GMO’s Grantham: Stocks near bubble, but there’s nothing to pop it

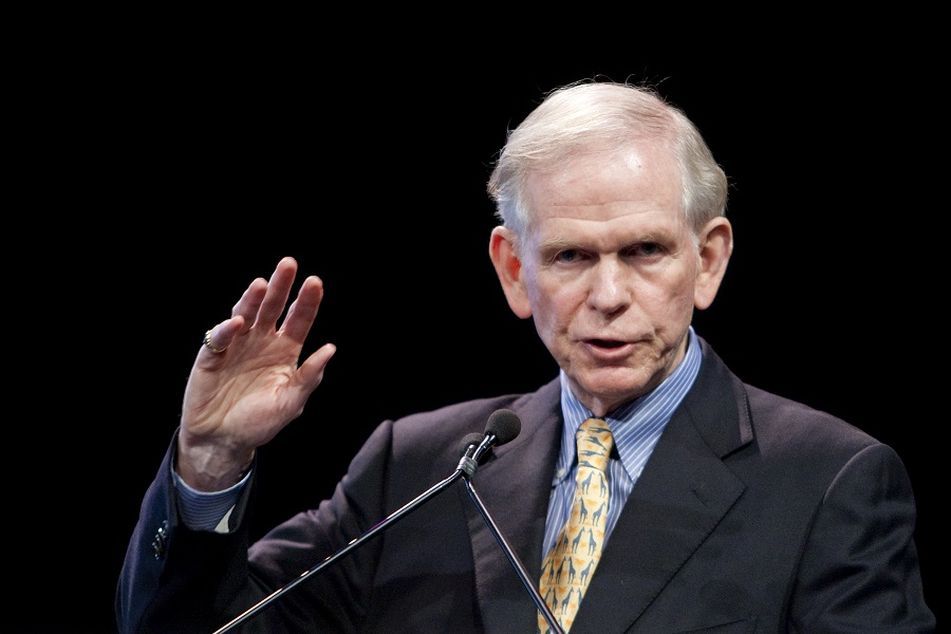

“Great bubbles break when the economy is screaming over rated capacity." — Jeremy Grantham, co-founder and chief investment officer of money manager GMO.

“Great bubbles break when the economy is screaming over rated capacity." — Jeremy Grantham, co-founder and chief investment officer of money manager GMO.

Money manager says the market still has room to run, but admits allocating assets in today's environment is not easy.

The stock market is reaching bubble territory but might expand more before it bursts, because there is currently nothing to pop it, according to Jeremy Grantham, co-founder and chief investment officer of money manager GMO.

“We’re creeping nicely but slowly toward bubble land,” Mr. Grantham said at the Morningstar Investment Conference in Chicago on Wednesday.

“I don’t believe there’s any chance of this bubble breaking before we get over two sigma,” he said, referring to a point when market valuations reach two standard deviations above historical norms.

He said the current price/earnings (P/E) ratio on the S&P 500 stock index is 21.1 compared to a historic norm of 16. While a high P/E ratio does point to an overvalued market, the current figure is most likely not enough to pop the bubble.

Profit margins, another valuation measure, are 7.3% per year on average for S&P 500 companies, versus the historic annual average of 5.7%.

“We have to wait until deals become more of a frenzy and individuals become crazy buyers,” Mr. Grantham told the audience. “No bubble has ever broken until individuals pour into the market.”

RATE HIKE WON’T DO IT

He said that while investors are mostly bullish, they are only buying “normal” amounts of stock for the most part.

The market is likely to follow the “line of least resistance from the Fed and keep going at least until the election,” he said, pointing out that a rate increase by the Federal Reserve is not going to set off major selling on Wall Street.

“Some think the trigger will come from a rate increase,” Mr. Grantham said, pointing out that investors are in “a state of mild hysteria” over when the central bank will act. But he said the most recent instances that the Fed raised rates — eight times from early 2004 to early 2006 — the market rallied every time.

“Why, therefore, would a single rate increase have everyone in such a conniption?” he said.

Anemic economic growth is another major indicator that the stock market bubble is not going to burst any time soon, he said.

“Great bubbles break when the economy is screaming overrated capacity,” he said.

‘BE BRAVE’

Mr. Grantham’s advice to investors?

Simple: “Be brave.”

However, he did admit that allocating assets in today’s environment is not easy.

“You have to do something with your money,” Mr. Grantham said. “The Fed wants everybody to reach [for return] and we’re reaching, but we don’t want to reach too far.

“It’s a wonderfully tricky game which needs thorough analysis, fairly good nerves and a willingness to lose some money,” he added. “There’s no easy answer.

“I’m prudent, but I’m going to be very, very prudent closer to the election — I recommend the same for you.”

When the bubble finally bursts, investors could be in for a long period of subpar — if not negative — returns, Mr. Grantham said.

“When you get really crazy prices, it takes a crazy long time to correct it,” he said, explaining that it could take 25 years to return to a P/E ratio of 16 once it hits 36. In today’s market, with that 21 P/E ratio on the S&P 500, it would take a 4% decline every year for seven years to get back to a 16 P/E ratio.

Learn more about reprints and licensing for this article.