed, under Chairwoman Janet Yellen, had expanded beyond its two primary mandates of monitoring unemployment and inflation to include the financial markets.

On Thursday morning, ahead of the Fed’s announcement, U.S. jobless claims were reported at an eight-week low, further bolstering the case for a rate hike now.

At 5.1%, the unemployment rate is well below its 50-year average of 6.2%. And with the core consumer price index at 1.8% year-over-year, “the economy simply doesn’t justify an emergency monetary policy,” said David Kelly, chief global strategist at J.P. Morgan Funds.

The Fed has been effectively boxed into a corner as a result of a record-level quantitative-easing program that now appears to have provided little benefit to the U.S. economy.

This analysis likely throws a wrench into the traditional mindset of winners and losers following a rate hike. Because of the unprecedented nature of the Fed’s consideration of whether to move off the zero mark for the first time in U.S. history, the normal wonky nature of Fed watching his migrated beyond Wall Street to a capture a mainstream following, even if that following isn’t fully on board with the overall implications of a rate hike.

Even though the stock market has more than recovered from the March 2009 low point following the financial crisis, household incomes have flat-lined over the period along with the economy.

Along those lines, Mr. Kelly said a zero-interest rate policy “both promotes inequality and undermines economic efficiency by nurturing asset bubbles and removing interest rates as an efficient allocator of capital in the economy.”

“Raising rates today would reduce uncertainty as investors will be able to predict Fed action based on economic improvement,” he added. “Regardless, the Fed should have begun to tighten long ago.”

Learn more about reprints and licensing for this article.