TAMP is ‘a misused term’

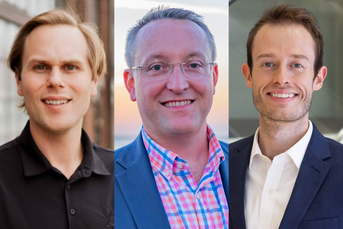

Barrett Ayers of Adhesion Wealth

Barrett Ayers of Adhesion Wealth

Adhesion Wealth’s Barrett Ayer highlights problems related to TAMPs – and a solution – in advance of RIA Labs webinar.

Advisors who are interested in growth, scale, practice management and margin expansion “absolutely have to attend” an upcoming webinar on turnkey asset management platforms.

“TAMPs are about outsourcing,” said Barrett Ayers, president and chief executive of Adhesion Wealth. “If you’re struggling with margin compression and you’re being asked to do more for less … then it’s through sourcing and specialization. It’s really a powerful concept and we’re excited to talk about it.”

Ayers will be one of the several speakers at InvestmentNews’ next and final RIA Labs webinar of 2023. The topic? Evaluating and Comparing TAMPs.

Speakers from sponsor AssetMark, Sovereign Financial Group, Sowell Management, Anchor Pointe Wealth Management and Adhesion Wealth will explore the benefits firms can realize by using TAMPs.

TAMP, Ayers said, is a misused term.

“I think people overgeneralize what exactly a TAMP is,” he said. “I think any time you outsource investment management to some other party, people call it a TAMP. And while maybe technically it is a TAMP, there’s also an array of ways to potentially outsource. In some cases, you can outsource everything to a very curated investment solution.”

Ayers added that TAMPs have gotten confusing because there are two different ways advisors can use them. “One of the spectrums, it’s fully curated, fully outsourced,” he said. “The other one, you’re expressing your own opinions. So those are two entirely separate engagement models and value propositions.”

When it comes to finding the right TAMP, Ayers suggested putting all the jargon away and getting down to what’s motivating advisors. “Are you gripped by fee compression? Do you have a succession planning problem? Are you bad at investment management? Find out what your problem is first and then identify who on this spectrum of outsourcing makes the most sense for you.”

One thing the industry is good at, Ayers adds, is marketing. He suggests issuing an RFP or a one-pager once the problem is identified. Advisors can then understand what the different players do and how they’re different.

They can also focus on what it’s going to take to outsource to the right partner.

“If you can find a provider who’s truly a partner, who’s going to invest in your growth and understand what you have the potential of being, I think it’s a really good fit,” Ayers said. “A TAMP relationship is a highly integrated, symbiotic relationship, and if you’re partnering with somebody that doesn’t make a lot of sense, it’s gonna get itchy and scratchy down the road.”

Ayers said while he has a lot more to talk about, he doesn’t want to give it all away, but adds that those who attend the webinar will be less confused when it comes to TAMPs.

“My hope is that the outcome of this conversation [tells] what exactly is a TAMP and which one of these stops on the spectrum is most appropriate for what I’m trying to do,” Ayers said. “We’re super excited to talk about it.”

The RIA LABs webinar takes place on Dec. 7. To register for the free webinar, and for more information, click here.

[More: 10 largest TAMPs by assets in 2023]

Why advisors should consider adding options overlays to client portfolios

Learn more about reprints and licensing for this article.