Optimism abounds for financial advice industry in 2015

Vast majority of advisers expect the U.S. economy — and their own businesses — to keep on humming.

This year looks to be rosy for advisory firms — if you believe both the pundits and advisers themselves. “I am bullishly optimistic on the wealth management business,” said adviser JJ Burns, founder of JJ Burns & Co. in Melville, New York. “We’ve seen an influx of people coming to us who have been mismanaged, and not globally diversified, and there’s a dwindling supply of firms that do comprehensive wealth management.”

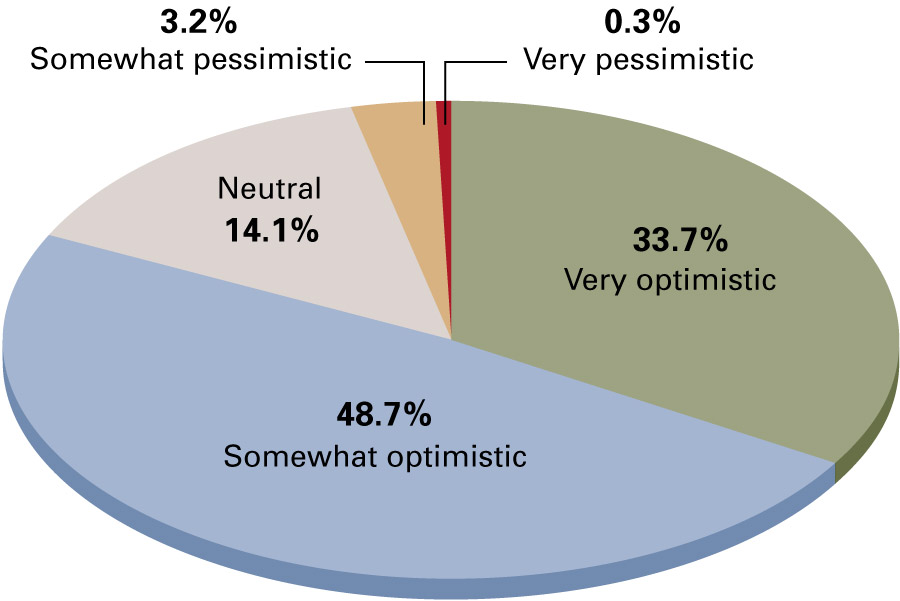

Eight out of 10 advisers are confident about their business prospects for 2015, according to the InvestmentNews 2015 Outlook survey. About half of advisers are “somewhat optimistic” and another 34% characterize themselves as “very optimistic,” the online survey of about 380 advisers found.

Advisers are coming off a year of great momentum, with 2014 producing broad economic growth and the stock markets — though volatile — producing solid gains for the year. The Dow Jones Industrial Average advanced about 11%, while the Standard and Poor’s 500 Index rose about 15% in 2014.

For investors trying to navigate the markets themselves, the last few complicated years have shown many that they need help from advisers.

U.S. stock markets are predicted to continue their bullish course for a seventh year — forecasts call for U.S. equities to return 5% to 9%, assuming the economy grows at about 3% — a condition that not only helps boost assets but also tends to keep clients satisfied with their financial professionals.

And the vast majority of advisers expect the U.S. economy to keep on humming.

About 44% of advisers predicted the economy will remain on par with 2014, and 40% think the economy will improve slightly this year, the survey found.

Burt White, LPL’s chief investment officer, said adviser optimism is warranted given these economic and market forecasts, and he offers even further good news to wealth managers this year.

“This bull market has been relatively unloved,” he said.

Even though stocks have increased more than 200% since March 2009, there has almost always been a reason for investors to be worried about whether the end of the bull market was just around the bend.

At times it was a dysfunctional U.S. Congress, while in other months it was fears about overseas political events or economies that weighed on investor minds — and added volatility.

For investors trying to navigate the markets themselves, the last few complicated years have shown many that they need help from advisers, Mr. White said.

“Right now a lot of investors are realizing this bull market is for real and will come back to advisers to get in,” he predicted.

On Regulation

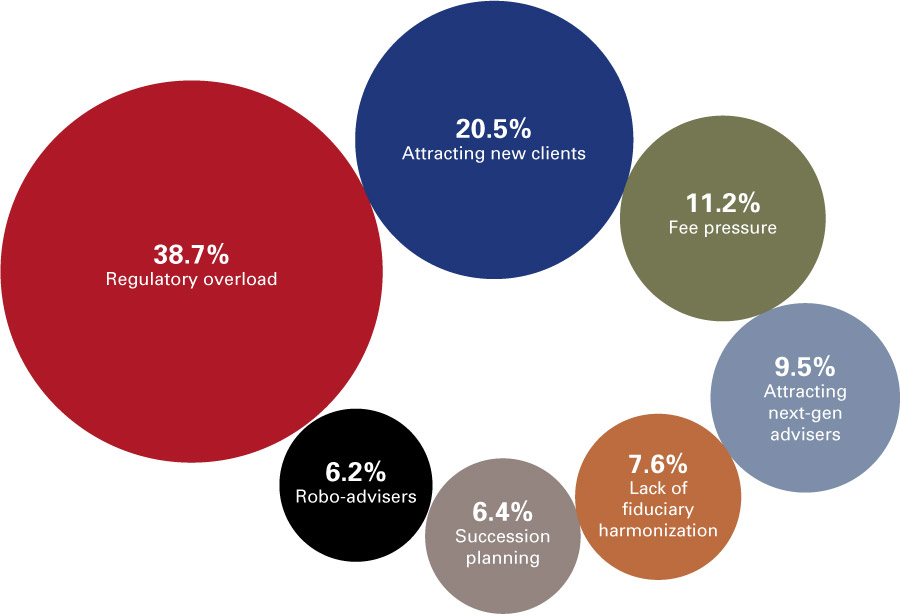

Advisers believe the biggest issue their industry will face this year is regulatory overload.

About 39% of advisers in the survey pegged too many regulations as the top challenge for this year.

“The regulatory environment is getting more and more complex,” said Karen Barr, chief executive of the Investment Adviser Association. “Advisers are having to really up their game in the compliance area.”

Ms. Barr said 2015 will be another extremely busy year for the individuals at investment advisory firms who handle compliance. She predicts the Securities and Exchange Commission will be even more active in 2015 than it was last year.

Advisers should take a look at what they have in place in terms of continuity planning, Ms. Barr said.

SEC Chairwoman Mary Jo White said at the end of last year that her agency is focusing on how investors are affected during times when their adviser can’t serve them. The SEC may introduce rules in October that require advisers to put a transition plan in place for such sudden shakeups as a planner dying or becoming incapacitated.

There also is talk that the SEC may take another stab at proposing anti-money-laundering rules for investment advisers, Ms. Barr said.

And of course, the Department of Labor fiduciary fight rages on. It’s too soon to predict whether the department will succeed in finally releasing a rule designed to expand the number of financial advisers who must act as fiduciaries to retirement plans, including brokers who sell individual retirement accounts. The notice of proposed rulemaking remains on the DOL docket for this month, but history suggests there will likely be more delays.

“Just living life we have to be concerned about cybersecurity.” — Patricia Struck, Wisconsin securities administrator

About 39% of advisers said the fiduciary standard is the regulatory/legislative issue that concerns them most, the survey found.

At the state level, regulators already are working on rules about continuity planning. They also expect to help advisers address an issue near the top of many advisers’ compliance concerns: cybersecurity.

“Just living life we have to be concerned about cybersecurity,” said Patricia Struck, Wisconsin securities administrator and head of the North American Securities Administrators Association’s investment adviser committee.

This year, for the first time, state regulators conducting routine examinations of investment advisers will be looking at cybersecurity procedures and policies, she said.

“This is at the forefront of everyone’s mind,” Ms. Struck said.

On Practice Management

One thing investment advisers said they aren’t too worried about is so-called robo-advisers.

Some professionals have predicted these digital advice providers will disrupt the industry. But most advisers aren’t buying it.

Only 16% view the impact of robo-advisers as a threat to their business this year. Six in 10 advisers said the threat is inconsequential, while a quarter of advisers view them as an opportunity, the survey found.

In fact, some advisers are teaming with robo-advisers and plan to unveil online advice offerings of their own in 2015 to draw in consumers they ordinarily wouldn’t be able to affordably service, including younger investors.

Digital platforms are a way to approach the emerging affluent, a group more advisers are targeting, according to David Canter, Fidelity Institutional Wealth Services’ executive vice president and head of practice management and consulting.

Many advisers also are taking a more active role in helping clients deal with aging, both for the clients themselves and the clients’ parents and other family members, he said.

This year about 40% of advisers plan to spend more time talking with clients about retirement planning, according to the survey. It’s the No. 1 topic in terms of getting the highest increase in time allocated to it.

An additional 21% of advisers said they will engage in more client discussions about withdrawal strategies.

One-tenth said health care planning is a topic they’ll discuss with clients more in 2015, the survey found. About 8% said they plan to discuss Social Security more than they did last year.

As for fees, more than 80% of advisers plan to keep what they charge clients at the same level as last year, while 14% plan to boost fees and 6% expect to lower fees, the survey found.

On Technology

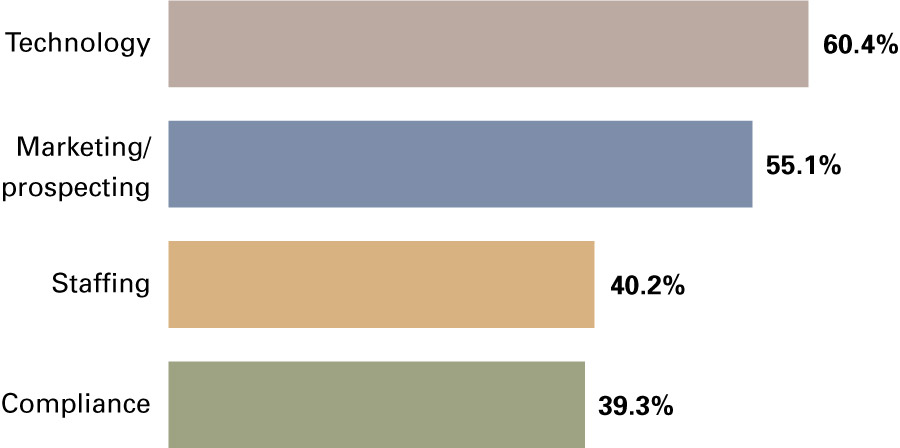

Spending priorities suggest sophisticated technology is essential for running an advisory business these days.

About 58% of advisers said technology spending will increase in 2015, according to the InvestmentNews survey. Software spending is the top area, with seven in 10 advisers planning to invest in it next year.

About 35% of advisers will put money into buying hardware and 30% said they’ll target cybersecurity solutions, the survey found.

“For many years advisers looked at technology as a play on efficiency of their systems and their processes,” said Neesha Hathi, senior vice president of Schwab Advisor Services. “There’s been a change in the advice mindset to see technology as a driver of client experience, too.”

Technology is being deployed to create a compelling client experience that is personalized and available anytime, anywhere, she said.

Schwab encourages advisers to think about their mobile presence.

“Sometimes the most effective way to engage investors in their financial life is to capture them when they are commuting or sitting in an airport,” Ms. Hathi said.

Advisers also should be leveraging social media to build their brand, prospect and create a strong reputation for themselves, she said.

“Social media allows advisers to amplify their reputation in a scalable way,” she said.

Advisers have to think about their public reputation today more than they used to because it’s rare that a prospect comes into an adviser’s office without having done a Google search of the firm, Ms. Hathi said.

Marketing is another important area of adviser spending this year, according to the survey. About 55% of advisers said they’ll spend more on marketing and other methods of prospecting for new clients.

About 40% of firms will spend more on staffing and 38% will spend more on compliance, the survey found.

On Investments

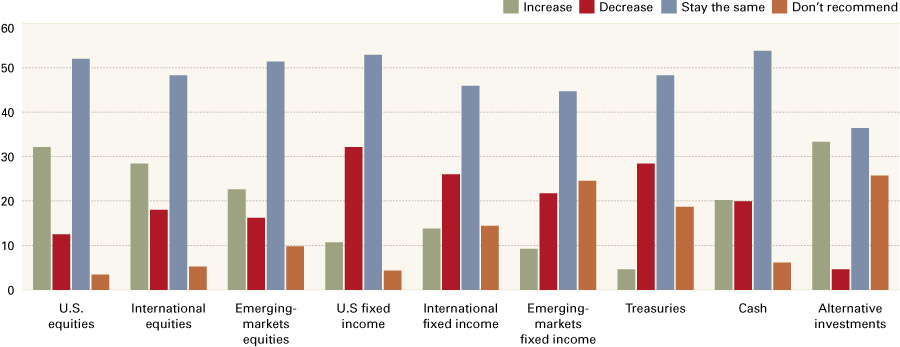

Despite expectations for a wobbly stock and bond markets in 2015, advisers plan to keep their client allocations about the same as last year in most investment categories.

Portfolios should be overweight in stocks, especially in comparison to how expensive fixed-income investments are, said Mr. White of LPL.

About 32% of advisers surveyed said they favor boosting their allocation in U.S. equities, and 28% favor raising the portion of investments in international equities.

Mr. White favors large caps — branded franchise companies such as Disney that are global and tend to do best late in the business cycle, which he predicts will experience a seventh year of growth.

Technology companies, industrials, transportation issues and other cyclical growth companies are important stocks to hold when the economic growth winds are at this stage, Mr. White said.

The decrease in the cost of oil could be a boon to transportation companies like airlines, for which fuel is a hefty portion of expenses, he said. But it also could help firms like Amazon, which will benefit from lower energy costs in addition to Americans buying more as the economy grows, Mr. White said.

Alternatives is one area where a third of advisers said they will recommend clients increase their allocation in 2015.

Mr. White said that’s a wise choice.

LPL expects to see huge swings in currencies because of actions out of the central banks, and where there are dislocations in commodities and currencies there’s a great chance for global macro alternative strategies to do well, he said.

Adviser JJ Burns said particular investments he’d like to see clients include in their portfolios are wearable technologies that pertain to health care and biotechnology, such as those that can help with chronic and other diseases.

Access to investments in such digitally enabled care include biotech-focused exchange-traded funds, he said.

“Wearables will be the iPhone of the older population going forward,” he predicted. ■

Advisers’ outlook for their own business in 2015

Biggest issue facing the industry this year

Advisers plan to increase spending this year on:

Advisers will recommend the following changes to asset allocation:

Topics to be discussed more in 2015

Parting advice

“I don’t believe we can get to a [universal] fiduciary standard if we are going to keep the definition of what it means to be a fiduciary that we use today. I think we are going to have to cheapen that to some degree — and that might be okay in order to get everyone on the same playing field.”

John Johnson, president, National Planning Corp.

“Technology used to be nice to have. Now it’s the backbone of our business. Right now, I am very focused on development, build-buy decisions and the uptime on our technology.”

Wayne Bloom, chief executive, Commonwealth Financial Network

“We see these fairly large seismic shifts coming and we want our adviser base to be able to take advantage of them. One of them being the fact that women are going to inherit and create big wealth. Another is [the emergence] of Gen X and Gen Y investors.”

Peter Dorsey, managing director of institutional sales, TD Ameritrade Institutional

“2015 should be a more volatile year for equity and bond markets, so advisers will need to better understand clients’ risk tolerance and stay well diversified. With valuations a little stretched for equities and with interest rates likely to move higher, advisers will need to shift portfolios to reflect a different market than in 2014.”

Todd Rosenbluth, director of mutual fund and ETF research, S&P Capital IQ

“Last year, the headlines were that robo-advisers are taking over your business. I just don’t think that’s happening in 2015. In fact, advisers are leveraging this technology in their own businesses rather than being supplanted by the technology.”

Karen Barr, president and chief executive, Investment Adviser Association

“Inconsistent regulation is difficult. If the regulators are not consistent with what they care about, what they think about and how they enforce regulations, it makes it real difficult to wake up in the morning and think about the end client, the adviser, our broker-dealers and the solution providers.”

Larry Roth, chief executive, Cetera Financial Group

“In the next 12-24 months, the advisory business will see another medium-size washout wave coming … A washout being a period of time when advisers simply decide either willfully or involuntarily to leave the business. Most don’t have any sort of succession plan so assets will scatter and distribute as they can.”

Sam Jones, president, All Season Financial Advisors

“I’m spending a lot more time and energy on advocacy at the national level as well as the state level. The independent model really needs to be explained; there’s an educational process that has to be done.”

Robert Moore, president, LPL Financial

“I still don’t think our industry is leveraging social media in the highest capacity it could. It will be a strong part of our value proposition in the future. It’s still misunderstood by advisers, who think it takes too much time. But as the industry evolves, there’s nothing but opportunity there.”

Amy Webber, president, Cambridge Investment Research Inc.

“We’re going to continue on this path that we started on through the digital adviser platform. We want to make sure that instead of the adviser cottage community serving just 2% of Americans, that number gets to 5%, 7%, 15% and even 25%.”

Michael Durbin, president of Institutional Wealth Services, Fidelity Investments

“The world is getting more complicated. I believe people who deliver on a service model — not just investment advice — will continue to have a great business. Advisers who do that well will do incredibly well.”

Jim Jessee, co-head of global distribution, MFS Investment Management

“My hope for the industry is that there continues to be a focus on national retirement policy, a focus on the need for Americans to have a dignified retirement.”

Alan Spierer, SVP of investments and retirement plans consultant, UBS International Consulting Group

“Fee compression will continue to be a major issue with the addition of providing more services for less. With investment management being commoditized, more and more RIAs and advisers are having to reinvent themselves.”

Paul Schatz, president, Heritage Capital

“We know that there is going to be this huge succession of assets coming along — something like $15 trillion or $16 trillion over the next 20 years. So, we are going to focus on making sure our firms are ready for that generational wealth transfer.”

Bernie Clark, executive vice president, Schwab Advisor Services

“We’ve made a big effort to deeply integrate with BNY Mellon and Pershing to deliver a more seamless solution. That’s really going to be our big focus in 2015.”

Mark Tibergien, chief executive, Pershing Advisor Solutions

“Most of our advisers serve middle America but they aspire to serve high-net-worth clients. So we are focusing on giving them the resources, technology and tools to do that.”

Matt Enyedi, executive vice president, LPL RIA Solutions

Learn more about reprints and licensing for this article.